TeleCheck: The Ultimate Guide

Introduction

TeleCheck is a corporation that accepts checks. It analyses information about check transactions provided through its system to enable more than 374,000 retail locations to determine whether to accept check transactions. If any retailer refuses your check, ask for a free copy of the report and file a dispute to have your record cleared.

What Is Telecheck?

It is a corporation that accepts checks and analyzes the check transaction information to help 374,000 locations to know if they can accept check transactions. It evaluates the risk you pose in real-time, allowing shops to decide whether or not to accept your check right away. In addition, It ensures payment to the shop or merchant once a customer has been cleared. The system is concerned with the information around a customer’s checking history.

How Does Telecheck Work?

TeleCheck compares the identifying information to its transaction database to see if there are any matches with an overdue debit or checking account difficulties. Risk models applied to the transaction identify fraud and other risk factors and provide an acceptable risk level.

- TeleCheck collects customer information and then offers retailers access to it. When shops pay for TeleCheck’s services, they may scan a paper check and examine it against TeleCheck’s database for risk indicators.

- It converts a paper check into an electronic transaction. It allows merchants and retailers to avoid receiving a check that a financial institution later rejects.

- If the scan declines your Check, the shop or merchant must provide you with a receipt that contains a TeleCheck number. This code, which is generally a 3 or 4, will explain why your check was rejected.

- TeleCheck’s algorithm provides you with a risk level after scanning your check. If it concludes that there is a chance your check may bounce, it will tell the shop to reject it.

How To Get A Copy Of Your Telecheck Report?

- It is a consumer reporting service that maintains track of your banking activities based on information provided by your banking connections and financial institutions.

- Telecheck or ChexSystems get information from banks and credit unions on how you’ve managed your financial accounts. It receives information from these financial institutions on excessive overdrafts, account misuse, and outstanding non-sufficient fund fines.

- You may be denied if you apply for a new bank account and the bank employs Telecheck as part of the verification procedure.

- Telecheck, as a consumer reporting agency, as required by the FCRA to submit only accurate and verified information. You have the right to seek a free copy of your report and object to any inaccuracies or mistakes.

You have three options for requesting your report: online, via mail, or by phone.

- Online: To request your report online, go to the website and fill out the application requesting the report. You need to provide your banking details to fill out the application.

- By Mail: Get your report by mail. Provide your name, phone number, driver license copy, and social security number to prove your identification. TeleCheck also requests a copy of a canceled check, although many financial experts advise against doing so because you are under no duty to give them your account information.

- By Phone: You can request a TeleCheck report over the phone by contacting 1-800-366-2425.

Why Does Telecheck Decline Checks?

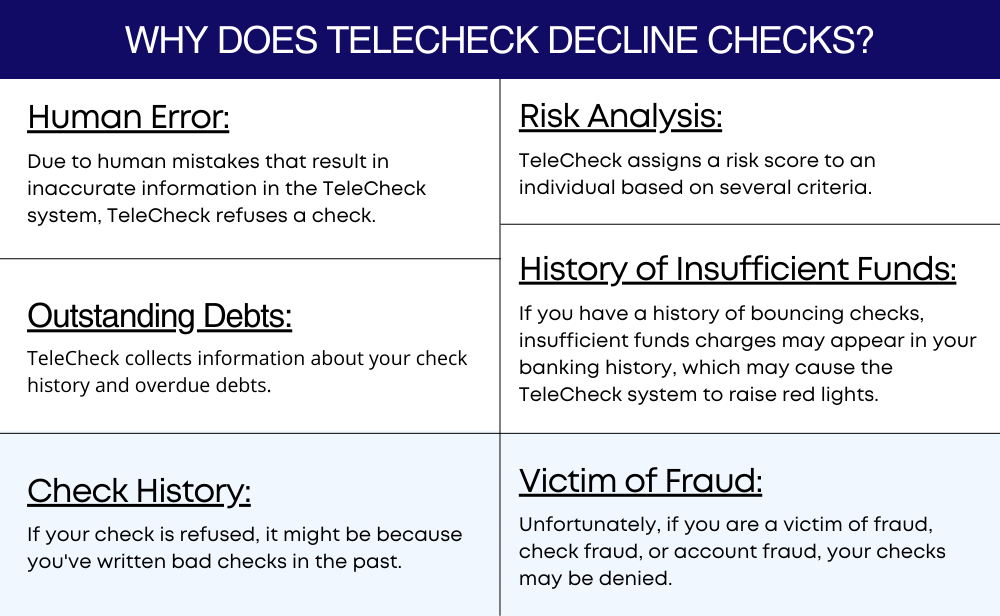

If the TeleCheck system rejects your check, it means they don’t have sufficient details in their database to determine if they should examine your check. It might also indicate that you have an outstanding debt in the TeleCheck system.

