12 Top Banks That Don’t Use Chexsystems – April 2022

It is inconvenient to live without a bank account. Banks that don’t use ChexSystems provide realistic bank account options for persons who have ChexSystems data. ChexSystems’ blacklisting may be disastrous. Many banks offer second chance bank accounts. However, they frequently levy a monthly service cost.

The cost of doing day-to-day financial activities without a checking account is high. Re-establish your financial history with a trustworthy bank that does not employ ChexSystems to check new clients.

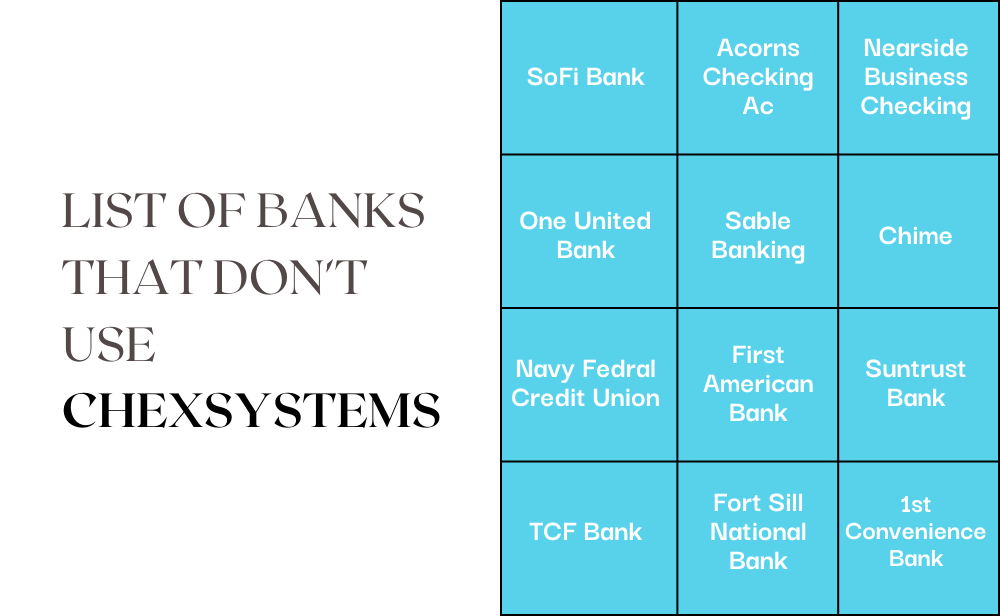

List Of Banks That Don’t Use Chexsystems

SoFi Bank

SoFi’s Checking Account has no overdraft fees and no monthly fees. Members may use their SoFi debit card to access the Allpoint® Network’s 55,000+ fee-free ATMs. Direct deposit members can earn 1.25 percent APY on their accounts. Plus, when you pay with your SoFi debit card, you may receive up to 15% cashback at local businesses.

Acorns Checking Account

Acorns Spend is the only checking account that allows you to invest when you spend. It earns up to 10% cash back and invests your change. No hidden fees.

Chime

Chime is a checking account that does not require a credit check and has no monthly bank fees. The Chime Spending Account is akin to a second chance checking account with no starting deposit that anybody over 18 and a U.S. citizen may establish.

Furthermore, if you require a credit card for terrible credit, Chime will provide you with a no credit check Visa credit card that reports to all three major credit agencies, has no interest costs, and no annual charge.

OneUnited Bank

People in ALL STATES can open an online checking account with OneUnited Bank. We choose OneUnited Bank because, thanks to a collaboration with Green Dot®, users may add cash to their OneUnited Bank Debit Card at over 90,000 locations across the country.

The Black Wall Street Checking account from OneUnited Bank has no monthly cost. If you do not qualify, they offer the U2 E-Checking Account, mainly created for those with terrible credit.

Sable Banking

The Sable account is a no-fee, no-credit-check account that offers unlimited 1% cashback on daily transactions. Add a debit card to your digital wallet and begin using it.

Nearside Business Checking

Nearside provides free online business checking with 2.2 percent cash back and no monthly cost. As a result, small company owners may expand their operations by saving money and utilizing the unique advantages provided by Nearside.

Navy Federal Credit Union

They do not use ChexSystems and have a variety of checking account alternatives. Membership is open to service members from all branches of the armed services. This category contains the following:

Delayed Entry Program for active duty personnel of the Army, Marine Corps, Navy, Air Force, Coast Guard, National Guard, and Space Force (DEP).

