Mercury MasterCard Reviews

Introduction

The Mercury MasterCard conjointly referred to as the Mercury Credit Card, has no annual fee. This unsecured MasterCard is specially created for those who have had issues related to their credit in the past but decide to pay their full balance every month. It is a part of First Bank & Trust, South Dakota, with half a million members. Mercury MasterCard has wide membership, so we have provided a complete guide to cover its various aspects in this article.

Mercury MasterCard Overview

The Mercury MasterCard has received positive reviews since it has no annual fees. However, it has various additional charges applied to it. For instance, the regular APR on the card is 25.65%- 28.65%. Furthermore, when you transfer the balance to someone, it will charge you 27.24% to 29.24% (V) APR, and the balance transfer fee is 4% for a minimum of $5. However, the reviews it has received from the customer are excellent, especially for people who have a credit problem.

Listed are the important details to consider about the Mercury MasterCard before proceeding to apply for the same:

- The Mercury MasterCard has high-interest rates. However, if the user clears off the balance in full, they will be away from paying high interest.

- As mentioned above, The Mercury MasterCard doesn’t charge an associate an annual fee because it is an unsecured card. The Mercury MasterCard is perfect only for people receiving a pre-approval letter from the issuer.

- This credit card is an invite-only credit card. So, people who have received an invitation through email can only apply for it.

- The cardholder can access the Mercury Mobile application for superior expertise. This card was launched in 2018, making it comparatively new in the credit card market.

- The Mercury Credit Card focuses on people with a credit score between 550-650, and it is a Tier III card.

Mercury MasterCard Pros And Cons

Every credit card comes with its own set of advantages and downsides, and Mercury MasterCard is no exception.

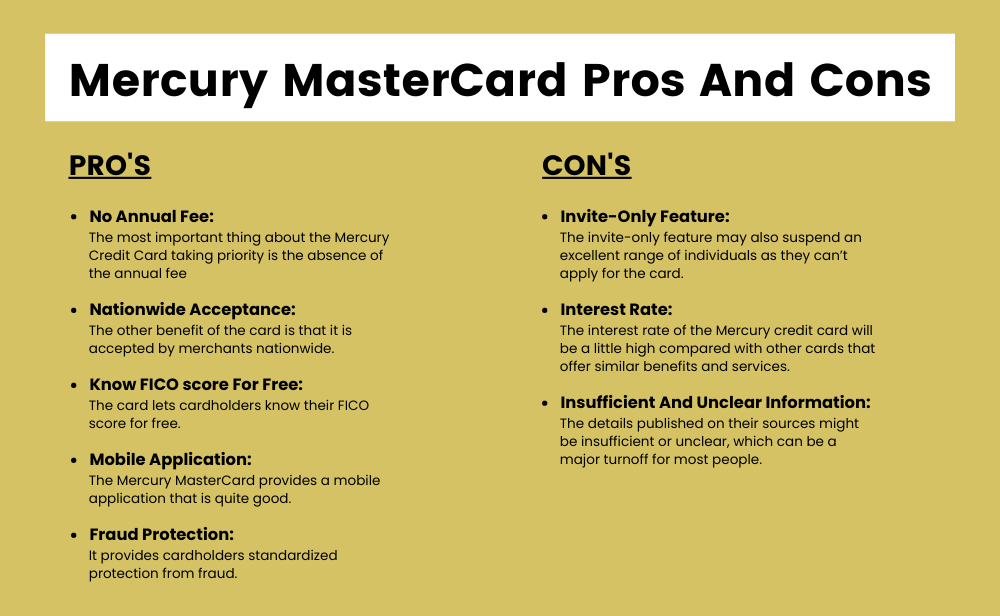

Following are the pros of using Mercury MasterCard:

- No Annual Fee: The most important thing about the Mercury Credit Card taking priority is the absence of the annual fee, an important feature for credit cardholders.

- Nationwide Acceptance: The other benefit of the card is that it is accepted by merchants nationwide.

- Know FICO score For Free: The card lets cardholders know their FICO score for free, which is the most important thing a user wants from the card issuer company.

- Mobile Application: The Mercury MasterCard provides a mobile application that is quite good.

- Fraud Protection: It provides cardholders standardized protection from fraud.

- Rewards: Though the issuer provides offers but no known rewards, some users reviewed that they have received cash, travel, and other rewards. However, their rewards cannot be claimed true as it is not mentioned in their official sources.

Following are the cons of using Mercury MasterCard:

- Invite-Only Feature: The invite-only feature may also suspend an excellent range of individuals as they can’t apply for the card. Even though the consumers are fascinated by the card as they have the required score, they can not apply for it unless they receive an invitation by email. Along with the email, they also send a sign-up code on the far side of their management.

- Interest Rate: The interest rate of the Mercury credit card will be a little high compared with other cards that offer similar benefits and services. But the interest rate should not bother the people planning to pay their dues on time. The high interest they charge is only to ensure that the users clear off their dues on time and do not let it increase.

- Insufficient And Unclear Information: The details published on their sources might be insufficient or unclear, which can be a major turnoff for most people.

