12 Best Credit Repair Software For 2022

Introduction

Credit repair software uses information from Equifax, Experian, and TransUnion credit reports. It allows you to keep track of your spending, spot mistakes, and submit dispute letters to credit card providers, mortgage lenders, and other creditors. Credit repair software might be a suitable middle ground between hiring a credit repair company and doing it yourself.

12 Best Options For Credit Repair Software

Credit repair software falls between trying to restore your credit on your own and hiring a credit repair firm to do it for you.

Credit Saint provides the greatest value for money among all the credit repair companies we’ve looked at. Their A+ rating with the Better Business Bureau is the highest in the credit repair industry, and they also provide a 90-day money-back guarantee.

The Credit Pros

We recognize that you have put your faith in us, and we take that confidence very seriously. Therefore, you are entitled to a complete refund of any fees paid to us if we fail to erase or change any of your suspicious items on your credit report within 90 days of enrollment.

You’ll need to switch to a more expensive plan if you want The Credit Pros to file complaints on your behalf. The Money Management package is the next level up, and it includes credit monitoring and debt validation letters addressed to creditors on your behalf.

Also, we guarantee that you will be able to discontinue your service at any moment.

- No one will over-promise or provide a particular assurance.

- The data is safe and secured.

- That you will be handled professionally and courteously, and that you will receive prompt responses to all of your requests

Credit Repair Cloud

It’s software makes it exceedingly simple to start, maintain, and develop your own successful credit repair business or add a completely new income stream to an existing one.

The program works similarly to other credit restoration tools, with the added benefit of being able to assist others with their credit repair requirements. Plans start at $179 per month for three users and up to 300 active customers and go all the way up to $599 per month for 24 users and up to 2,400 active clients on the Enterprise plan.

Credit Saint

Credit Saint is a full-service credit repair firm, but it also provides a more affordable option for those whose credit merely needs a quick fix. The Credit Polish is $79.99 a month plus a $99 setup cost.

You are restricted to five challenges every dispute cycle, so if your credit score needs more improvement or you have a lot of bad things to dispute, you have to upgrade to a more expensive subscription.

Credit Firm

Credit Firm is both a credit repair business and a law firm, which sets it apart from the majority of the credit repair competition. One service plan is available for $49.99 per month.

Credit Firms can issue an unlimited number of dispute letters on your behalf for that charge. It also includes an unlimited number of inquiry challenges, goodwill interventions, debt validation, and a full legal assessment of your credit record.

The Credit People

Credit People is a credit rehabilitation company with two service levels. The monthly plan is a pay-as-you-go service that costs $19 to start up and $79 per month, while the flat-rate plan is $419 for six months of credit restoration.

Results in under 60 days, an online account where you can watch us operate, and the only repair service that provides:

- All three credit reports and scores are accessible.

- Unbeatable customer satisfaction.

- 24/7 online access Keep track of our progress at all times!

Experian Boost

The Boost counts your streaming, phone, and utility payments in your Experian credit score with the use of Boost. Boost checks your bank transactions for payments and only displays good information. Experian credit ratings will be the only ones affected.

Credit restoration software isn’t always Experian Boost. Instead, it gives you credit for paying your phone and utility bills on time each month.

TurnScor

TurnScor is a credit restoration software product that allows you to fix your credit on your own. Instead of hiring a full-service credit repair company, you can save money by doing so. Tenscor will provide you with all the tools you need to complete the task if you are ready to put in the time and effort.

Unfortunately, the website has not listed Turnscor’s costs anywhere, making it difficult to compare its software to the competitors. If you’re not happy, the site offers a 60-day money-back guarantee.

Personal Credit Repair Software

Credit repair software includes credit trackers, cleaning kits, and simulators to detect your credit report mistakes. Credit repair software can assist you in rectifying mistakes on the credit report and submitting credit disputes.

The program is listed on the Personal Credit Repair Software website for $399.97. However, there is a limited-time deal on the site for a 50% discount to $199.97.

Intuit Turbo

Intuit both produces TurboTax and QuickBooks. In addition, Intuit Turbo offers solutions to assist you in getting out of debt, cutting your credit utilization, and increasing your credit score rather than credit repair software.

Unfortunately, Intuit Turbo does not create dispute letters or identify unfavorable things on your credit report. However, because both the website and the app are completely free to use, Intuit Turbo is worth exploring as part of your credit restoration approach.

Credit Detailer

The only bilingual credit software allows you to give your clients contracts in either English or Spanish! It’s easy to use, friendly, and automated. It is adaptable and is inexpensive.

