Guaranteed Online Installment Loans For Bad Credit 2022

Introduction

Having bad credit is frustrating since you know you will have difficulty qualifying for a loan. Fortunately, you have lenders that specialize in installment loans for bad credit. It is to note that there is no “guaranteed” installment loan, but some loans are easier to qualify than others.

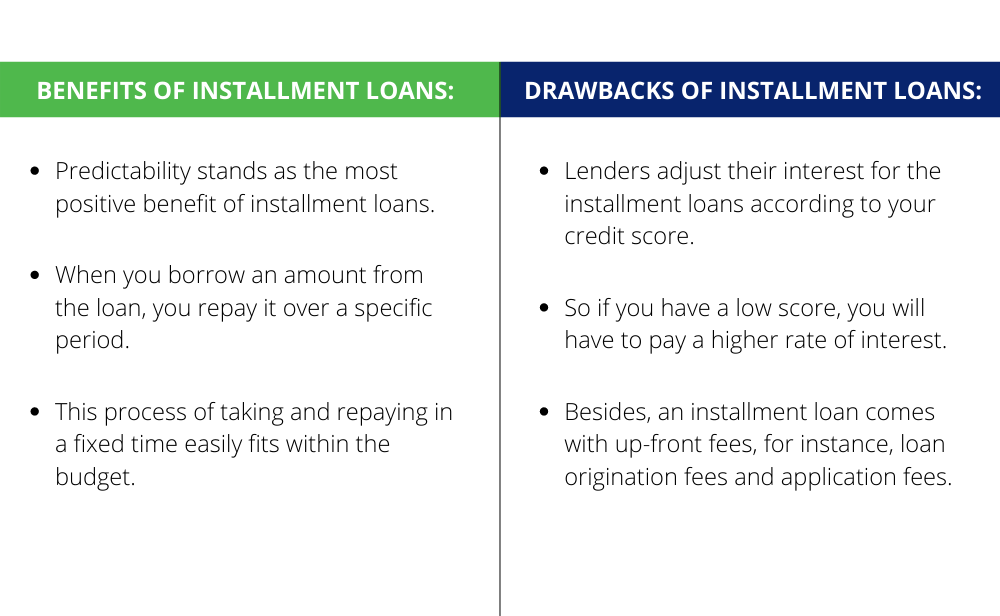

Benefits And Drawbacks Of Installment Loans For Bad Credit

Installment loans have their pros and cons. Therefore, going through them before signing up for the loan is crucial. But, first, let us discuss the benefits and the drawbacks of installment loans for bad credit:

Benefits of Installment Loans:

Predictability stands as the most positive benefit of installment loans. After you have borrowed a certain amount from the loan, you are required to pay it back over a specific period. This process of taking and repaying in a fixed time easily fits within the budget.

Drawbacks of Installment Loans:

Lenders adjust their interest for the installment loans according to your credit score. Therefore, having a low score will require you to pay a higher rate of interest, whereas having an excellent score will benefit you from low-interest rates. Besides, an installment loan comes with up-front fees, for instance, loan origination fees and application fees. In some cases, when you pay off your loan early, lenders might even assess a penalty.

Best 3 Installment Loans For Bad Credit

Even if your credit score is low or bad, you might still have the chance to qualify for a loan. You can consider the best three installment loans for bad credit online:

CashUSA.com

CashUSA is a site that connects you with networks of lenders. You will have lenders who accept consumers with poor credit on this site. However, the requirement to qualify for the loan with these lenders is that you must at least earn $1,000 a month after paying taxes. Besides, you must have an email address, phone number, and a checking account under your name.

Quick Takeaways:

- They provide loans that range between $500 to $10,000.

- After approval, you will receive your funds within the next business day.

Money Mutual

MoneyMutual has been in business since 2010 and has helped over 2 million consumers with bad credit. MoneyMutual does not directly fund the borrowers. Instead, it is a site that lets you fill out an application and assist in matching lenders with you that can stand as a good fit for you.