- Human Error:

Due to human mistakes that result in inaccurate information in the TeleCheck system, TeleCheck refuses a check. It might be anything as easy as a cashier hitting the wrong button on the register, or it could be something more serious like a driver’s license with the wrong address.

- Outstanding Debts:

TeleCheck collects information about your check history and overdue debts. If you owe them money, you may find that stores and merchants reject your checks.

- Check History:

Telecheck might refuse your check because you might have written bad checks in the past. They may flag you for kiting checks. It means that when you write an amount in the check that does not exist in your account.

- Risk Analysis:

TeleCheck assigns a risk score to an individual based on several criteria. While TeleCheck does not disclose how it determines risk, some indicators include how frequently you write checks, the size of the check, and the items you’re attempting to purchase.

- History of Insufficient Funds:

If you have a history of bouncing checks, insufficient funds charges may appear in your banking history, which may cause the TeleCheck system to raise red lights.

- No Check Writing History:

Some consumers are startled when Telecheck refuse their checks since they often don’t write them. When the system lacks information about an individual, it cannot assign a risk rating and may advise the store to deny the check.

- Victim of Fraud:

Unfortunately, your checks may be denied if you are a victim of fraud, check fraud or account fraud.

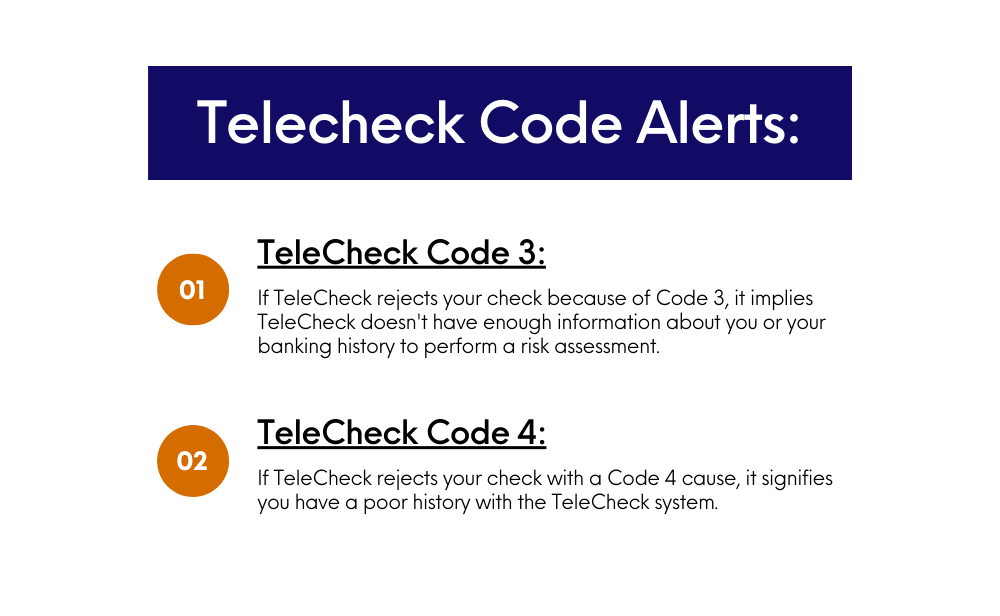

Telecheck Code Alerts:

If TeleCheck rejects your check, it will give you a code that explains why the system rejected it. You may search for the reason for your rejection using the decline code lookup tool.

However, most denied checks fall into one of two categories are given below:

- TeleCheck Code 3

If TeleCheck rejects your check because of Code 3, it implies that the system doesn’t have enough information about you or your banking history to perform a risk assessment. When people don’t write checks too regularly, they frequently obtain a Code 3.

