7+ Best Checking Accounts For Bad Credit (No Deposit)

Having a banking account is essential. However, you might have a bad credit score due to late or missed payments, account closure, and unpaid overdraft fees. A bad credit score might even block you from opening a new bank account. Opening checking accounts for bad credit is an ideal way to improve credit score. They also help you in getting back into business if you have faced financial problems in the past,

What is Second Chance Checking?

Financial institutions may refuse to open a bank account when you have an adverse banking history like past accounts closed by a bank, unpaid bank fees, payments made with insufficient funds, and other records. If a financial institution comes across this negative history, your traditional or saving account application may get denied on account of your past deeds. Then a second chance account stands as the alternative.

Second chance banking programs are for the people who are rejected for the services at the financial institution on account of their past negative history. People who have an account on these platforms are getting into a system helping them rebuild their banking history. Second chance banking accounts are bank accounts for bad credit where you are allowed to make deposits and payments the same as the traditional accounts. The only difference is that they will enable you to open an account to build a better banking history. Some banking institutions also offer second chance saving accounts.

Read the article to know the best checking accounts for bad credit.

The 7 Best “No Credit Check” Checking Accounts for Bad Credit

Here are the best accounts for bad credit:

Chime:

Chime is one of the best no credit check checking accounts for bad credit. It has the best features like no overdraft fees, no monthly fees, movie deposits, online bill payment, direct deposit, etc.

Nearside:

Nearside is a second chance checking account with no credit check. It does not require a minimum deposit and has no monthly maintenance fees. In addition, you will be provided with a free business Mastercard, debit card, online mobile app, and many features.

Chase Secure Banking:

Chase Secure Banking is a no credit check account with features like no minimum deposit to open, no overdraft fees, and free access to free money orders, cashier’s checks, free chase online bill pay, and many more.

Acorns:

Acorns is another checking account for bad credit that does not check for credit. They offer both checking and savings accounts, giving you the feature to enjoy the heavy metal tungsten Visa debit card and a smartphone app that enables you to manage your spending, budgeting, and security.

Current:

Current is another no credit check to check the account that has features like no minimum balance requirements, deposit to open an account, no overdraft fees, no fees at over 40,000 ATMs in the US, a smartphone app, 24/7 member support, and more.

SoFi Money Cash Management Account:

It is offered by SoFi Securities LLC. They do not use ChexSystems to approve your account. The best features include a debit MasterCard, a smartphone app, no monthly fees, no overdraft fees, etc.

Aspiration:

Aspiration does not check your credit to approve opening an account. It offers both savings and checking accounts. You can choose to have a monthly fee account or no monthly fee account that gives you the flexibility to pay your fees that is fair to your wallet.

How to Get a Bank Account With Bad Credit?

Listed are the ways to open a bank account with bad credit:

Look for Banks that Don’t Use ChexSystems:

Look for bank accounts that do not use ChexSystems to verify your new account. People with multiple ChexSystems might have problems getting a fresh start because, with negative banking records, it might be challenging to get an opportunity for a fresh start.

Request Consideration:

You can request another look at your application if your application is denied for the first time. You have a chance to show that the negative banking history is an anomaly caused due to emergency circumstances. It might make the bank reverse its decision.

Open a Second Chance Checking Account:

Second Chance Checking Account is an alternative if you do not have a chance to open a regular account. Check for a financial institution that emphasizes helping customers and that forms a personal banking relationship for a chance to open checking accounts for bad credit.

Take a Prepaid Debit Card for Temporary Use:

If You have no option left, you can use a prepaid debit card for temporary use. It offers a limited form of banking. In addition, they do not check for credit history or ChexSystems for your banking history.

Challenge your ChexSystems Report and Dispute Errors:

ChexSystems is a consumer reporting agency, and they are subjected to federal laws. You can challenge errors the same as you do with credit reports. If you find any accuracies, you can dispute it online by fax or mail. Dispute directly to your bank if you are unsuccessful with the dispute process. If you have funds, try settling with the bank or the collection agency in exchange for removing the negative information from the ChexSystems report.