Quick Takeaways:

- Fill out an online application.

- Get your funds within 24 hours.

- Receive a short-term loan of up to $2,500

PersonalLoans.com

PersonalLoans.com is a site that can connect you with potential lenders. The lenders offer installment loans that range from $1,000 up to $35,000. Before that, you need to submit an online application requesting a loan. You will receive the money within the next day after being approved.

Quick Takeaways:

You can access lenders with your bad credit score.

The period for repayment ranges from 90 days to 72 months.

The interest rate is 5.99% or lower.

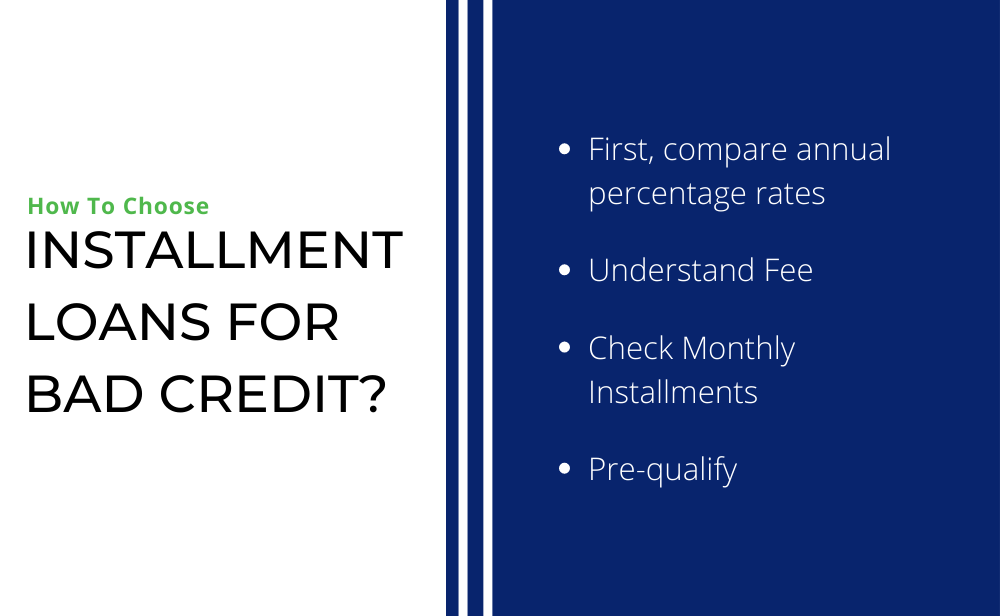

How To Choose Installment Loans For Bad Credit?

You can choose an installment loan in the following ways:

- First, compare annual percentage rates:

Lenders express a loan’s cost as an annual percentage rate. The annual percentage rates include the rate of interest and other fees. While looking for an installment loan, it is crucial to look for the lowest APR you find. An interest rate of 36% or lower than that is the most consumer-friendly personal loan.

- Understand Fee:

You might come across some lenders who charge an origination fee. The origination fee generally ranges from 1% to 10% of the loan amount or late fees. It is advised not to agree to borrow money till the lender discloses all the fees required to pay.

- Check Monthly Installments:

Your monthly payment can be calculated according to your chosen term’s length. If you have a longer loan term, you will pay more interest. Therefore, select or look for a short repayment term. This way, you can prevent yourself from overpaying interest. However, your loan’s payment term must be long enough so that you can make the payments manageable.

- Pre-qualify:

There are some ways through which you can determine if you qualify for an installment. First, you will need to fill out an application providing your basic details, such as your income and the loan you want. You will have a soft credit pull by the lenders, but it will not impact your credit. After entering your details, all the information regarding the rates, terms, and loan amounts will be provided that you are qualified.

How do Installment Loans Affect Your Credit?

Loans can either hurt or boost your credit score, and it entirely depends on the use. Many lenders report your activities to the credit bureaus; thus, you have a credit card record. This way, you have a chance to boost your credit score and display how financially responsible you are.