- TeleCheck Code 4

If TeleCheck rejects your check with a Code 4 cause, it signifies you have a poor history with the system. The system find that you are too risky for a merchant or store to accept your check with a Code 4.

How To Dispute Wrong Information On Your Telecheck Report?

You have the authority to contest any incorrect information on your TeleCheck report. It is good to analyze any check denial since the cause for the rejection might be a mistake, a hint of fraudulent activity, or even a lack of check-writing history.

- Obtain a duplicate of your TeleCheck report

They will ask you to provide both personal and banking information, including your account and routing numbers. You can also get your report by phone by dialing 1-800-366-2425 or by normal mail by writing to:

TeleCheck Services, Inc.Attn: Resolutions Department – FAP.O. Box 4514

Houston, TX 77210-4514

- Check for errors and inaccuracies in your report:

Once you’ve received your TeleCheck report, go over it carefully for any errors, discrepancies, or incorrect information. The law requires the to report consumer information properly, and you have the right to challenge any incorrect things.

- Dispute any incorrect items:

You may directly challenge any problems or inaccuracies on your report using TeleCheck. You can do so by filling out the online dispute form or printing out a paper disagreement form and forwarding it to them through fax at 402-916-8180 or mail at the following address:

TeleCheck Services, Inc.

P.O. Box 6806

Hagerstown, MD 21741-6806

- Wait for Them to look into it:

TeleCheck has 30 days to investigate your claim after receiving it. However, this time they might extend the limit to 45 days if you supply additional information about your disputed item under federal law.

Non-Telecheck Banks:

Renasant Bank

Since its inception, Renasant Bank has been a pioneer in financial innovation, becoming the first commercial bank in Mississippi to offer automated cash dispensing machines and debit cards.

Chime

It’s a well-known fintech firm whose objective is to serve regular Americans with low-cost financial services. Chime’s low-ego, flat-hierarchical culture fosters collaboration, growth, and excellence. It also encourages all employees to “Chime In” on any element of the company’s operations.

Varo Bank

Varo offers high-end digital banking services to some a hundred and eighty million Americans WHO are underserved and overcharged by the standard industry. This bank symbolizes a new age in banking in a digital environment, helping millions of consumers develop their financial health across the United States.

FAQs

Does Telecheck Have Access To My Bank Account Balance?

The system cannot access details of your account’s current balance. Therefore, if the system rejects your check, it means they do not have sufficient details of your account in their database to know if they should examine it.

How Do I Clear My Telecheck Report?

There are five steps to clear the report are given below:

- Find out what information is in your TeleCheck report by calling 1-800-366-2425.

- Make contact with the retailer who reported you to TeleCheck. If the information provided was correct, you might be able to work out an agreement with the seller to get it deleted. Contact them to dispute the information if the merchant’s information is wrong.

- Your record will be cleared from it once you have paid the merchant the check amount, plus any extra costs.

- Dispute the information on your report if the retailer has provided false information or if you suspect identity theft or fraud. You can dispute the details by going to www.TeleCheck.com and clicking on the “How to Report Check Fraud” option.

How Do I Know If TeleCheck Will Accept My Check?

If the TeleCheck system concludes that your check poses a low risk to the merchant according to the details of your account in their database and check history, they will authorize it. The merchant can determine whether or not to accept your check once it passes through the system.

How Does Telecheck Verify A Check?

When you produce a check for payment, It is authorized using a specially built, secure system that records banking information as well as the check amount. You’ll need to sign for authorization either on a printed receipt or online throughout the transaction process.

How Long Does A Bad Check Stay On Telecheck?

Negative information is kept for five years. You have the authority to conduct a free annual review of those reports and contest any errors.

Conclusion

TeleCheck is a consumer reporting agency (CRA) specializing in checking and bank account information. Retailers may utilize it to determine the check accepting risk and immediately decide whether or not to accept it as payment. Retailers and merchants will benefit from it since it can assist them in avoiding accepting bogus checks. However, because TeleCheck’s system isn’t flawless, it’s critical to use your consumer rights and register a dispute if you feel something in your TeleCheck report is incorrect.