Best banks for a Second Chance Checking Accounts for Bad Credit

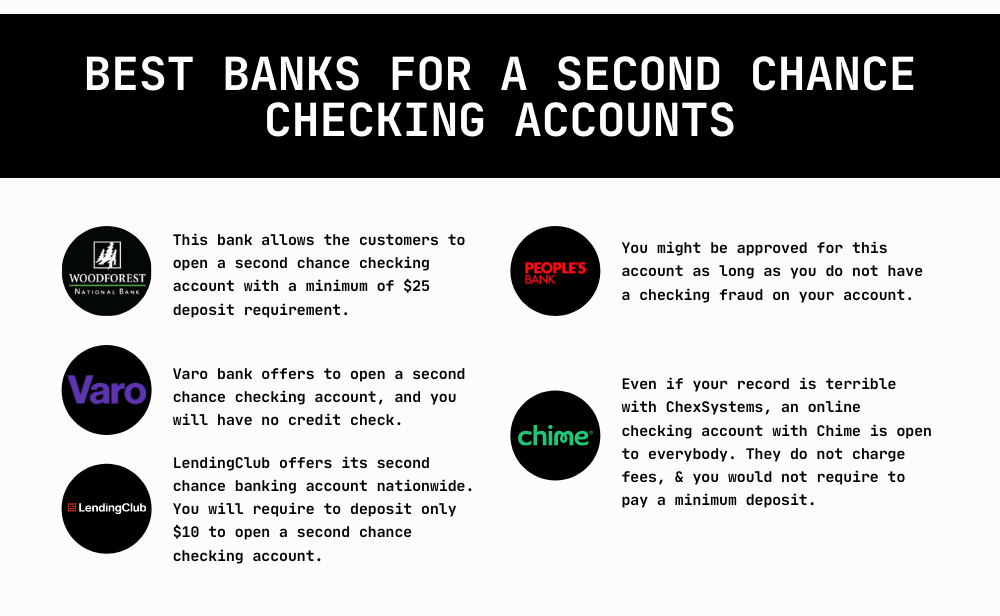

Woodforest National Bank Second Checking:

This bank allows the customers to open a second chance checking account with a minimum of a $25 deposit requirement. However, their accounts are available to the customers having a physical branch at their location.

Varo Bank Account:

Varo bank offers to open a second chance checking account, and you will have no credit check, no requirement for minimum balance, or monthly fees. Customers with Varo Bank Account can withdraw money from the Allpoint ATM network fee-free.

LendingClub Essential Checking:

LendingClub offers its second chance banking account nationwide. You will require to deposit only $10 to open a second chance checking account.

Peoples Bank Cash Solutions Second Chance Checking:

It is a Texas-based bank, and second chance checking is offered nationwide. You might be approved for this account as long as you do not have to check fraud on your account. However, your account will be activated after you have deposited at least $30.

Chime:

Even if your record is terrible with ChexSystems, an online checking account with Chime is open to everybody. They do not charge fees, and you would not require to pay a minimum deposit or maintain a minimum balance. They also offer non-traditional features to rebuild your bank history.

The Pros and Cons of a Second Chance Checking Account

A second chance checking account for bad credit has several benefits, yet they are subject to some drawbacks. Let us understand how it is beneficial and what is its drawback:

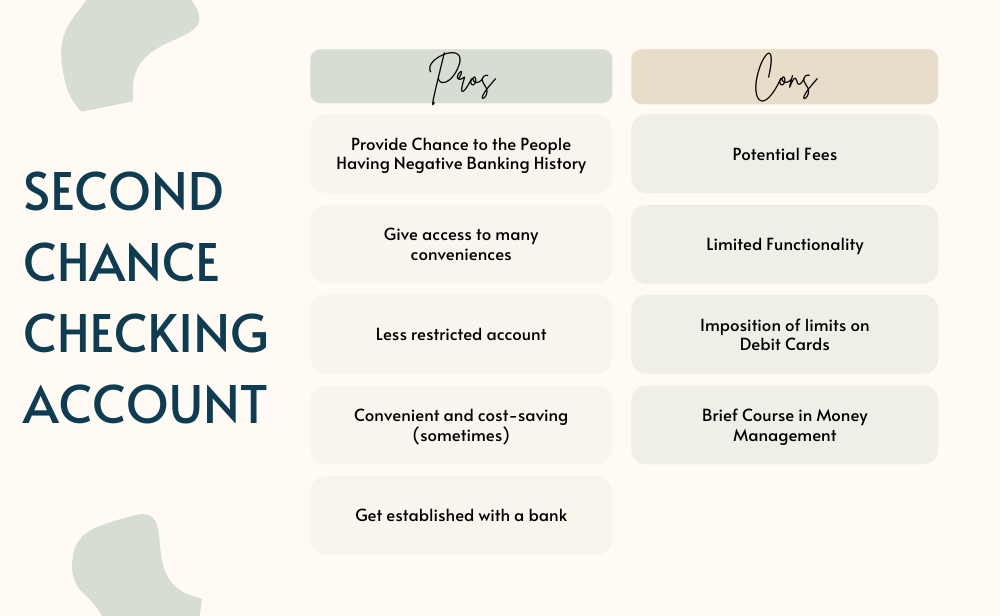

Pros of Second Chance Checking Accounts:

- Provide Chance to the People Having Negative Banking History: People with negative banking history have a chance to rebuild their history. Besides, they do not get to open an account at the traditional financial institution, but second chance checking offers them an account.

- Give Access to Many Conveniences: The high-risk customers who have a negative banking history get access to many conveniences of a checking account like using Debit Cards, ATM Cards, depositing cash, etc.

- Less Restricted Account: If a customer can handle his/her account responsibly for six to one year, they may be entitled to get a less restricted or free checking account.

- Convenient And Cost-Saving (Sometimes): It helps you manage your day-to-day finances. You can avoid going to a check-cashing outlet every time; you can get your wages directly on your account. In addition, you can make payments directly from your bank instead of taking a costlier way like in-person payments. Besides, you can go cashless without the need to carry cash.

- Get Established with a Bank: You can transform your account into an inexpensive and flexible bank account after establishing a blemish-free banking history. You might need to wait for six months to a year. The bank has your banking history, like earning and spending history, and this gives you a chance to improve with other services like loans.

Cons of Second Chance Checking Account:

- Potential Fees: Monthly maintenance fees may be charged for second chance bank accounts. You might not get a chance to waive the fees like the banks that offer opportunities to waive those fees. The monthly payments might be costly and might discourage you when you make an effort to get back on your financial feet.

- Limited Functionality: You cannot enjoy features like writing checks, and the bank might limit your spending. Besides, not many banks offer second-chance checking accounts, so you have only a few options.

- Imposition of Limits on Debit Cards: The bank might limit the spending amount on your Debit Card.

- Brief Course in Money Management: Customers with a second chance account might require to set up a direct deposit on the account. Or they might choose a short course on money management before opening an account.

What are the best second chance checking accounts for bad credit?

- Chime: Chime uses no ChexSystem to check your baking score. It provides the best features like no monthly fees, free debit cards, up to $100 in overdraft protection, 38,000 free ATMs.

- GO2bank: Green Dot offers GO2bank a digital and mobile-first bank account with features like no monthly fees. Eligible direct deposit, from rewards to high-interest savings overdraft protection and more.

- Chase Secure Banking: It is a checking account that does not check banking scores or credit. But it has a monthly fee of $4.95 per month. However, you can get a $100 bonus after opening an account to complete the required activities.

- Peoples Cash Solutions Second Chance Checking: This second chance checking account takes a minimum of $30 to open an account. It provides the best features like the ability to upgrade to the Radius Rewards Checking account after completing excellent banking and free ATMs.

- Wells Fargo Opportunity Checking: This second chance checking account provides features like free ATMs, the opportunity to waive the fee, overdraft rewind fee, and more.

