First Premier Credit Card Reviews

Introduction

The First Premier Credit Card is an unsecured credit card created for those with bad credit who would otherwise be denied a credit card. So, if you have strong or great credit or can get a no-annual-fee credit card from another provider, this card isn’t for you. However, if you have less-than-perfect credit and are having difficulty obtaining a credit card, the First Premier Bank Credit Card may be of interest to you.

Overview Of First Premier Bank Credit Card

The First Premier Bank Credit Card is intended for customers with poor credit. Because other unsecured cards may deny them. You should not intend to utilize this card indefinitely. Instead, utilize this card for a brief period of time to establish credit before going for a typical card. Other cards might have incentives, reduced fees, a bigger credit limit, and lower interest rates.

First Premier Credit Card: Its Pros And Cons:

Following are the advantages and downsides of the First Premier Credit Card:

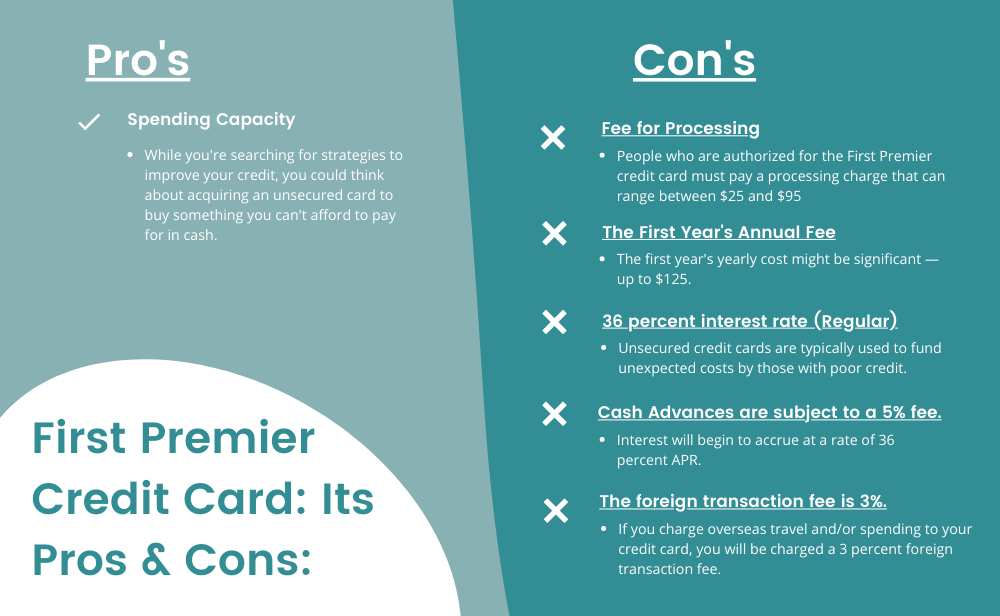

Pros

- Spending Capacity

While you’re searching for strategies to improve your credit, you could think about acquiring an unsecured card. It might help to buy something you can’t afford to pay for in cash. That’s where the First Premier credit card comes in. Assume they have authorized you for the card and must pay $25 after approval. In addition, a $79 first-year charge for a $1,000 credit line. This gives you a total purchasing power of $896 ($1000-$79-$25= $896). Because they will waive the monthly costs, you will pay $8 in the first year. But you will need to pay $10.4 in the second.

Cons

- Fee for Processing

As previously stated, people who are authorized for the First Premier credit card must pay a processing charge. The charge can range between $25 and $95. This may influence your spending limit, and if you are unable to pay the charge within 85 days of approval, First Premier will close your account.

- The First Year’s Annual Fee

The first year’s yearly cost might be significant — up to $125. If you are approved for the First Premier credit card with a $500 beginning credit line, you will have to pay $125. For $400, you must pay $100, for $600, $700, and $1000. For $300, you must pay $75.

- 36 percent interest rate (Regular)

Unsecured credit cards are typically used to fund unexpected costs by those with poor credit. As a result, you’ll almost certainly be carrying a balance on the card each month. Unfortunately, the excessively high 36 percent APR on the First Premier credit card will make this quite expensive for you.

- Cash Advances are subject to a 5% fee.

If you use your First Premier card to withdraw money from an ATM, you must pay a cash advance charge of 5% of the entire amount withdrawn. Interest will begin to accrue at a rate of 36 percent APR.

- The foreign transaction fee is 3%.

If you charge overseas travel and/or spending to your credit card, the card issuer will charge a 3 percent foreign transaction fee.

