Cerulean MasterCard Reviews

With the ever-increasing number of banking services and cards available, choosing the right one for you might be difficult. Each card and bank provide a myriad of perks to their cardholders while also charging fees. In this blog, we are going to provide you with a Cerulean MasterCard Reviews so that you can decide which card is best for you.

Nonetheless, everything is straightforward and uncomplicated when you have a solid credit score to fall back on. Rest self-assured, and you can apply for any card of your choice. What about people who have had bad luck with their grades and require some assistance? They have specific cards developed for them. In a word, these cables help to control their expenditure by imposing various constraints.

This article will provide detailed Cerulean MasterCard Reviews to help you look into every aspect before proceeding with the card.

Cerulean MasterCard Overview

The first thing you should ask yourself is why you should go through the bother of getting a Cerulean MasterCard rather than a simpler card with fewer restrictions, criteria, and a lower interest rate.

The Cerulean MasterCard, however, is not for everyone. Instead, it caters to a certain demographic that needs these limitations but isn’t necessarily eligible for other cards. This demographic comprises persons who have a negative credit score or a low credit score that they wish to improve.

In other words, whether you’ve had horrible credit, missed payments, too much credit to pay, and so on, the Cerulean MasterCard will help you build your score by following its requirements. In this manner, it will have zero impact on your future.

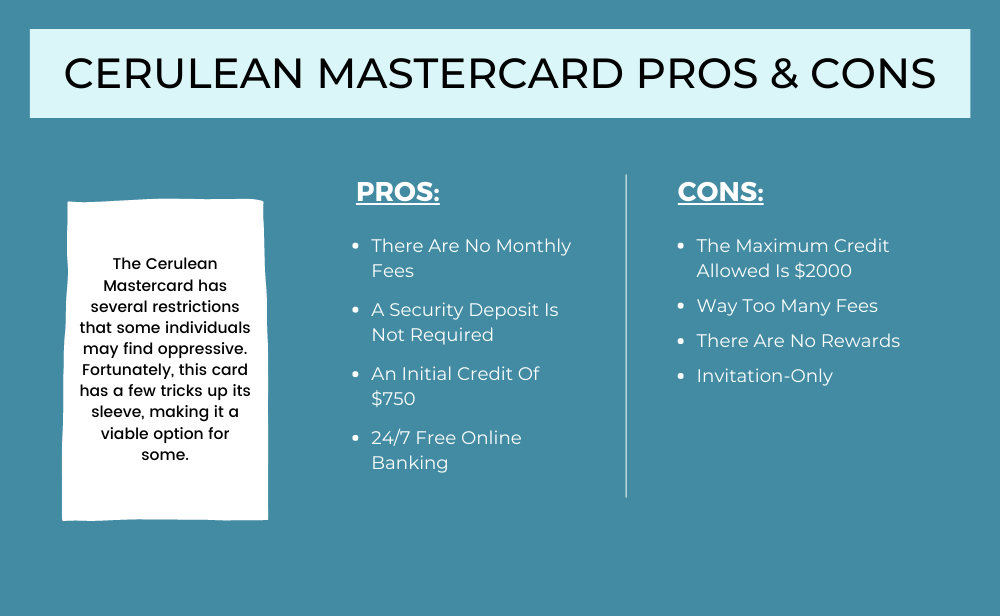

Cerulean MasterCard Pros And Cons

The Cerulean MasterCard has several restrictions that some individuals may find oppressive. Fortunately, this card has a few tricks up its sleeve, making it a viable option for some.

PROS

THERE ARE NO MONTHLY FEES.

The absence of recurring monthly fees is one of the best features of the Cerulean MasterCard. Most of these fees are tiny, but they build up to an amount of money you might have invested more efficiently elsewhere at the end of the year. Furthermore, because they are already deducting an annual charge, a monthly tax is, at best, nonsensical.

A SECURITY DEPOSIT IS NOT REQUIRED.

Another outstanding feature must be the absence of security deposits. Therefore, you do not require to spend the extra money and wonder where it will end. It’s also a huge comfort for individuals who want to create a new page but don’t have much to work with.

AN INITIAL CREDIT OF $750

Trying to improve your financial ratings from the ground up is an exhausting undertaking. As a result, Cerulean is attempting to assist you as much as possible. They are granting a minimum of $750 in credit. It all depends on your application and their belief in your capability.

24/7 FREE ONLINE BANKING

Online banking is becoming just as crucial as traditional banking. Everything is at your fingertips with a few swipes of your finger.

CONS

On the opposite end of the scale, you can consider the below-given factors before proceeding with Cerulean MasterCard. Let us go through them with you.

THE MAXIMUM CREDIT ALLOWED IS $2000.

We’ve already discussed the minimum credit, which is $750. The limit is $2000, which may be insufficient for any large transaction you may need to make. As a result, you can’t use this card for large-ticket transactions.