Eligibility Criteria For Mercury MasterCard

The Eligibility Criteria for Mercury MasterCard is that the credit score you need for the mercury credit card is 640+. It means people with fair credit scores can only be approved for the card.

How To Apply For Mercury MasterCard?

The consumers must go through a few steps to apply for the Mercury Credit Card. Listed are the steps:

- You need to get the Mercury Card official website.

- By clicking on this link https://www.mercurycards.com/cards/, you will be routed to the website.

- There is an option Respond to mail offer on the site and just click it.

- Then, the appropriate box will open. In this box, you have to enter your reservation code.

- Fill in the following field with your SSN’s last four digits.

- Then, choose the applied today option.

- If the site validates your reservation code, you may continue to the next stage.

Mercury MasterCard Reviews – As Per Credit Karma

There are two types of reviews positive and negative. Below are the reviews:

- Based on positive reviews, this is the best card for bad credit. The process was very easy, and it delivered the card within a week with a $2,500 limit, unlike the $300 to $500 limits for other cards. The card back rewards are awesome, plus it gives us a $750 increment after six months.

- Based on negative reviews, the customer service is horrible! When they answer the phone, they are rude and impatient. They constantly interrupt and answer in sarcastic tones. It is like putting people straight off the street onto the phone.

Best Alternative Options For Mercury MasterCard

The best alternatives to Mercury MasterCard the listed below:

Merrick Bank Double Your Line™ Visa

The Merrick Bank Double Your Line Credit Card gives us a chance to build credit with no security deposit. It is a legitimate credit card company that issues all real credit cards.

Some points related to Merrick Bank Double, Your Line™ Visa, are given below:

- Merrick Bank gives Doubles your CL after the first three on-time payments. It’s faster than other cards.

- The initial CL was $750 @ 24% APR. $0 Annual fees.

- It gives instant approval with 640 Vantage (640 Trans / 650 Equi, from scores here on CK).

- A card arrived six days after approval.

Capital One Platinum Credit Card

The Capital One Platinum MasterCard could be a solid choice for those with an average credit score. It has an associate degree annual fee of $0 and conjointly charges no foreign dealings fees. Except for several, it’s a standout feature. In addition, it offers the prospect of earning a better credit limit when paying off timely payments within six months.

Some points related to Capital One Platinum Credit Card are given below:

- The Capital One Platinum Credit Card is good for those with fair credit. The annual charge is zero, so you can build a credit score and history at no cost. But, the card has a high APR. Therefore, paying the balance every month on time can help you prevent any additional charges.

- The cardholders can fund a credit line as high as $5,000. If you have sufficient money to establish a larger credit line, this could be the best way to build up your score.

Capital One Quicksilver One Card

The Capital One Quicksilver money Rewards MasterCard may be easy money back MasterCard, through which you can accomplish many rewards. The cardboard offers 1.5% money back on each purchase and a one-time money bonus of $200 once you pay $500 on purchases at intervals of three months from the account gap.

Following are some points about Capital One Quicksilver One Card:

- It is an ideal card for consumers who do not spend much or who want only one reward rather than various rates depending on the purchase. Furthermore, it can also be an ideal choice for people looking for a long 0% APR promotion on purchases.

- Consumers with a credit score ranging from good to excellent on the FICO scale can qualify for it. Besides, the excellent features of the card are only for the consumers with high credit scores instead of those with poor credit.

Mercury MasterCard FAQs

What Are Rewards And Cashbacks Given By Mercury MasterCard?

There are no known rewards on this card. However, some reviewers have claimed that they have received cash, travel, and other rewards. But these claims cannot be justified since nothing is mentioned about the rewards and cashback in their official sources.

Does Mercury MasterCard Give Credit Increases?

Yes, the Mercury MasterCard gives credit increases. The credit issuer will check credit account to know if the consumer is fit for a credit increase. Unfortunately, we do not estimate the fixed time to increase the credit limit. The issuer will notify you if you qualify for a higher credit limit. Getting a credit limit increase for your Mercury Credit Card won’t result in a hard pull, so your credit score won’t take a hit either.

Is Mercury A Good Credit Card?

Yes, Mercury MasterCard is a good Credit Card. The main reason is that it gives standard fraud protection if you lost your card. In addition, they also provide offers according to your creditworthiness, where they will automatically enroll you in the reward program.

What Bank Does Mercury Credit Card Use?

The First Bank and Trust issued the Mercury Credit Card. The card does not charge the users with annual maintenance costs. Furthermore, the zero yearly charge makes it an ideal card for people with bad credit.

Does Mercury MasterCard Have a Mobile App?

Yes, Mercury MasterCard has a mobile app to assist users in checking balances, paying bills, checking statements, and redeeming rewards.

Conclusion

Mercury MasterCard does a significant quantity of data to itself, which doesn’t make many users happy. The card is for the people with a bad history with their credit. It is a good choice for those with issues with their credit history and for people who don’t wish to be fazed concerning paying an annual fee for the services offered. Unfortunately, there are no reliable sources to ensure the offers. Therefore, proceeding with the application is a risk to the user.