First Digital Credit Card Review

Introduction

The First Digital credit card is an unsecured credit card created for persons with bad credit, limited credit, or no credit, with a faster approval procedure and the chance to start developing excellent credit. However, it is more expensive than many of its competitors and is unlikely to be the best initial choice for most consumers.

What is the First Digital MasterCard?

Synovus Bank issues the First Digital MasterCard®, a credit card aimed at those with negative credit who want to rehabilitate their credit. They are one of several cards that aims at those with less-than-perfect credit. It does not offer the most affordable fees or rates. However, if you want to rebuild with an unsecured credit card and the other difficulties have refused you, this may be a card to explore.

First Digital Credit Card Overview

The First Digital Credit Card is one of several credit cards that aims toward those with poor or no credit. Unfortunately, First Digital card has one of the highest overall fees and APRs among its rivals. It costs a one-time application fee, a yearly fee, and a monthly service fee beginning with the second year.

The card also lacks a few properties that other cards have. Cards like Credit One, for example, provide cashback benefits as well as a free Experian Vantage score.

First Digital Credit Card Fees

There is a yearly fee, a one-time application cost, and a monthly service fee for the First Digital MasterCard. After being authorized, you must pay a $95 one-time charge to activate the card. The yearly charge for your card membership is $75 for the first year. The annual rate increases to $48 for the second and subsequent years, with a monthly servicing fee of $6.25. The standard APR is 35.99 percent.

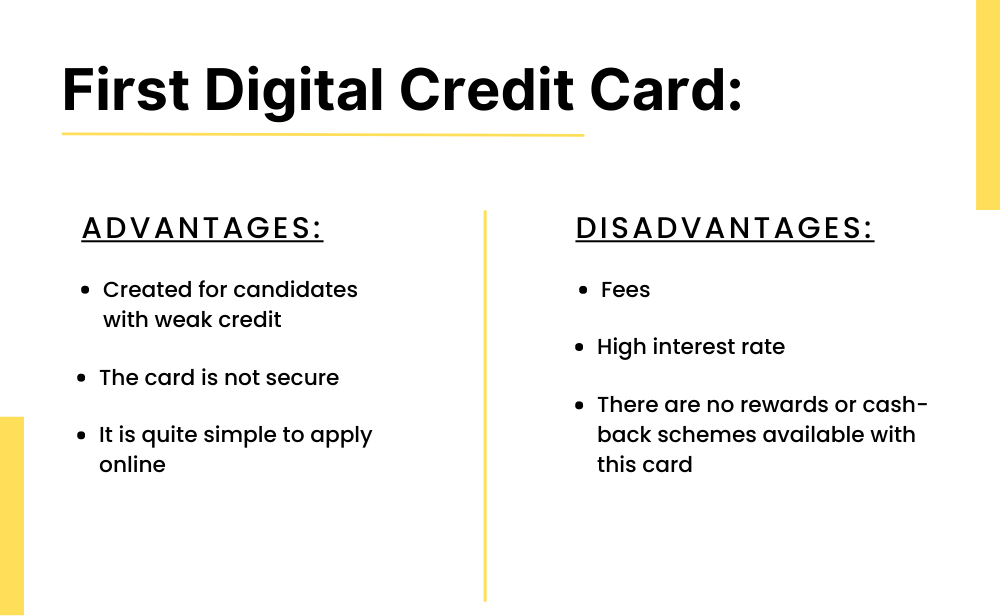

First Digital Credit Card: Advantages And Disadvantages:

Following are the advantages and disadvantages of the First Digital Credit Card:

Advantages:

- Created for candidates with weak credit: The First Digital MasterCard is specifically designed for those who have poor credit and are working to improve their scores. Unsecured credit card approval might be quite challenging in general.

- The card does not require a security deposit: The First Digital MasterCard does not need a security deposit. The starting credit limit is $300, with a program charge of $95 and $75 in the first year. If you responsibly spend and pay during the first year, the company might increase your credit limit.

- It is quite simple to apply online: Another significant benefit of the First Digital MasterCard is the ease of obtaining it. You can do everything online, and you only need to submit your basic details.

Disadvantages:

- Fees: When using this card, users should anticipate incurring fees. There is a credit limit increase penalty, an extra card cost, and an accelerated telephone payment charge in addition to the yearly and introductory fees.

- High-interest rate: Annual percentage rates on credit cards targeted for those with weak credit are often high (APRs). The First Digital MasterCard, on the other hand, has an exceptionally high APR of 35.99 percent, even for a bad credit card.

- There are no rewards or cashback schemes available with this card. Such benefits, however, users cannot expect in credit cards for consumers wanting to enhance their credit.