WAY TOO MANY FEES

As you can see at the beginning of the post, there is a list of fees that you should keep in mind while considering the Cerulean MasterCard. This card comprises the yearly fee, transaction fees, and so forth. Each cost may appear tiny on its own; nonetheless, we combine our efforts, and the result is a sizable chunk of money that you will be obliged to cope with every year.

THERE ARE NO REWARDS

Unlike many other cards, the Cerulean MasterCard has no rewards program. Therefore, it has no ties to any shops or services to make your life simpler. Unfortunately, this may be a significant disappointment for many individuals, as these rewards schemes might represent an indirect means of saving/making money.

INVITATION-ONLY

One of the most vexing aspects of the Cerulean MasterCard has to be the fact that you can’t merely apply for one. That’s not how it works; this card is only available via invitation. As a result, you must get an invitation along with the reservation number.

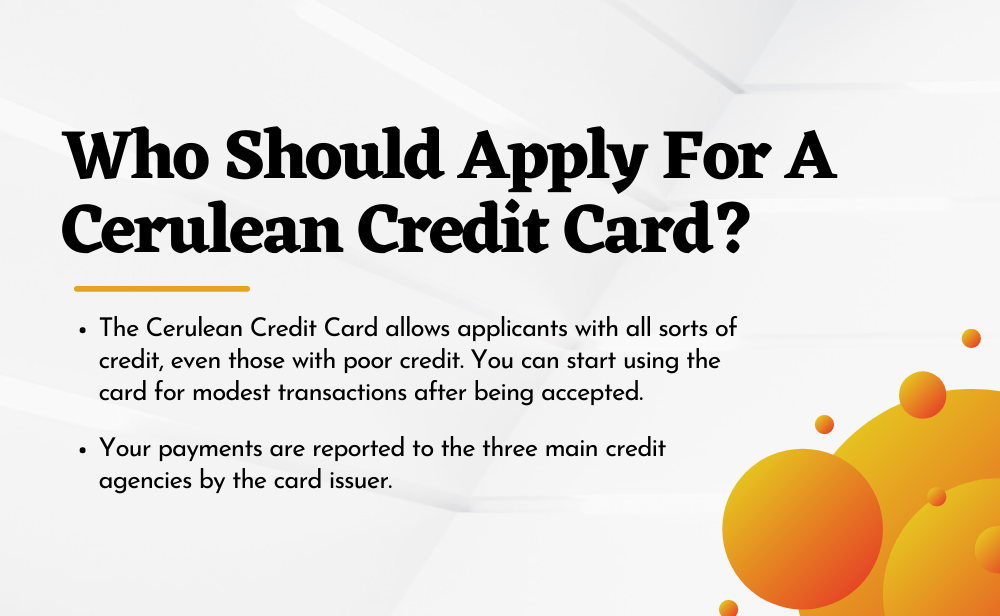

Who Should Apply For A Cerulean Credit Card?

The Cerulean Credit Card allows applicants with all sorts of credit, even those with poor credit. You can start using the card for modest transactions after you have being accepted. The card issuer reports your payments to the three main credit agencies. If you choose to pay the minimum payment by the due date, you might have a chance to increase your score over time. In addition, those who have bad credit can apply for this card.

Steps To Apply For Cerulean MasterCard

It’s never been easier to apply for a Cerulean MasterCard. You can apply for a Cerulean credit card online on the website by calling 1-866-513-4598. If you choose to return, you can return the acceptance certificate by the offer you got in the mail.

You must provide some basic information to apply for a credit card online via phone or mail. For example, to apply for a Cerulean credit card, you must provide your full name, social security number, physical address, and date of birth. A P.O. box will not suffice. When applying for a big credit card, this is standard for everyone.

Cerulean MasterCard Reviews

Here the are the most recent Cerulean MasterCard Reviews:

Best Alternative Options For Cerulean MasterCard

Discover it Secured Credit Card

The Discover it® Secured card is one of the only secured credit cards that allows you to earn rewards as you restore your credit. Every quarter, you’ll get 2% cashback on your first $1,000 spent on petrol and restaurants, plus 1% back on anything else. There is no cap on the benefits you may earn, but your credit limit will determine how much you can spend each month.

It is a secured credit card that has no annual charge. Therefore, this card can be a fantastic option if you’re on a limited budget. Your first credit limit will be $200, and you will be required to put down an equal security deposit. If you’ve cleared all of your payments on time for the past eight months, Discover might increase your credit limit up to $2,500.

Capital One Secured MasterCard

A security deposit is required for approval of the Capital One® Secured MasterCard®. Depending on your credit, that deposit might be $49, $99, or $200. In exchange, you’ll get a $200 credit line right now. Capital One will increase your credit limit by examining the time of your payments for the duration of five months. If you make on-time payments in this duration, they might increase your credit limit.

The card has a $0 annual charge, making it less expensive than the Cerulean Credit Card. However, take care to clear the balance. The APR on the Capital One® Secured MasterCard® is considerably higher than on the Cerulean Credit Card, and any debt you hold might soon balloon.

Citi Secured MasterCard

With no annual charge, the Citi® Secured MasterCard helps you develop a credit history for a good financial future. Simply make your regular purchases and pay your bills on schedule. Apply for Citi’s secured credit card today to take the first step toward attaining your financial objectives.

