S&S Recovery: How To Remove It From The Credit Report

Introduction

Debt collectors like S&S Recovery are frequently employed by debt collection agencies, however others work independently. Some are also lawyers. These agencies can sometimes function as intermediaries, collecting unpaid bills from clients and remitting them to the original creditor.

Collection companies often specialize in the sorts of debt that they collect. For example, a collection agency may only collect unpaid bills of at least $200 that are less than two years old. A good collection firm will also confine its efforts to debt collection within the statute of limitations, which differs by state. Being within the statute of limitations indicates that the debt is not too old to be pursued legally.

The creditor pays the collector a portion of the amount collected, often ranging from 25% to 50%. Credit cards, medical bills, automotive loans, personal loans, company loans, school loans, and even overdue utility and cell phone bills are all collected by debt collection companies.

Some collection agencies also negotiate settlements with clients for less than the amount due for difficult-to-collect debts. Debt collectors may also submit cases to attorneys, who will launch lawsuits against clients who refuse to pay the collection firm.

What Is S&S Recovery, Inc?

S & S Recovery, Inc is a Memphis, Tennessee-based debt collection service. They may appear as a collections account on your credit record. This can occur if you fail to pay a bill.

How Can You Remove S&S Recovery, Inc From Your Credit Report?

Collections can lower your credit score and stay on your credit record for up to seven years, whether you pay them or not. Paying the collector may actually harm your credit score. However, a collection account might be removed from your credit history before seven years. (Debt collectors would rather we didn’t tell you this, but it’s something you should be aware of.)

A normal person by taking help or advice from the attorneys or from those people who are very well aware about removing the collection and can save your credit score.

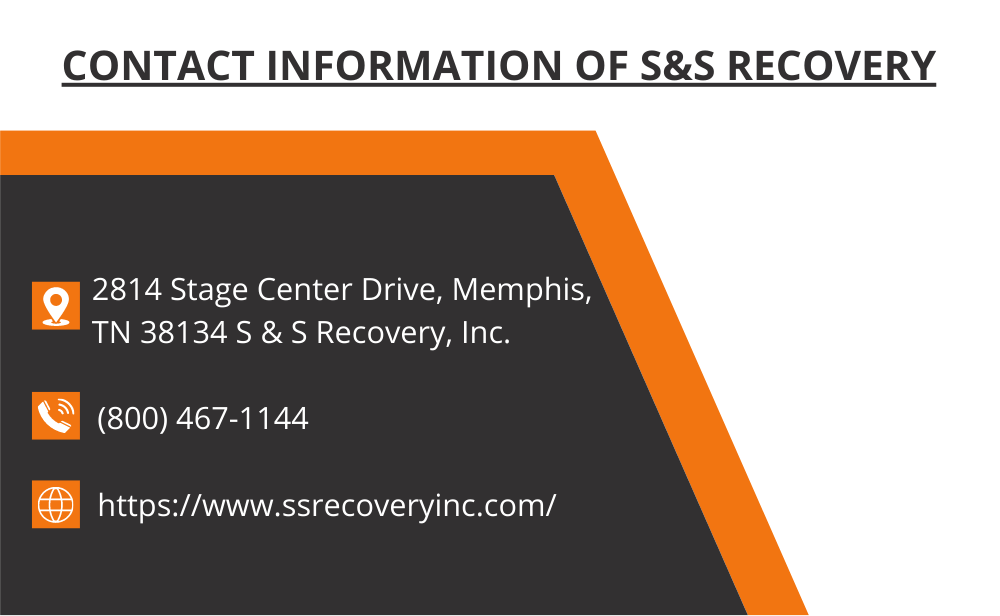

Contact Information Of S&S Recovery

Address:

2814 Stage Center Drive, Memphis, TN 38134 S & S Recovery, Inc.

URL: https://www.ssrecoveryinc.com/

(800) 467-1144 is the phone number.

Should You Contact Or Pay?

Nothing positive can come from talking on the phone with a collection agency. Payments on the collection account will also reset the clock. As a result, instead of improving your credit, it may exacerbate it. Of course, there are situations when it is advisable to simply pay the collection account, particularly if it is new and you are confident that it is legitimate.

Working with a professional credit repair firm is the best method to deal with S & S Recovery, Inc. They have removed millions of bad things from firms such as S & S Recovery, Inc for millions of clients around the country. They can also help you in solving this problem without paying a single penny to the collection agency.

How Does S&S Recovery Affect Your Credit Score?

Missed payments over a period of time may lower your credit score. A collection account on your credit record will further limit your ability to obtain fresh credit. Debt collectors frequently purchase and sell debt, which can result in many collections appearing on your credit reports for the same account.

When this happens, if you do not dispute the accounts with the credit bureaus and have them all erased, your credit score will suffer.