How To Use First Premier Credit Card

If you still wish to apply for this card or if you already have one, never carry a balance on it. You’ll not only avoid paying 36 percent interest on any revolving amounts, but you’ll also improve your credit and be able to apply for other, better cards. When First Premier reports your card usage to the credit agencies, you’ll only want to display a positive history of on-time, complete payments.

Alternatives To First Premier Credit Card:

Indigo Platinum Mastercard

The Indigo Platinum Mastercard is another alternative for folks with a low FICO score who want to acquire a credit card. It has a continuing APR of See terms, and a yearly fee of $0 – $99*. It’s also travel-friendly, with a 1% international transaction cost, although the card limit is only $300.

OpenSky Secured Visa

The OpenSky Secured Visa is an excellent option for anyone looking to establish or restore their credit. A $3,000 refundable security deposit protects this card. And they will not pull your credit when you apply, so you won’t have to worry about your credit score suffering as a result.

Discover It Secured Mastercard

Each quarter, you may earn 2% cash back at gas stations and restaurants on up to $1,000 in total purchases. 1 percent limitless cash back on all other transactions – Discover It Secured Mastercard will increase the credit limit. Your credit line will be equivalent to your security deposit of at least $200. There is no yearly charge, and there is no late fee on your first late payment.

FAQs Related To First Premier Credit Card

Is First Premier Bank Legit?

South Dakota is the home of First Premier Bank. Premier Bankcard, a sibling company, offers the First Premier Bank Credit Card and is the 12th-largest issuer of Mastercard credit cards in the United States. United National Corporation owns both organizations.

Who Is First Premier Credit Card Best For?

The First Premier Bank secured credit card is for people with no or poor credit. Because there is no credit check, practically anyone can authorize it. It will report to all three credit reporting agencies, as do most secured cards. If you use the card carefully, this can help you develop a positive payment history.

Does First Premier Increase Your Credit Limit?

After their credit card account has been open for 13 months, First Premier cardholders may be eligible for a credit limit increase. However, each time the bank authorizes your account for a credit limit increase, you must pay a charge of 25% of the credit limit increase amount.

What Credit Score Do You Need To Qualify For Your First Premier Credit Card?

Because First Premier credit cards are for those with low or poor credit, there is no minimum credit score requirement. Not all candidates, however, will get an approval.

Is First Premier A Secured Credit Card?

If you have no or terrible credit and need a credit card, a secured credit card from First Premier® is a solution. If you are eligible for a no-fee secured card, that is a better alternative. Many no-fee secured cards offer pre-qualification without a rigorous credit inquiry, so you have nothing to lose by checking to see if you qualify.

What Is The Annual Fee For The First Premier Card?

The First Premier Bank will collect a yearly fee when your credit account starts. Then each year in the same billing cycle, the bank will charge a monthly fee until the amount on your credit account is $20 or less.

There are no benefits for these fees other than having access to a credit card. Instead, First Premier claims that the program charge is to “balance the risk associated with the credit account.”

Can I Withdraw Money From My First Premier Bank Credit Card?

As a cash advance, you can take funds from your First Premier Bank Credit Card. Your initial cash advance limit will be 10% of your credit limit after you have opened your account. However, if your account has been opened and active for at least 90 days, has two consecutive months of current payment history, is not late, and has had no return payments in the last 60 days, your cash advance limit may be extended to 50% of your credit limit.

If you accept a cash advance, you must pay a $8 cash advance transaction charge or 5% of the cash advance amount, whichever is larger. You’ll also start earning interest on cash advances right now. As a result, it’s better to avoid monetary advances.

Should I Close My First Premier Bank Credit Card?

Keep credit card accounts open in general to boost your average account age. However, unless you can downgrade to a no-fee card with First Premier Bank, you should delete the account. Getting a downgrade does not appear to be a possibility. Therefore you should delete your card account after you’ve been approved for a more traditional credit card with reduced costs.

Conclusion

The First Premier Credit Card is designed for a specific subset of customers who require an unsecured credit card yet have weak or poor credit. Expecting this card to provide the same advantages, rates, and fees as credit cards that need great credit is unrealistic. However, this card has exorbitant costs, including a monthly fee, an annual fee, and a programme fee while granting a limited credit limit of $300 to $1,000 depending on creditworthiness.

If you don’t want to use a secured credit card and can’t get approved for an unsecured credit card with lower costs, the First Premier Bank Credit Card may be a good option. However, I wouldn’t apply until you’re debt-free and actively striving to repair your credit.