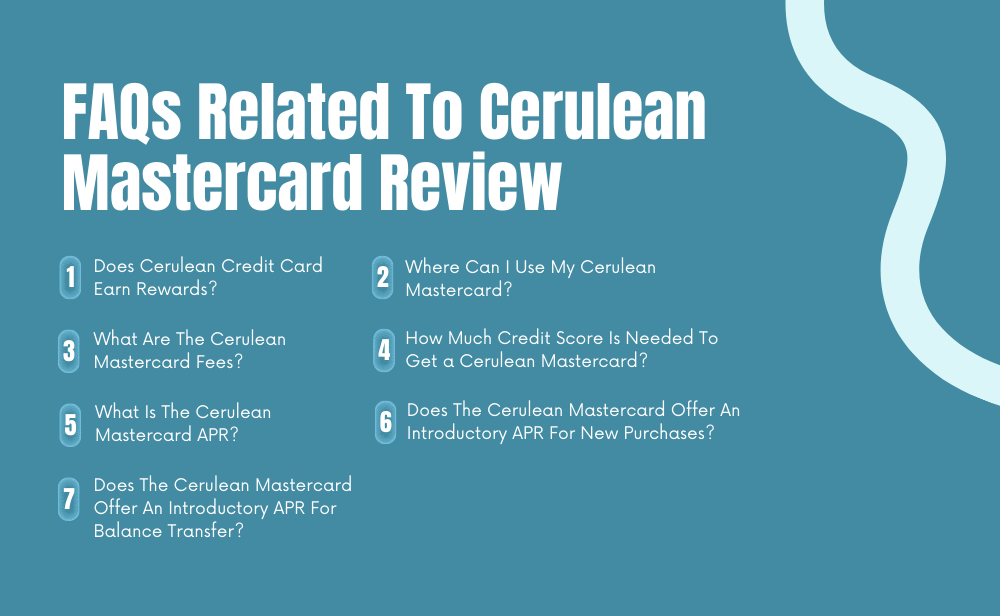

FAQs Related To Cerulean MasterCard Reviews

Does Cerulean Credit Card Earn Rewards?

You would not likely enjoy any benefits like earning rewards with this Credit Card. Most credit cards for bad credit do not offer rewards, but a few do. Earning rewards isn’t a must-have feature, but it might help offset the expense of carrying a secured credit card.

Where Can I Use My Cerulean MasterCard?

A Cerulean MasterCard has a credit limit ranging from $300 to $1,000. Use your Cerulean card at any place that accepts MasterCard. With your new Cerulean credit card, you can go out shopping, travel, or even eat out. In addition, when you pay the debt on time and maintain your balance within your credit limit, your Cerulean credit card account can help you restore your credit score.

What Are The Cerulean MasterCard Fees?

The yearly charge for the Cerulean MasterCard is $99. There is also a $40 late payment fee and a $40 cost for any denied payments. Finally, each extra user incurs a $30 yearly cost.

How Much Credit Score Is Needed To Get a Cerulean MasterCard?

In terms of credit-building cards, the Cerulean MasterCard offers a greater initial credit limit than many comparable cards on the market, with a touted $750 maximum. Of course, that is not to indicate that this is the credit line you will be given, but it is an option.

Cerulean is also marketed as a card with flexible credit score restrictions, implying that even individuals with poor credit can apply. However, there is a catch.

What Is The Cerulean MasterCard APR?

The Cerulean MasterCard’s APR, or annual percentage rate, reaches a mind-boggling 25.9 percent. Of course, it might very possibly alter in response to market swings. Nonetheless, this is the amount we have to deal with now.

As a result, clients should be aware that the Cerulean MasterCard does not provide an introductory APR under any circumstances, including new purchases or first-time cardholders. The interest rate of 25.9 percent is the rate you will pay under any circumstances. It is also completely unaffected by balance transfers. As previously said, the card does not include them, and we believe that even if it did, introductory APRs would not have been included in the package.

Does The Cerulean MasterCard Offer An Introductory APR For New Purchases?

The Cerulean MasterCard does not have an introductory APR. However, the APR of 25.9 percent applies to all purchases beginning on the first day.

Does The Cerulean MasterCard Offer An Introductory APR For Balance Transfer?

There is no introductory APR for balance transfers with the Cerulean MasterCard®. Therefore, you have to use this card by keeping in mind that you will also bear the introductory APR.

Conclusion

It concludes our post “Cerulean MasterCard Reviews.” We believe that now you completely understand the circumstances underlying this one-of-a-kind MasterCard. However, it’s important to understand that it’s not for everyone because it comes with a slew of restrictions and lacks numerous bonuses that other cards have.

Finally, do your homework, know what you want, what you don’t want, what your credit score is, and where you want to take it and act accordingly. Finally, don’t be concerned if your credit score is too low; anyone can improve their credit score by making better decisions every day. That is exactly what the Cerulean MasterCard encourages and supports.