Ways To Remove Gragil Associates From Your Credit Report

Gragil Associates may be eliminated from the credit record if any details on the account are erroneous or deceitful and are not corrected in a reasonable length of time. According to research conducted by the PIRGs in the United States, 79 percent of credit reports include inaccuracies or severe errors.

What Are Gragil Associates?

Gragil Associates, Inc. is a Pembroke, Massachusetts-based debt collection agency and accounts receivable management organization. It can reflect as a collections account on the report. It can occur if you fail to pay a bill.

How Can You Remove Gragil Associates From Your Credit Report?

Gragil Associates collections may harm your credit score and do not fall off your credit before it turns seven, whether you pay them or not. So paying the collector may actually harm your credit score. However, you can get it removed even before it turns seven years. Of course, all the collecting firms may or may not tell you this as they don’t want you to get rid of all these fusses, as they don’t want to lose their clients, but you can ask anyone who is an expert in removing all these first or someone whom you think is capable of doing such things.

Contact Information Of Gragil Associates

Address:

29 Winter St, Pembroke, MA 02359 Gragil Associates, Inc.

Postal address:

PO Box 1010 Pembroke, MA 02359 Gragil Associates, Inc.

(800) 336-0299 is the phone number.

Should You Contact Or Pay Gragil Associates?

You should not consider a collection agency as your friend. They are there to earn profits, and calling them or asking them for suggestions will make things worse for you. On the contrary, it may worsen it more than improve your credit. But, of course, there are situations when it is advisable to simply pay the collection account, particularly if it is new and you are confident that it is legitimate.

Working with a professional credit repair firm or with specialists in such fields can be an exit option for you from all these kinds of trouble. They have removed millions of bad things from firms such as Gragil Associates, Inc. on behalf of millions of people around the country.

How Does Gragil Associates Affect Your Credit Score?

It is feasible, but if you work on it, it will not have a negative impact on you and can even be erased, as we stated before. They will assist you in disputing the collection account and perhaps having it removed from your credit report. It’s also conceivable that you won’t hear from or contact Gragil Associates, Inc. again.

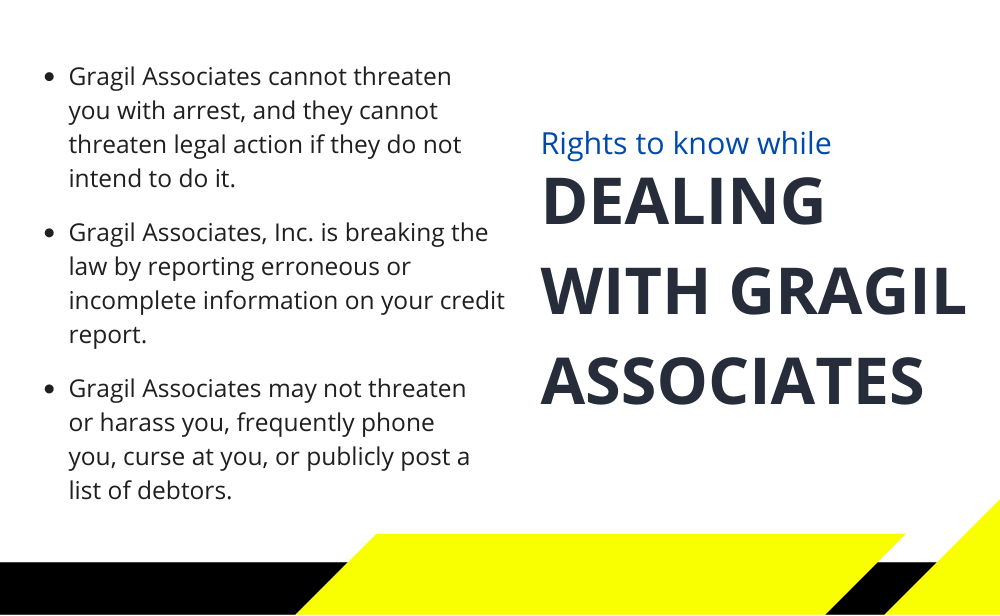

Rights To Know When Dealing With Gragil Associates

In the United States, there are tight rules governing what a collection agency may and cannot do. Furthermore, the FDCPA gives you several rights to guarantee that collection firms do not take advantage of you. Specifically:

- Gragil Associates cannot threaten you with arrest, and they cannot threaten legal action if they do not intend to do it.

- Gragil Associates, Inc. is breaking the law by reporting erroneous or incomplete information on your credit report.

- You have the legal right to demand debt validation for an alleged debt. Send a debt validation letter to the collecting agency. They have 30 days under the law to establish that the debt is yours and that the entire amount is correct.

- Gragil Associates may not threaten or harass you, frequently phone you, curse at you, or publicly post a list of debtors.

- Gragil Associates must be open and honest about who they are and what they are trying to accomplish, all verbally and in writing.

Additional Tips To Deal With Gragil Associates :

- Prevent yourself from talking over the phone: You should not speak with them on the phone. However, it is good if you choose to provide less information about yourself.

- Inform them politely that you wish for everything in written format: Request a letter containing the original debt details and hang up the phone.

- Keep track of their phone calls. If you decide to discuss with them over the phone, record the conversation. You can surreptitiously record phone calls in 35 states in the United States.

- You can record in the remaining 15 states with the opposite party’s consent. After informing them that you are going to record and they do not say a thing, it means you are permitted. Otherwise, they might also hang up.

- Prevent yourself from believing them. Debt collectors are notorious for making bogus threats, lying, and making up anything that makes the consumers clear their debts.

- Do not conceal money. However, hiding money is banned; even if you owe a genuine debt collector, keeping your bank account and credit card details private is also good.

- Do not apply for new credit lines. You should not apply for additional credit until you pay off the unpaid bills to the present lender.

- Do not dismiss them. You can affect your way, but Gragil Associates won’t go down if you ignore the matter. Ignoring them puts you at threat of being sued.

Is Gragil Associates A Scam?

The Consumer Financial Protection Bureau and the Better Business Bureau have received several complaints about collection companies. The majority of consumer complaints include erroneous reporting, harassment, or a failure to verify a debt. If a collector harasses you, it is important to file a complaint.

A credit repair company understands your rights, as does Gragil Associates. Gragil Associates is a genuine business. They are not a forgery or a hoax. They may, however, spam phones and annoy you. You can resolve it by contesting and erasing unjustified debts.

Conclusion

We recommend contacting a Credit Repair specialist to review your credit report in some circumstances. It’s a lot less worry, effort, and time to let specialists figure out why your score dropped.