Dispute Bee

Credit restoration software is available from Dispute Bee for both individuals and businesses looking to market credit repair services. Users may input their credit reports into Dispute Bee and have dispute letters generated automatically.

The program also includes templates for the various letters you might need to send during the dispute resolution process. Individuals pay $39 per month, and corporations pay $99 per month for the program.

Credit Repair Magic

Credit Repair Magic is a unique service. It’s not your normal program; instead, it requires an approach of one step at a time that everyone can follow. With the world’s most effective approach for permanently deleting bad things from your credit reports, you get genuine point-and-click simplicity.

It’s a one-of-a-kind approach that sixteen independent credit repair review sites named the World’s Best Credit Repair Program.

Credit Repair Magic is the world’s easiest credit repair program and the quickest way to improve your credit score drastically. Some of our proprietary, patented ways may raise your credit score in days, not months or years.

What Is Credit Repair Software?

Credit repair software uses information from Equifax, Experian, and TransUnion credit reports. It allows you to keep track of your spending, spot mistakes, and submit dispute letters to credit card providers, mortgage lenders, and other creditors. Credit repair software might be a suitable middle ground between hiring a credit repair company and doing it yourself. Credit repair software comes in a range of packages, each with its own set of advantages and disadvantages, so do your homework before you buy. While some software products provide extensive help and instruction, others need you to be more self-sufficient.

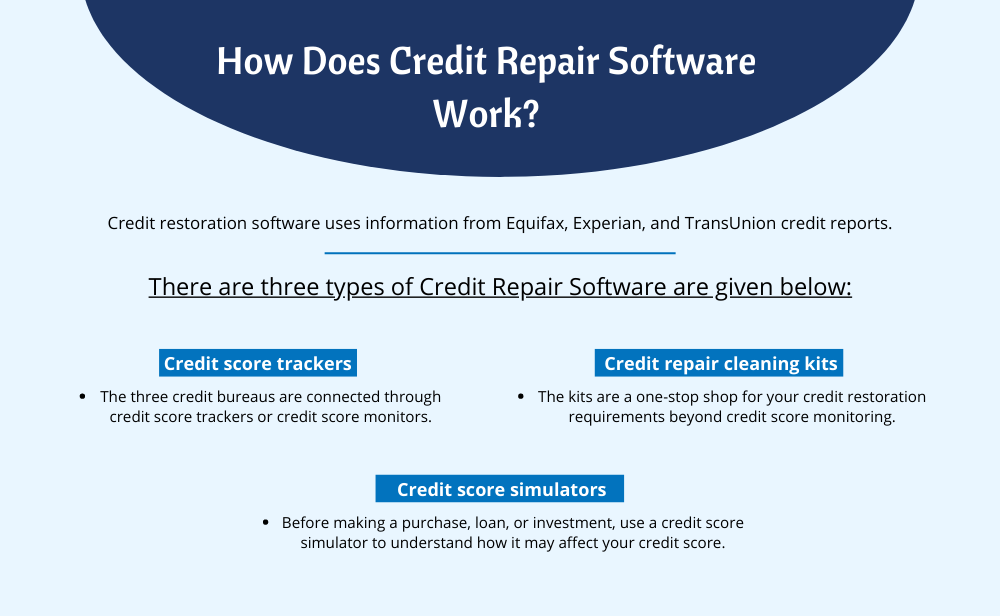

How Does Credit Repair Software Work?

Credit restoration software uses information from Equifax, Experian, and TransUnion credit reports. It allows you to keep track of your spending, spot mistakes, and submit dispute letters to credit card providers, mortgage lenders, and other creditors.

E-books, DVDs, credit score monitors, and simulations are all readily available. Consider the gravity of your circumstance, goals, timetable, and financial resources while deciding on the best option.

There are three types of Credit Repair Software are given below:

- Credit score trackers

The three credit bureaus are connected through credit score trackers or credit score monitors. These software programs monitor your credit reports and look for behavior that might affect your credit score.

- Credit repair cleaning kits

Credit repair cleaning kits consist of software, manuals, and video resources that assist you in correcting prior credit problems by acquiring credit reports, interpreting scores, detecting fraud, and writing dispute letters. In addition, the kits are a one-stop shop for your credit restoration requirements beyond credit score monitoring.

- Credit score simulators

Before making a purchase, loan, or investment, use a credit score simulator to understand how it may affect your credit score. The users can use both the FICO Score and the Vantage Score to anticipate how your previous and present spending patterns will influence you in the future.

