Elevate Recoveries LLC: Ways To Remove It From Credit Report

Elevate Recoveries, LLC is a debt collection agency that specializes in medical debt collection. It claims to treat patients with respect. However, it has many complaints stating violations of the Fair Debt Collection Practices Act. In this article, we will help you find out about Elevate Recoveries and how you can remove them from your account.

Who Is Elevate Recoveries LLC?

Elevate Recoveries, LLC, also called ELEVATE RECO, is a third-party debt collection agency. The company is situated in Sherman, Texas, founded in 2012. It is an agency that specializes in health care collections but is not accredited by the Better Business Bureau (BBB). You might find Elevate Recoveries on the report as a collections account. Elevate Recoveries can be on your credit report due to missed payments.

How To Contact Elevate Recoveries?

Address:

Elevate Recoveries, LLC

P.O. Box 910009,

Sherman, TX 75091.

The main telephone number is 888-806-9145.

The main website is http://elevaterecoveries.com/.

Elevate Recoveries has various phone numbers to call the debtors like other debt collection agencies. Phone numbers are given below:

- 972-781-0400

- 678-648-7959

- 214-668-9426

- 657-888-2906

- 866-324-7040

Is Elevate Recoveries LLC A Scam?

Elevate Recoveries, LLC is a legitimate private collection company. The Better Business Bureau (BBB) has rated this debt collection agency as “B.” Therefore, it is important to resolve your debt with this agency to stop damages that might come up if it is not removed.

Elevate Recoveries states on the official site that the company is dedicated to offering service for the healthcare authority that treats their patients with respect. However, you will find consumers argue the opposite. They state that the agency has violated the rules of FDCPA.

Who Does Elevate Recoveries LLC Collect For?

Based on their statement on their website, Elevate Recoveries, LLC collects debts on behalf of lenders in the healthcare sector. The debt collection agency states that they work together with leading medical entities such as Georgia Regents, LifePoint, Florida Hospital, Memorial Hermann, AMR/Rural Metro, Cleveland Clinic, EmCare/RTI, Oakwood Health Sys, The Schumacher Group, and Meridian Health. Although you will find information about their various services, it is always recommended to inquire about your specific debt. To solve your debt discrepancy, you should contact Elevate Recoveries to prove your debt and get the required information on the account. Acquiring the details is crucial because of the outsourcing of the debt. Only one collection account can turn into many listings on your credit report if you do not deal with the debt.

Should You Contact Or Pay Elevate Recoveries LLC?

Even if you speak to the collection agency on the phone, it’s likely that you won’t have any positive outcome. Besides, it might also make your credit worse. However, it can work if your debt is new and legitimate. You can then pay the amount and clear the debt. It is wise to contact the credit repair company to handle the collection account as they have deleted many negative items from the consumer’s report.

Can Elevate Recoveries LLC Sue Or Garnish Your Wages?

It is not legal to threaten to sue any customers. Some states also permit garnishing wages. But many states consider it illegal to threaten to garnish your wages. Besides, it is also illegal for Elevate Recoveries, LLC to make any statements that they do not intend to follow it.

However, the circumstances can be different if there is a default judgment. It is to note that it is unlikely for debt collectors to solve it until they have evidence. But if you find yourself under such debt collection discrepancy, it is wise to contact an attorney to make sure to receive protection on your assets and rights.

What If Elevate Recoveries LLC Keeps Calling Me?

If you are in a circumstance where the debt collection agency is harassing or calling you continuously, you can familiarize yourself with the Fair Debt Collection Practices Act (FDCPA). Under this legislation, you will find they have outlined a person’s protection against the misconduct of the debt collection agencies. Unde the “Debt Collection FAQs’, ‘you will have the FDCPA rights listed on the website of the Federal Trade Commission. If you find them calling or harassing you, you can contact an attorney to get legal protection. Besides, Telephone Consumer Protection Act (TCPA) and Consumer Financial Protection Act (CFPA) provide the customers with additional protection outside the FDCPA.

Will Elevate Recoveries LLC Affect Your Credit Score?

It depends on various facts whether or not your credit will be affected. It includes:

Opening Date Of The Account: If it is your recount account that has been listed with the collections account, you should remove it from the credit report to prevent it from negatively affecting you.

Derogatory Markings: If your account has derogatory markings like collections, charge-offs, late fees, etc.

