How To Beat Certegy Check Services Inc.?

Let’s suppose you have been shopping around on the market and picked everything essential to you. Then you moved to the counter and handed over a freshly written check to the cashier. After scanning, the cashier politely stated that they could not accept the check and required another payment form. You are shocked due to the cashier’s response and immediately check that you have money in your account. You will certainly be thinking about why your check was unacceptable. Well, there are many companies behind the scene to help retailers examine if it is risky or not to accept checks. One of them is Certegy Check Services. However, you would not hear from them if nothing went wrong. If they have held your check back, consider you have something serious. Let’s dive deep into Certegy, examine what circumstance your check might hold back and how to beat it.

What Is Certegy Check Services Inc.?

Certegy Check Services is a company that manages check risk. It provides businesses with risk analytics and guarantees by verifying those who access checks as payment methods.

Retailers, as well as other merchants, use Certegy Check Services to examine how risky a consumer’s payment check is before accepting it. In addition, it determines the risk at a point-of-sale (POS). For instance, when a consumer provides a check as a form of payment for purchasing goods or services, the retailers scan it through Certegy to know and examine if the consumer is risky. Then, they determine if the check is acceptable or not.

Below listed are the companies that use Certegy:

- Best Buy

- Staples

- Lowe’s

- Check’ n Go

- Money Mart

- Unite Check Cashing

- ACE Cash Express

- Walgreens

- Rite Aid

- Walmart

- Dollar General

- Big Lots

- Publix

- Kroger

- Target

- Sears

- Harris Teeter

- Food Lion

- Costco

- Other companies as well.

Who Uses Certegy Check Services Inc.?

Major and small retailers use Certegy Check Services to check if the check provided by their consumers is valid and can be cashed out. Retailers such as Walgreens, Staples, Sears, Walmart, Target, Kroger, Costco, Publix, and smaller grocery chains and local businesses use the Certegy verification system to check the checks. The risk models in the system use the factors based on the former transaction that resulted in a loss for the client; the retailer wanted to approve the check. In addition, the system compares the check of the consumer’s recent activity to understand the transaction validity.

How Does Certegy Work?

When a consumer chooses to use a check as a payment method with a retailer who uses Certegy, Certegy’s verification system scans the check details. The system then analyzes the check’s risk while accepting the check. After it scans, Certegy lets the retailer know if they should or shouldn’t accept the check.

However, Certegy’s verification system’s detailed information is not revealed publicly for security reasons. If Certegy releases detailed information about its system, it might help the fraudulent check writers and others understand how they can bypass the Certegy system. The Certegy team states that they use “proprietary risk models concerning the checks’ acceptance for the decision process—the risk models of the system work according to some factors. For instance, it examines the previous transaction models that caused losses for the retailers.

However, some of the information can only be stated about how the system’s risk models work. First, consumers must understand that the verification outcomes would not affect their credit score. Certegy checks the consumer’s former transactions and a sample of check writings. Then they statistically analyze it by comparing all the other checks that have passed through the Certegy system. It is specifically made for examining checks. Therefore, even though you have a credit less than stellar, it would not be a factor while verifying your check.