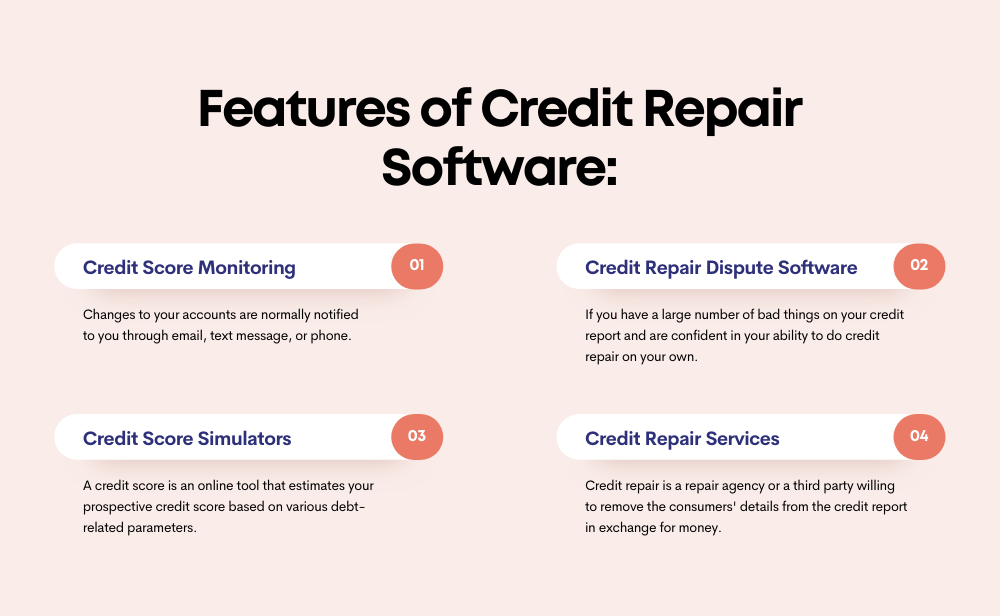

Features of Credit Repair Software:

Repair software for credit ranges from the most basic to enterprise-level systems with bells and whistles. Credit score monitoring, credit report dispute software, and credit score simulators are all frequent characteristics to look for when looking for a software package that meets your demands.

Credit Score Monitoring

A credit monitoring service is a commercial business that costs you a monthly subscription to keep an eye on your credit reports and notify you when accounts listed on your credit report change. Changes to your accounts are normally notified to you through email, text message, or phone.

Credit Repair Dispute Software

If you have a large number of bad things on your credit report and are confident in your ability to do credit repair on your own, several of the more well-known credit report dispute software programs on the market could suffice.

Credit Score Simulators

A credit score is an online tool that estimates your prospective credit score based on various debt-related parameters.

Credit Repair Services

Credit repair is a repair agency or a third party willing to remove the consumers’ details from the credit report in exchange for money. A credit repair firm or credit repair organization provides credit repair services.

Factors To Consider While Deciding The Best Credit Repair Software For You:

Choosing one among many credit repair software solutions isn’t always easy. Consider the following aspects when you explore your possibilities.

- Price

First, consider how much credit repair software costs for its services. Then, consider whether the program is accessible as a monthly subscription or as a one-time purchase, as paying monthly might quickly add up.

- Features

Compare and contrast the characteristics of each software type. Of course, no credit repair service or program can do anything that you can’t do yourself, but a decent software package or service can help you stay organized and speed up the dispute process.

- Security

Because your credit report contains sensitive personal and financial data, you should be sure that any software you use is encrypted and capable of protecting your information.

FAQS Related To Credit Repair Software:

What Is The Best Credit Repair Software?

Credit Saint provides the greatest value for money among all the credit repair companies we’ve looked at. Their A+ rating with the Better Business Bureau is the highest in the credit repair industry, and they also provide a 90-day money-back guarantee.

Do Credit Repair Companies Work?

For a price, credit repair organizations promise to help people improve their credit ratings. Some are reputable companies, while others are nothing more than con artists. The capability of a credit repair business is listed below.

What Is The Fastest Way To Repair Your Credit?

Here are some fast ways to boost your credit:

- Strategically pay down credit card bills.

- Request increased credit limits.

- Become a registered user.

- Always pay your payments on time.

- Dispute mistakes on your credit report.

Conclusion

Low credit scores are associated with higher interest rates, resulting in higher financing costs on credit card balances. Repairing your credit will enable you to obtain a lower interest rate and save money on interest payments. However, the credit restoration procedure can be intimidating, which is why many individuals seek assistance from credit repair software.