Can You Remove Elevate Recoveries From Your Credit Report?

Yes, when you come up with the right strategy, you can remove collection accounts like Elevate Recoveries, LLC from your report. But at first, you must make sure to know if the account is negative. Otherwise, it will affect the score. Fortunately, removing a collection account can positively impact your credit score. In addition, it will improve your financial health, allowing you to open new lines of credit.

How To Remove Elevate Recoveries LLC From Your Credit Report?

When you have an accurate collection account on your credit report, it might reasonably be impossible to remove it before the maximum allotted time, seven years. Your allotted time starts with the original date of delinquency.

However, it can only be done by disputing the debt collection agency. However, if the account is legit and you have paid it, it will likely be removed only when the bureaus must do so by law.

But, you can definitely consider some steps to assist it in getting removed faster. However, it is not guaranteed that it will work:

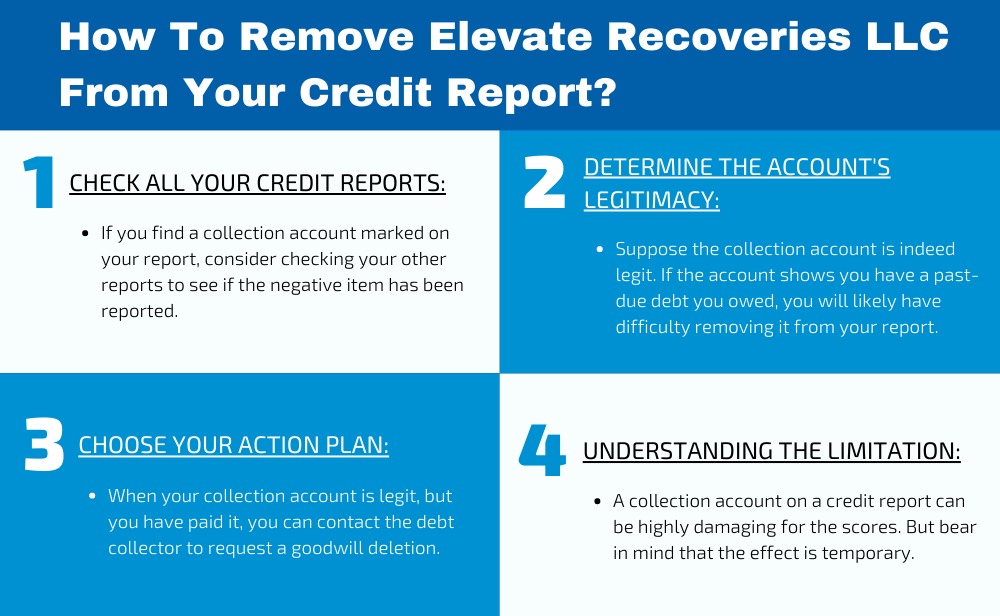

Check All Your Credit Reports:

Remember that you are permitted to request a free credit report once a year. If you find a collection account marked on your report, consider checking your other reports to see if the negative item has been reported.

Determine The Account’s Legitimacy:

Suppose the collection account is indeed legit. If the account shows you have a past-due debt you owed, you will likely have difficulty removing it from your report. However, if it is inaccurate and has not yet been removed, you can remove it through dispute.

Choose Your Action Plan:

Following mentioned are the ways you can take to handle your collection account on your credit report:

- If your account is inaccurate, you can dispute it with the lenders and the debt collection agencies. You can use phone or mail for this purpose. Consider sending a dispute letter through your certified mail. Besides, you can also dispute with the bureaus who are reporting it. The credit bureaus allow you to file disputes online.

- When your collection account is legit, but you have paid it, you can contact the debt collector to request a goodwill deletion. It might not surely work, but you can give it a shot. A goodwill deletion may be a good choice if you have not made other mistakes in the past.

- The negative marking can stay on the report for seven years, even though unpaid. But its effect reduces with time.

Understanding The Limitation:

A collection account on a credit report can be highly damaging for the scores. But remember that the effect is temporary. So, take care of the credit wisely to recover it in time.

Conclusion

Therefore, it is important to keep your credit in good standing, avoid paying the bills late and manage it wisely to ensure you do not have your account in collections. Even if you have a collection account, you must be aware of the rights. Besides, you can also take the assistance of a credit repair company to help you remove it.