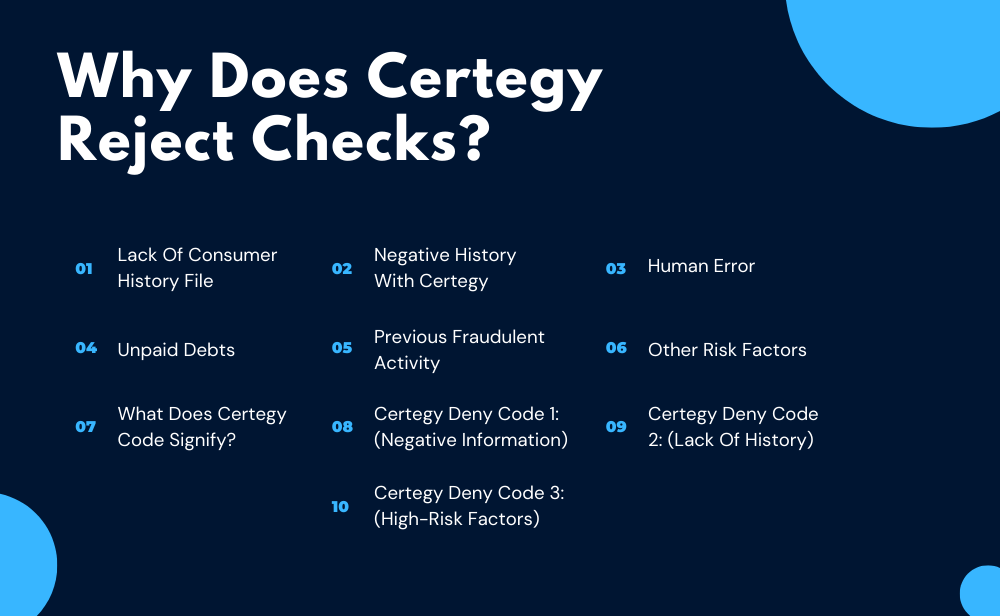

Why Does Certegy Reject Checks?

It has already been stated that the specifics behind the system’s proprietary risk models are not revealed. But, according to our research, some common features can affect the outcome of the verification. So make sure you know all the factors before finding any remedies on how to beat certegy:

Lack Of Consumer History File

When a consumer does not use checks as a payment method very often in any retailer or if they have never used it before, Certegy’s verification system might mark you as a risk since they have no history of your payment. Unfortunately, nothing much can be done in this circumstance.

So, it is important to note that if you have never used checks as a payment medium, how will the system know if your check is good? Besides, you cannot build a check history if you do not pay with a check. Keeping these questions in mind, it is crucial to establish a history with a check payment. You can beat certegy on this issue by purchasing inexpensive goods or services to create a positive check payment history.

Negative History With Certegy

Another issue that might occur is if you have a no positive history with Certegy. If Certegy flags your information, the retailer will likely deny your check. It entirely depends on the check writer. Furthermore, if you have written bad checks in the past, that can be writing checks without having sufficient balance on the account or if you tried to “float” a check numerous times. Then Certegy will reflect your account as high-risk and refuse the payment. It can damage your history even if you have paid for former infractions. You can beat certegy on this issue by avoiding writing bad checks or using deceptive methods in the first place.

Human Error

In today’s increasingly tech-driven economy, we still have humans who handle basic activities. Besides, humans are not perfect beings. Therefore, the Certegy system can decline a consumer’s check due to human error.

The cashiers handle customers and their transactions throughout the day. So, mistakes are inevitable at some point. For example, the cashier might enter incorrect details of the customer in Certegy’s POS system. Besides, other details may have been entered into the device inaccurately before you paid in-store. It might also be that your identity may have confused another person’s identity. For instance, you may have quite a similar name or address. Thus, you can ask the cashier to recheck your information to beat certegy on such instances.

Unpaid Debts

Your check might also be denied if you have a negative history with the financial institutions. For example, it might occur due to various unpaid debts, including closing the accounts because of negative amounts. Indeed, Certegy would not always contact the banks; their website states that they may try to verify funds with the consumer’s financial institutions depending on the consumer’s check transaction specifics. For example, the verification might be about the consumer’s current or previous account.

Previous Fraudulent Activity (Even If You Were A Victim)

The denial of previous fraudulent activity may be less obvious, but it can improve the chance of your check getting denied. Along with checking previous uses of checks, Certegy also examines the fraudulent history activity associated with your account. It is applicable even if you were the victim of fraud in the past. In addition, if your account has fraudulent history reports, checkbook thefts, and more, Certegy might mark you as a high-risk check-writer. Therefore, retailers can deny your check payment.

Other Risk Factors

As Certegy’s property risk models are unknown, other risk factors can be anything that you do not know about. It includes everything that the system uses to calculate the risk of a transaction that is not based on the payment history. For instance, if you write a check for a new iPad instead of a card, the device may associate your payment with high-risk behavior, even though you have established a perfect payment history.

