Legacy Credit Card Review

Introduction

A legacy credit card is an unsecured card for people having bad credit. It might be worth checking for the people whose credit score is lower than 400. If you use the card responsibly, you can get out of a low credit score.

However, the legacy credit card comes with an exceptionally higher cost. The high fees and annual percentage rate (APR) might worry you. Besides, participating in the card’s reward program comes with an extra cost which makes using the card more expensive. In this article, we will provide a clear legacy credit card review to help you decide if it is worth it for you.

What Is a Legacy Visa Credit Card?

First National Bank offers legacy Visa Credit Cards. Visa Credit Card is an unsecured card specially designed for individuals with bad credit scores. It also means that you are not required to deposit in advance to use the card as it is a Visa card. Furthermore, the cardholders get the flexibility to use it at every merchant within the U.S while also using it worldwide. Moreover, with this credit card, you can improve your credit score.

It offers a reward program known as “premium club membership,” When accessing the membership, you will need to pay a monthly fee. Besides, it is an invite-only credit card that requires a pre-approval code to get the application for the card. Additionally, the high APR and fees make people seek an alternative for a credit card to use and improve their credit score.

Why Get The Legacy Credit Card? – Features And Benefits

The Legacy Card offers have various benefits, which are listed below:

Rewards program: Rewards program is the Legacy Visa Card’s perks. The cardholders in the card’s premium club can get discounts on entertainment, prescriptions, dining, rental cars, and hotels. But the rewards programs come with a higher cost. You must pay a monthly fee of $4.95 to join the premium club. The premium club might not be worth paying if you are the one who does not travel or fill prescriptions more often.

Payment Protection Plan: The Legacy Visa Card offers a payment protection plan to cover the payment caused due to an emergency and when the user cannot pay on time. The payment protection plan costs 89 cents per $100 of the monthly balance. It applies only in some instances like military services, unemployment, hospitalization, jury duty, or family leave under federal or state law.

The card issuer only covers your payment of up to $5,000. But you must enroll in the plan for at least 30 days. After that, you can claim it only after every 120 days.

Is a Legacy Visa Credit Card Good For You? – Pros And Cons

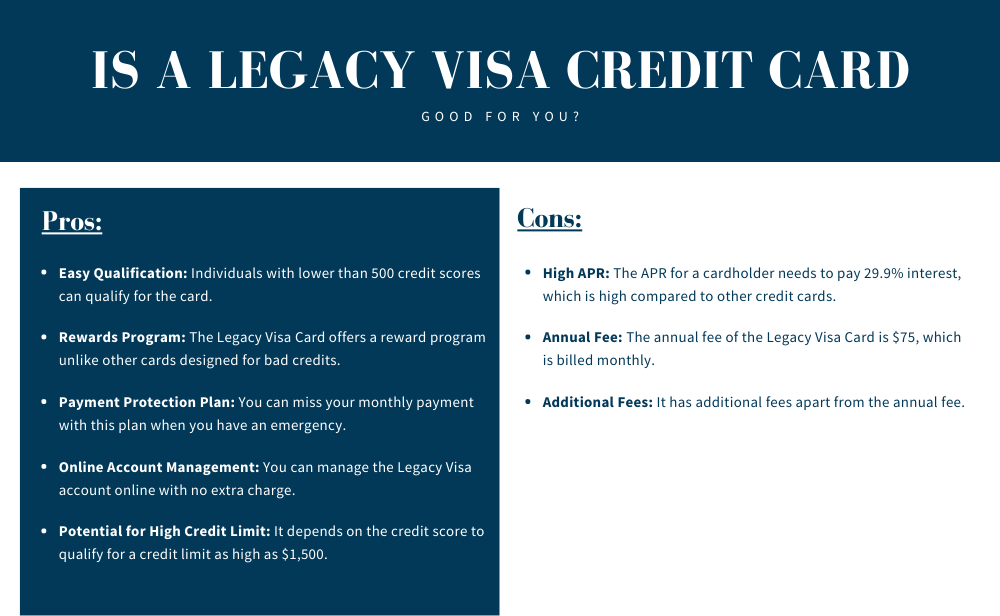

Like all other credit cards, Legacy Visa Credit Card also has advantages and disadvantages. If you want to move forward with the Legacy Visa application, it is good to be aware of the pros and cons:

Pros:

- Easy Qualification: As the Legacy Card is designed for people with bad credit, individuals with lower than 500 credit scores can qualify for the card.

- Rewards Program: The Legacy Visa Card offers a reward program unlike other cards designed for bad credits. However, it comes with extra fees.

- Payment Protection Plan: You can miss your monthly payment with this plan when you have an emergency. For every $100 of the monthly balance, the plan costs 89 cents, and it maxes out at $5,000.

- Online Account Management: You can manage the Legacy Visa account online with no extra charge. With the provided account management system, you can view your monthly statement. Besides, it also helps you to sign up for automatic payments.

- Potential for High Credit Limit: It depends on the credit score to qualify for a credit limit as high as $1,500.

Cons:

- High APR: The APR for a cardholder needs to pay 29.9% interest, which is high compared to other credit cards.

- Annual Fee: The annual fee of the Legacy Visa Card is $75, which is billed monthly.

- Additional Fees: It has additional fees apart from the annual fee. You will need to pay $25 as a late or returned fee, while it costs $20 to add an authorized user.