If you fail to pay your bills on time or miss your payments, your score might drop. However, if you continuously miss your payments, you can set up autopay to ensure you make payments on time. It has been found that many lenders provide discounts on APR to the borrowers who use autopay.

How Can You Use An Installment Loan To Build Your Credit?

Installment loans can assist you in enhancing your score. But, first, look at the listed points:

- Improves your payment history:

The history of your payment accounts for 35% of the credit score. Therefore, it is the single factor that can build your credit score on your credit report. If you regularly pay your monthly payments on time on your installment loan, you can definitely improve your payment history. On-time payments history reflects that you are a reliable borrower the creditors can trust.

- Help your mix of credit:

An installment loan acts as a diversity to the types of credit accounts you take. This installment loan adds a mix of credit to the credit report, and variation accounts for 10% of the credit score. So, if you add an installment loan to your credit card, it can help you enhance your score.

- Lower your credit utilization:

Credit utilization is another important factor after payment history that determines your credit score since it accounts for 30% of your credit score. Therefore poor utilization rate can impact a lot.

- Hard Inquiry:

It is crucial to note that an installment loan will get you a “hard inquiry” on the credit card, affecting your score negatively. In addition, a hard inquiry can get pulled since the lenders will pull your credit report when you submit your application.

- Do Not Apply For Many Loan Applications At The Same Time:

But one or two hard inquiries cannot drop your score. A flurry of hard inquiries must be pulled to impact your score negatively. Applying for many loan applications at the same time can get several hard inquiries on your credit report. Therefore, it is important to limit the number of applications and take time to compare the loans and apply for the one you know you can qualify for.

Bad Credit Installment Loans Vs. Payday Loans

The feature of bad credit installment loans is that they are paid in installments that you would not find in payday loans. An installment loan is also safer than payday loans since you can manage smaller payments monthly, while payday loans must pay a lump sum all at once. Listed are the key differences:

| Installment Loans | Payday Loans |

| It is paid over months or years. | Payday loans are repaid within a week or two. |

| You usually have an APR of 36% or lower. | Payday APR can be 400% or higher. |

| It is generally repaid online, by phone, or by check. | The lenders withdraw the repayment amount from the consumer’s account. They do it either through a check you write ahead of time or through your account information. |

It typically requires a credit check to determine your ability to pay the loan amount. | It does not require a credit check. |

| They report your activities to the bureaus, improving your credit score. | It does not report your activities to the credit bureaus, so it cannot help in enhancing your score. |

FAQs Related To Installment Loans For Bad Credit

Where Can I Get Installment Loans For Bad Credit?

You can check out loans for bad credit in various places.

- Banks: There are banks that offer loans with bad credit. If you have already built your relationship with the bank where you are trying to get the loan, you might have more success.

- Credit Unions: You can get a loan from a credit union.

- Online: If finding a bank or credit union seems tough for you, especially with bad credit, consider expanding the research area online. Some sites can assist you with finding a lender that fits your interest rates and terms.

What Credit Score Is Required To Qualify For Installment Loans?

You might require a credit score ranging from 550 to 720 FICO with many lenders. The credit score for each lender may vary. Some lenders might have a lower score requirement than other lenders. However, borrowers having bad credit generally get higher APRs on installment loans.

Furthermore, you might also find lenders that offer no-credit-check requirements for loans. But, no-credit-check loans generally have a very high rate of interest.

What Qualifies An Installment Loan?

Installment loans are loans that are received in a lump sum, requiring you to pay monthly or yearly. These loans are provided by credit unions, banks, or online lenders. The feature of installment loans is that they are repaid over time instead of all at once. Therefore, it makes it more affordable than other loans.

Conclusion

Installment loans for bad credit can be difficult to get but are not impossible. However, if you really have a poor credit score, get yourself prepared to pay extra. Therefore, people with bad credit should consider improving their credit score before applying for a loan.