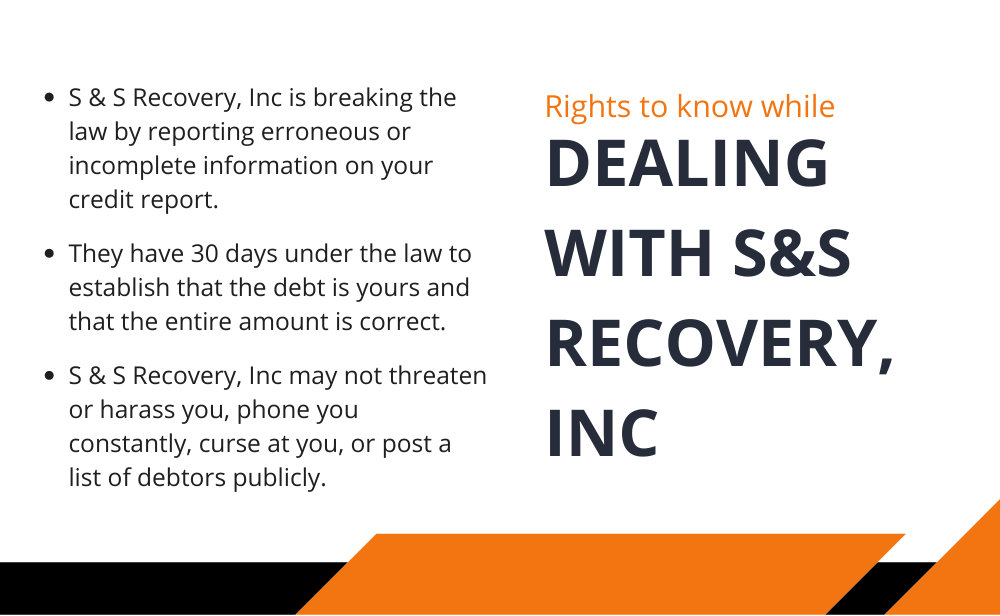

Rights To Know When Dealing With S&S Recovery, Inc

In the United States, there are tight rules governing what a debt collector may and cannot do. The Fair Debt Collection Practices Act, for example, prohibits the employment of abusive or fraudulent debt collection practices. Furthermore, the FDCPA gives you several rights to guarantee that collection firms do not take advantage of you. Specifically:

- S & S Recovery, Inc is breaking the law by reporting erroneous or incomplete information on your credit report.

- You have the legal right to demand debt validation for an alleged debt. Send a debt validation letter to the collecting agency. They have 30 days under the law to establish that the debt is yours and that the entire amount is correct.

- S & S Recovery, Inc may not threaten or harass you, phone you constantly, curse at you, or post a list of debtors publicly.

- S & S Recovery, Inc must be open and honest about who they are and what they are trying to accomplish. They must inform you, both verbally and in writing, that they are a collection agency.

Additional Tips To Deal With S&S Recovery, Inc:

- Avoid using the phone. NEVER speak with a debt collector over the phone. The less information they have about you, the better.

- Inform S & S Recovery, Inc that it is your policy to deal with everything in writing. Request a letter containing the original debt details and then hang up the phone. If they continue to call, send them a stop and desist letter.

- Keep track of their phone calls. If you have to speak with a debt collection organization over the phone, videotape the conversation. You can surreptitiously record phone calls in 35 states and the District of Columbia.

- In the other 15 states, you can record with the approval of the other party. If you inform the debt collector you’re going to record and they continue talking, you’ve given consent. They will almost always

- Don’t believe anything they say. Bill collectors are notorious for making bogus threats, lying, and telling you whatever they need to tell you in order to get you to pay the debt.

- Don’t try to hide money. Hiding money or assets from a legitimate debt collector if you owe them is criminal. However, you should avoid allowing anyone access to your bank account or credit card information.

- Do not apply for new credit lines. Applying for additional lines of credit while unable to pay your present creditors is also deemed dishonest.

- Don’t dismiss them. You can do things on your own terms, but ignoring the matter will not result in S & S Recovery, Inc disappearing. Ignoring them puts you at risk of a lawsuit.

Is S&S Recovery, Inc. A Scam?

No it’s not a scam as it is a collection agnes like any other agency and they have to follow all the rules imposed upon them by the federal agencies of USA who regulates the subject matter in which the particular agency is dealing which is debt capital, although companies are bound to follow all the rule and specified protocol as hey cannot just overlooked it, so the firm is nit a scam and you will not get thugged.

The Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau have received several complaints about collection companies (BBB). The majority of consumer complaints include erroneous reporting, harassment, or a failure to verify a debt. If a debt collector is bothering you, you might think about filing a complaint.

Conclusion

The collection can hurt your credit score badly but the good news they can be removed within a period of 7 years from the date of loan and paying those companies will not help, if you feel like you are trapped you can always seeks the expert opinion and get yourself out from the mess ( if any ) created by the agency without your fault.