The Legacy Visa rewards might make it look promising. But it is crucial to consider the additional fees such as $75 as an annual fee, fee for the rewards program that costs $4.95 per month, which makes a bill of $135 per year. Besides, if you do not use the rewards program often, you might reconsider the choice.

How Does Legacy Visa Credit Card Work?

Legacy Visa Credit Card works by providing an option for people seeking to build credits even with a bad credit score. However, an individual cannot apply for a credit card since it is an invite-only card. The best features it offers are the payment protection plan and rewards program. In addition, cardholders can enjoy some security in times of crisis with the payment protection plan, and premium clubs provide additional offers. But nothing comes without a cost, and a Legacy Visa card is no exception. Though it provides the best features, it has its own share of interests and fees.

How To Apply For Legacy Credit Cards?

You can issue the Legacy Visa Card when they invite you. So, you cannot apply for it until you receive a mail inviting you for the card. Imagine that they have offered you a code. Then, follow the listed four steps to easily apply for the same:

- Visit the First National Website: Visiting the First National Website is the initial step you are required to take. On the website, you will find a green box that reads “accept online.”

- Enter your Reservation Number: After you click “accept offer,” the website will redirect to a screen where you will enter the offer code. For the First National, it is “reservation number.”

- Fill out the Application: You can proceed to fill out the application after they have accepted your reservation number and the access code. You need to fill your application with information, such as your name, income, address, name, and date of birth.

- Submit your Application: Fill out the application, then submit it online. Then, First National will let you know the approval of your application and when you might receive the credit card all through the mail.

How To Login to Your Account?

You can follow the following steps to log in:

- Go to the First National Website: You can log in to the website and find an orange-colored button that reads “account login.”

- Enter the essentials: You will be redirected to the cardmember services page, where you will be asked to enter your username and password. You can enter the requirements to log in to the account. If you have not opened an account, you can click on the option that reads “register new user.”

- Access your account: You can access your account after entering the username and password. Then you can view your bills and balance, enroll in autoplay or set up your text alerts.

How To Pay Your Payment?

You can pay the payment for the card online through mail or phone. You should log in to the account if you want to pay online. If you choose to pay by mail, you need to send the payment to their address: Paying by phone will require you to

contact customer service at 888-883-9824.

Alternative Options For Legacy Credit Card

You might think that you have limited options for having a poor credit score. At the same time, indeed, you cannot qualify for most credit cards. But you do not have to get a card with high fees and a high-interest rate. You can, however, consider three different options to rebuild your credit score without paying high fees.

Discover it Secured Credit Card

Discover it Secured card is a card with no annual fee. It is a secured card. It can be an excellent choice for people because it is less than stellar credit. But you must pay $200 as a security deposit to open the card, which also serves as the credit limit. You might require to pay an APR of 24.49%, but it can entirely be avoided by clearing the full balance every month.

The cashback reward program is the main advantage of the card. For example, you can earn 2% cash back on dining and fuel while enjoying 1% cashback on other purchases. Besides, all the rewards in the first year will likely be matched.

OpenSky Secured Credit Card

This credit card has an annual fee of $35. However, the easy qualification and no credit check make it accessible to the people with bad credit, which can help build their credit score.

In addition, this credit card comes with an 18.99% interest rate which is lower than other cards for bad credit. Besides, depending on your creditworthiness, you can choose a security deposit. The security deposit ranges from $200 and $3,000. For all other credit cards, you might have a lower credit limit, but with an OpenSky card, you get the possibility of having a $3,000 credit limit.

Capital One Secured Credit Card

Capital One Secured Credit Card is a secured credit card that has no annual fee. Besides, you get the flexibility to put down $49, $99, or $200 as a security deposit. You can also enjoy an automatic credit limit increase by responsibly using the credit card that comes with no additional security deposit. However, you will need to pay 26.99% as an APR for the Capital One Secured Mastercard.

Legacy Credit Card FAQs

What Credit Score Is Required To Get The Legacy Visa Card?

First National has not specifically listed the credit score required to qualify for the legacy card. But online reviewers have stated that they have received offers with credit scores lower than 400 or 500. Therefore, you can get a chance to receive an invitation from it even if you have a credit score lower than 500. However, since the Legacy Visa is an invite-only card, you cannot apply until you are offered by mail.

What Is The Minimum Payment On Legacy Credit Cards?

The minimum payment is the due of the past month’s and the current month’s payment with the amount over the credit limit. You must pay a minimum of $30 or 4% of your balance with the interest and late fee. It is required to pay the minimum balance by the due date. However, paying the full balance every month will prevent you from accumulating interest.

Does Legacy Visa Give Credit Increases?

The terms and conditions have not disclosed any information about the credit card limits. So you would not even find any information on the First National website.

How Do I Cancel My Legacy Credit Card?

Even if you do not plan to use the credit card, it is ideal for keeping the credit card open because it helps in credit utilization, helping you raise your credit score.

In the case of the Legacy Credit Card with a $75 annual fee, it is good to cancel if you choose not to use it. The terms and conditions of the Legacy Visa state that “you may cancel your account at any time by notifying us in writing at the address on your monthly statement and returning all cards issued on your account (cut in half).”

Conclusion

While Legacy Credit Card might seem an appropriate card to boost your credit score, keep in mind that it comes with a high cost. Every reward program you participate in requires a fee, while the annual fee is much higher than another credit card for bad credit. Consider yourself fortunate, for alternative options are providing your credit cards even with bad credit.