What Does Certegy Code Signify?

Fair Credit Reporting Act (FCRA) does not allow Certegy to accept or deny checks on behalf of the consumers. Rather, it gives the recommendations according to the risk models. Listed are the causes as to why the system helps retailers deny checks:

Certegy Deny Code 1: (Negative Information)

Certegy Deny Code 1 indicates the potential check fraud. The system’s retailers can see the code when the customer has a negative history on the device or a hidden file.

Certegy Deny Code 2: (Lack Of History)

Certegy Deny Code 2 is generated when the check-writer has little or no history of paying in checks or if the consumer’s behaviors are out of the ordinary. For example, this code may be triggered if you do not use checks but choose to pay for an expensive item.

Certegy Deny Code 3: (High-Risk Factors)

Certegy Deny Code 3 is generated when the consumer has a high-risk factor associated with the check or its authority. It might also indicate if the check comes from a check fraud area with other risk factors.

Certegy Deny Code 8: (Unknown)

The cause behind Certegy Deny Code 8 is not known. However, it can be generated for various reasons, such as the variance of check-writing frequency and lack of details for Certegy.

Can You Dispute Negative Items With Certegy? Can You Check What Your File Says?

Although Certegy is not similar to other consumer reporting agencies like Experian, TransUnion, or Equifax, it is still kept in the same category by the law. Therefore, Certegy requires to act according to the FCRA. So, consumers can dispute items to Certegy like other credit reporting agencies. Thus, it is also one of the way to beat certegy in case inaccuracy.

As it is a consumer reporting agency, you can authorize a free report every year. You can truly review the reasons that cause the retailers to deny your checks after you have received your report. The law allows Certegy to provide a free report once a year. To get hold of your report, you can Certegy directly.

If you get denied by any retailer due to this system, they will prove you a specific reference number for the transaction. You can also visit the Certegy Check Search webpage with the number to check in the lookup box. In addition, if you have your check, you can enter the necessary details like the check number, date, and amount to examine it.

How To Get In Touch With Certegy?

Customers can request a free copy of their report once every year. In addition, you can also request a free report within two months of an “adverse action notice.” You can request in written form, via Fax, or by Phone.

Certegy Payment Solutions, LLC

P.O. Box 30046

Tampa, FL 33630-3046

Fax: 727-570-4936

Phone: 1-800-237-3826

When you contact Certegy, include your name, address, government-issued I.D. number, bank routing, account number, social security number, and phone number. Besides, you get a downloadable request form that you will find on their website. You can fill in the details and send them.

How Does The Dispute Process Work?

If your check has been declined due to Certegy’s decision, you can request a free report within 60 days of the transaction. Then Certegy, like other reporting agencies, has a month to respond. Furthermore, if you request a free report as you are granted in any given one-year period, it has 45 days to answer.

If you find anything inaccurate, you can dispute it with the agency. The agency will then work to prove the details you have provided through the source that originally reported to you. Even if you do not receive any response after the dispute, Certegy should remove it from your file.

Bear in mind that the negative entry will be removed if Certegy had an issue with their records or if it is inaccurate. But they can validate the item; it will stay on your report.

Is Opening Second Chance Banking Right For You?

If you continuously get issues with Certegy, you can get a “Second Chance Banking” for you. However, you would not find the major banks offering these accounts. Fortunately, you will find community banks and credit unions offer it. It may have various names like Fresh Start Checking and Opportunity Checking.

How To Beat Certegy?

There are several ways to beat Certegy. While reviewing your Certegy Check Services file, examine if all the details are correct and not outdated. If you find any inaccuracy, you have the right to dispute and remove it or get it corrected. You also have the right to sue if Certegy does not solve the issue according to FCRA guidelines. Besides, you can also contact consumer protection attorneys if they ignore your dispute. Thus, you have right to legal aid in such instance to beat Certegy.

Conclusion

As discussed in the article, now you understand why Certegy holds your checks back. It is by analyzing, examining, and verifying your account and check payment history. Therefore, it is important to consider establishing the check payment history to help accept your checks in any retailer.