MidSouth Adjustment Co.: Things To Know

MidSouth Adjustment Co, Inc. is an Arkansas debt collection business situated in Pine Bluff. They may appear as a collections account on your credit record. It can occur if you fail to pay a bill.

Things To Do When Midsouth Adjustments Call You:

Do not panic and stay cool if you receive a call from Mid-South Adjustment Co. Inc. Do not lose your mind, as these agencies rely on it. Instead, follow these steps to determine whether this call is legitimate:

- Instead of the so-called debt collector questioning you, make sure you start questioning them as well- Inquire about their firm affiliation, what their company name and logo are, and so on. Make sure not to confirm any information, such as your bank account number or address. Inquire about the debt and the firm that issued it. If they are unable to supply you with any justifications or do not provide you with their firm name or phone number, they should be avoided.

- Do your homework- There are situations when the debt collection firm is legitimate, but the debt is not. They are prone to making blunders. Search for the firm on Google to see whether it is real. You may also see how many complaints have been made against them. Furthermore, after you have determined that this agency is authentic, call them, as some persons may pose as employees of the collection agency.

- Examine your credit report- You’ll get a fast overview of what you owe, who you owe it to, how much you owe, and so on. If someone contacts you out of the blue to inform you that you have an overdue obligation that is not included on your credit record, it is most likely a fraud.

- Check the applicable statute of limitations- The Mid-South Adjustment Co. Inc are not required you to pay the outdated debt if it has expired. Do not reiterate anything vocally since this may cause the stale debt to resurface.

Rights To Know And How To Use It Against Midsouth Adjustment Co.

In the United States, there are tight rules governing what a debt collector may and cannot do. Furthermore, the FDCPA gives you several rights to guarantee that collection firms do not take advantage of you. Specifically:

- You have the legal right to demand debt validation for an alleged debt. You can write a debt validation letter to the collecting agency. They have 30 days under the law to establish that the debt is yours and that the entire amount is correct.

- Mid-South Adjustment should not threaten, swear, harass, call you frequently or publicly post you as a debtor.

- Mid-South Adjustment Gragil Associates must be open and honest about who they are and what they are trying to accomplish, all verbally and in writing.

- Mid-South Adjustment cannot threaten you with arrest, and they cannot threaten legal action if they do not intend to do it.

Who Does Midsouth Adjustment Collect For?

Midsouth Adjustment buys debt from a variety of creditors. Therefore, providing an accurate and up-to-date list is challenging because the information is not always publicly available and is continuously changing.

Is Midsouth Adjustment A Debt Collection Agency?

Midsouth Adjustment is, indeed, a debt collecting organization. They acquire debt from various creditors who are no longer interested in attempting to collect the money themselves (also known as a “charge-off”).

Midsouth Adjustment may try to contact you by mail or phone (demanding payment). Worse, a collections account will now appear on your credit record. It lowers your credit score and reduces the opportunity to get a loan approval or other major financial event.

Should I Pay For Delete With Midsouth Adjustment?

Paying off Midsouth Adjustment to have it removed from your credit record seems a smart idea. However, there is one main issue. When you pay a bill in collections, the report might change from the status of unpaid to paid. But it does not get removed from the account for seven years. Therefore, it implies that your credit is still harmed.

Is Midsouth Adjustment A Scam?

Midsouth Adjustment is a recognized organization. They are neither a forgery nor an attempt to defraud you. However, they are most likely spam phoning you in an attempt to collect a debt. You can resolve it by contesting and erasing unjustified debts.

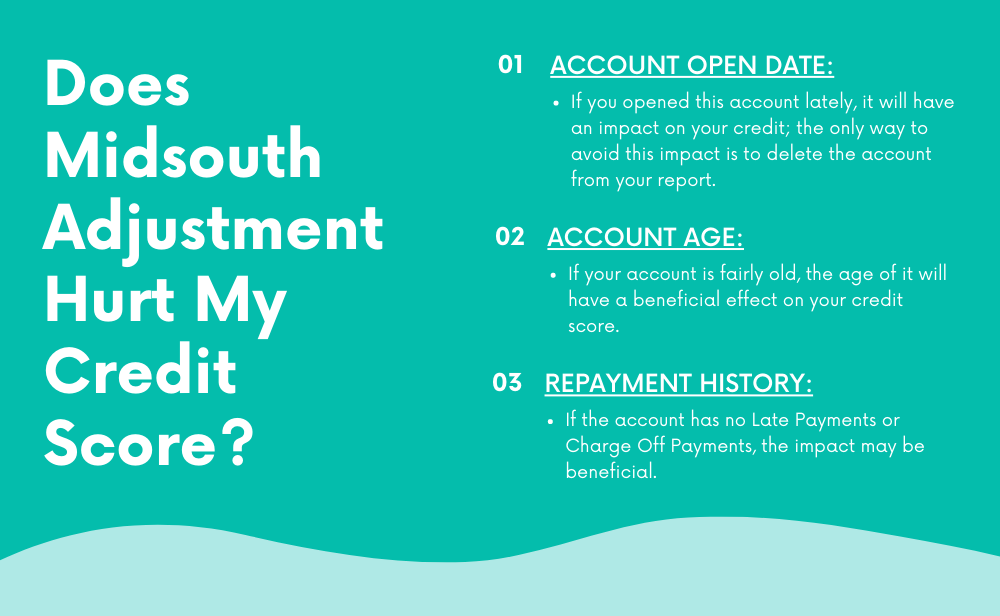

Does Midsouth Adjustment Hurt My Credit Score?

The impact of this account on your credit score is determined by a number of criteria, including:

Account Open Date: If the account is fresh, it will harm your report. You can avoid the effect by deleting it from the report. Suppose this account has any negative listings such as late payments, charge-offs, collections, and so on. However, there may be certain possible benefits to this account that might help you improve your credit score, such as:

Account Age: If your account is fairly old, its age will have a beneficial effect on your credit score.

Repayment History: The impact may be beneficial when your report has no late payments and other such negative markings.

Should I Negotiate A Settlement With Them?

As a general rule, avoid contacting creditors through unofficial methods such as phone and email. Because when you have not recorded a conversation legally, any agreements reached might be a challenge in court. If you must interact with this Creditor, you should do so via certified letter to protect yourself.

Working with a professional credit repair business is the best approach to restoring your credit. They are professionals at removing bad material from firms all throughout the world, including Mid-South Adjustment Co., Inc.

Does It Accept A Goodwill Letter To Remove My Collection?

This debt collection company does not accept goodwill letters to erase any negative listings.

Conclusion

Debt collectors are recruited because they are persuasive, nearly to the point of harassing and intimidating. In addition, because many individuals are unaware of their rights, they are under pressure to repay their debts, which causes them to go bankrupt.

You should be aware that it is in the debt collector’s best interests to put you under enough strain to crack you and force you to pay money. It is due to the fact that the Creditor who employs them gets paid on a commission basis. The earlier they obtain the money from you, the larger their commission.