Things to look for When Picking a Checking Account for Bad Credit

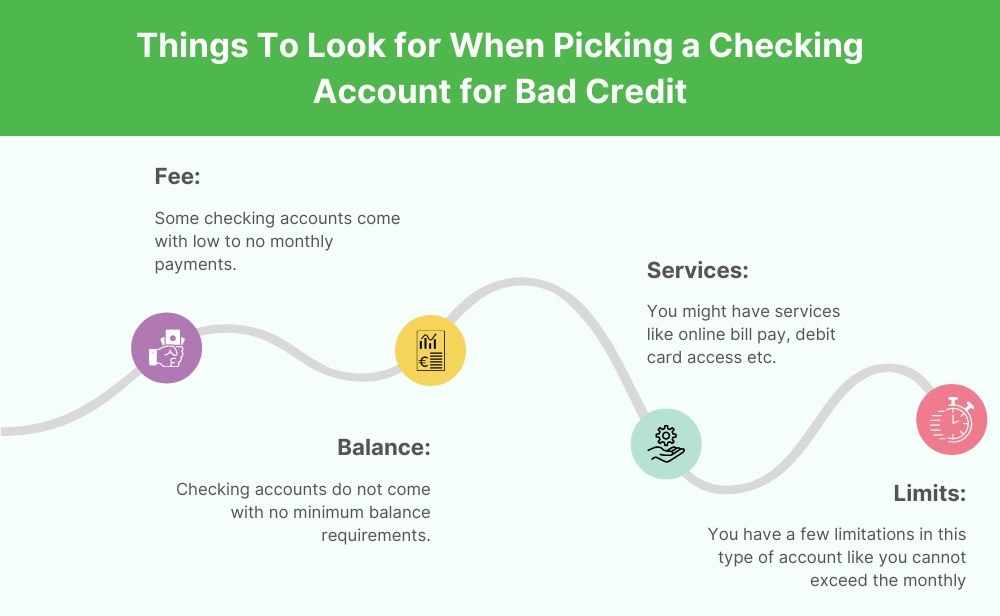

While picking a second chance checking account for Bad Credit, look for the following things because the best checking accounts come with:

- Fee: Some checking accounts come with low to no monthly payments.

- Balance: Checking accounts do not come with no minimum balance requirements.

- Services: You might have services like online bill pay, debit card access, unlimited check writing privileges, and more for free.

- Limits: You have a few limitations in this type of account like you cannot exceed the monthly or maximum daily amount.

But all second chance checking accounts do not have such features. Some accounts charge more than $20. Some do not issue checks or debit cards to the account holders. Additionally, you will have a fee requirement and a minimum account balance.

Quick Tips for Improving Your Credit

A good credit score can bring you better terms and lower interest rates on products, loans, and credit cards. However, you cannot boost your score overnight. Consider knowing what is affecting your credit score. However, you can increase your credit score with the following quick tips:

Pay Off Your Revolving Credit Balances:

You should do it each month if you can afford to pay more than the minimum payment every month. Your credit card score also depends on the creditor and how quickly he reports it to your credit report. It depends on the credit card issuer when they report the balance on your credit report. The faster the issuer reports the balance on your credit report, the higher the chances you get to improve your credit score. If you can pay off the entire balance at once, you will have the fastest impact on your credit score.

Increase Your Credit Limit:

You can opt for one way from two options: You can ask to increase your current credit card or apply for a new card. If you are sure you would not max out your card each month, you can opt for this solution because the higher you have an overall available credit limit, the lower the credit utilization rate.

If you consider opening a new credit card an option, it is essential to do your research before it might impact your credit score. Whenever you apply for a new card, the issuer needs to check your credit score, which will result in a hard inquiry on your credit score, affecting your credit score on a few points. However, this impact is much less, so you can earn the benefit of reducing your credit utilization ratio. But you need to make sure that you do not apply for too many credit cards within a short period to send the issuers a red flag.

Check Your Credit Report For Errors:

Another way to increase your credit score is by reviewing the credit reports and reporting them for any errors. If you can dispute the errors and remove them, your scores can increase. It is estimated that about 25% of Americans have an error on their credit reports. Experian, TransUnion, and Equifax are the three major credit bureaus that can give you a free credit report every week.

Ask Them to Remove the Paid Off Negative Entries From Your Credit Report:

If you have a record of late payments on your credit report that has been paid off, make sure to inform them and request them to remove it from the credit card report. If you have a collection account that you have not paid, make sure to take care of the debt because unpaid collection accounts can affect your credit score. After paying them, ask them to remove them from the credit report altogether to help reduce the effect.

Conclusion

Through the discussion above, you can understand how checking accounts for bad credit can help the account holders to have a fresh start to rebuild their banking history. In addition, it helps the account holders to do banking without the need for a regular account. You can choose the checking accounts for bad credit based on your needs, preferences, and habits.