Alternatives To The First Digital Credit Card

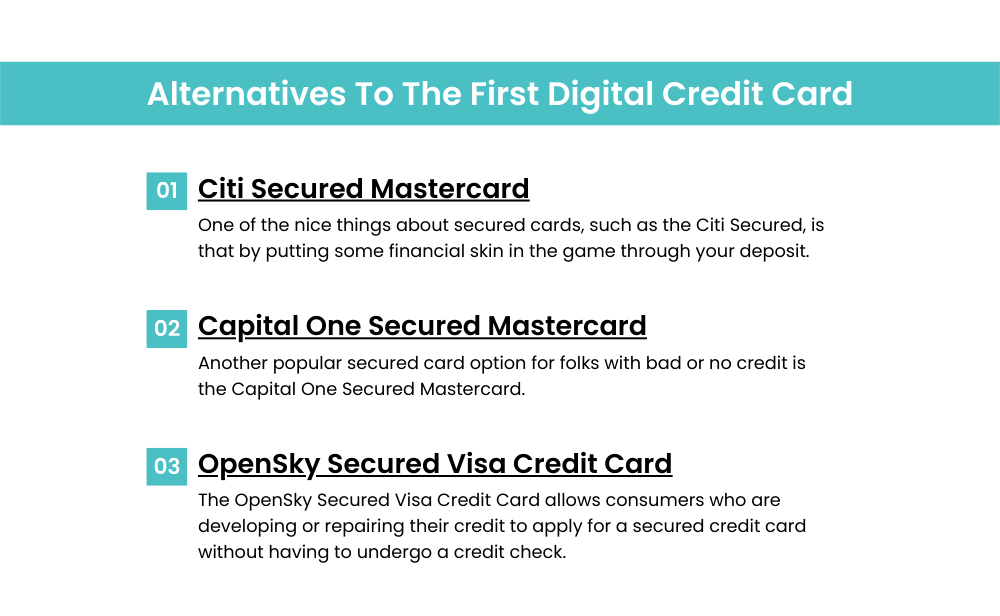

Citi Secured MasterCard

One of the nice things about secured cards, such as the Citi Secured, is that by depositing, you reduce lenders’ financial risk and make them more eager to accept instead of reject you. You can then begin establishing credit and eventually transition to an unsecured card. In addition, there are no upfront or annual fees with the Citi Secured card, making it an excellent choice for people just beginning their credit journey. So even if you have a shaky credit history, you can start developing it with the Citi Secured card while avoiding annual fees, activation fees, and other high costs that are too frequent on credit-building cards.

Capital One Secured MasterCard

The Capital One Secured MasterCard is another popular secured card option for folks with bad or no credit.

There are no registration or yearly fees with the card. In addition, the security deposit you submit is refundable, which means you may get back your money if you use the card responsibly. The advantage of the card is that you just have to give a security deposit of $49, $99, or $200. But, of course, it entirely depends on the strength of your credit. That implies you could require less money upfront to obtain the First Digital MasterCard®.

OpenSky Secured Visa Credit Card

This Credit Card allows consumers who are developing or repairing their credit to apply for a secured credit card without undergoing a credit check. The yearly charge is $35, and the card reports all your activities to the credit bureaus. In addition, it allows you to establish a credit limit of up to $3,000 by paying an equal security deposit.

FAQs

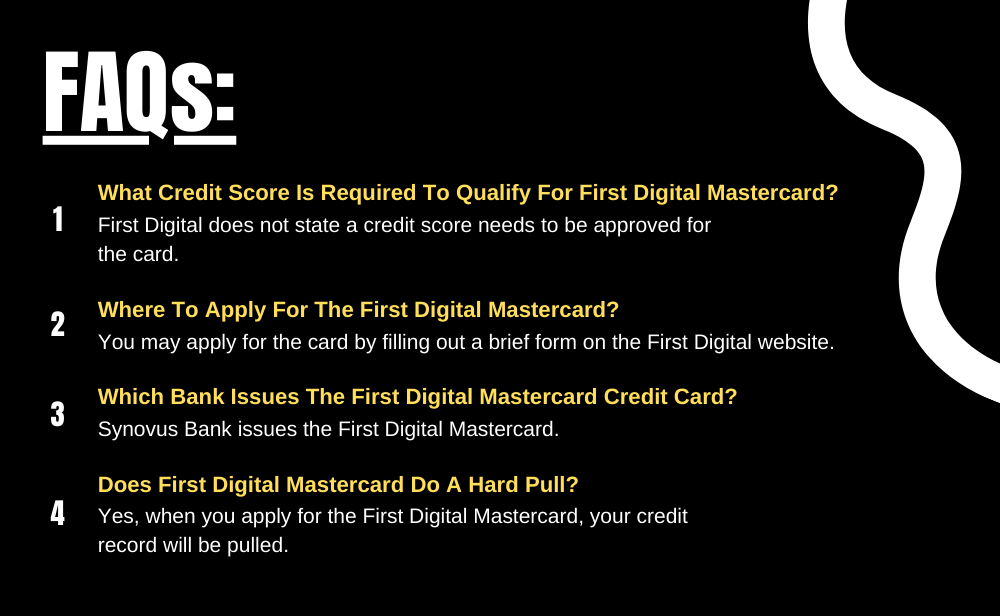

What Credit Score Do You Need To Qualify For First Digital MasterCard?

First Digital does not state a credit score needs to get approval for the card. Although the organization states that there is no requirement of an excellent credit, not everyone who applies will qualify—the higher your credit score, the higher your chances of acceptance.

Where To Apply For The First Digital Credit Card?

You may apply for the card by filling out a brief form on the First Digital website. Most applicants may get a decision in under a minute without going via a credit agency or issuing a credit report.

Which Bank Issues The First Digital MasterCard Credit Card?

Synovus Bank issues the First Digital MasterCard. Synovus Bank was established in 1888 and headquartered in Georgia.

Does First Digital Credit Card Have A Hard Pull On Your credit?

Yes, when you apply for the First Digital Credit Card, the issuer will pull your credit record. Because it is an unsecured credit card intended for people with less-than-perfect credit, they will go through the verification process of your score before authorizing you for the card. Pre-approval is not available with the First Digital Credit Card.

Conclusion

People with bad or no credit can use the First Digital Credit MasterCard® to establish or improve their credit history. Though there are cheaper choices, this one may be one of the simplest to qualify for. If you are thinking of this card, you should look at the alternatives first.

However, if building up the minimum deposit for a secured card is not an option, you should opt for an unsecured card; this one will suffice.