First American Bank

If you’ve had problems opening an account in the past, First American Bank offers a Fresh Start Checking account. First American, a privately held, Illinois-chartered full-service bank with 53 branches in Illinois, Florida, and Wisconsin, is the leading provider of banking services to the Hispanic market in the U.S.

Suntrust Bank

Suntrust Bank provides multiple checking accounts, including online banking, mobile banking, overdraft services, direct deposit, bill pay, and a SunTrust MasterCard® Check Card. You must deposit $100 to start.

TCF Bank

This bank does not operate in all states. TCFBank has 436 locations in Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana, Arizona, and South Dakota. This bank provides multiple checking accounts as well as a corporate checking account. In addition, they will create a Chexsystems account for customers, but you must not owe any money to TCFBank.

Fort Sill National Bank

When it comes to banks that do not utilize ChexSystems, Fort Sill National Bank is available to everyone – you do not have to be a member of the military. Furthermore, FSNB may not be situated in your state, so this may be a decent account for you if you want to use direct deposit. You can call their new accounts department to open an account from any location, and an application will be mailed to you.

1st Convenience Bank

The only locations of 1st Convenience Bank are in New Mexico, Texas, and Arizona. Chexsystems, Telecheck, and EWS are not used. Several checking account alternatives are available, but there is a $12 monthly maintenance charge if specific requirements, such as maintaining a certain daily amount, are not satisfied. Again, only checking account options are available.

What is Chexsystems?

ChexSystems is a banking reporting organization that gathers information regarding prior issues with deposit accounts, such as checking and savings accounts. In addition, the agency records your financial transactions, which banks and credit unions can use to decide whether to approve your application for a new checking or savings account.

Understanding Working of Chexsystems

ChexSystems maintains track of your deposit accounts with banks and credit unions. It also generates a report on the basis of that data to illustrate your account activity and reason for closure for previous accounts.

Here are a few examples of elements that may appear on your ChexSystems report:

- Account deletion due to inactivity

- Checks that bounce and overdrafts

- Negative amounts owed

- Abuse of a bank account, a credit card, or an ATM

- The bank suspects fraud or identity theft.

- The number of accounts you applied for lately.

When you apply for a new checking or savings account, the bank or credit union will look at your ChexSystems report. This is to ensure whether to approve your application or not. If your report reveals anything that leads the financial institution to believe you are a high-risk customer, you may be denied a bank account.

CheckSystem Score – What is it, and why does it matter?

Your ChexSystems score forecast your future banking behavior and the likelihood that you would mismanage your account. In other words, how dangerous it is for a bank to create an account for you. It differs from your credit score, which potential lenders and creditors use to make credit decisions. Though, your ChexSystems Score may also be utilized for similar purposes.

However, keep in mind that all banks will not use your ChexSystems score to evaluate your application to create a bank account. Instead, some refer to your comprehensive ChexSystems report.

Benefits Of Banks that Don’t Use Chexsystems

Banks that do not employ ChexSystems allow consumers to re-establish a financial relationship. A bad banking past might follow you for up to 5 years, making it difficult to perform everyday financial operations. In addition, traditional checking and savings accounts provide actual benefits that other banking options, such as prepaid debit cards or check-cashing services, do not.

Here are a few advantages of banks who do not utilize ChexSystems:

Reduce the cost of check-cashing fees

You will save money in the long run by not needing to utilize check-cashing services. Walmart, for example, charges $4 to cash checks up to $1,000.

Prepaid debit card fees should be avoided

Avoid the plethora of fees frequently associated with prepaid debit cards. Netspend, for example, charges a monthly cost of $9.95 without Pay-Go, a reload fee of up to $3.95, and an ATM withdrawal fee of $2.50. As you can see, there is no way to avoid paying fees while using prepaid debit cards.

Your money is protected

Have peace of mind knowing that your money in banks is FDIC-insured up to $250,000.

Maintain the security of your funds

Take advantage of a secure and handy location to store your cash. It may seem unusual, but not everyone keeps money at a bank, which might be risky. Several examples have emerged in which people have lost money saved at home after a fire. It might have been placed in a safe space, but it was risky. If you simply have a terrible credit savings account, that is preferable to a mattress or an at-home safe.

There is built-in fraud prevention

Purchases done with bank debit cards have no risk of fraud.

Make friends with your bank

Make a connection with your banker. Relationship banking allows your banker to approach you with better loan rates, insurance, investments, and certificates of deposit.

Non-CheckSystem Banks Vs. Second Chance Banking – Complete Analysis

Non-ChexSystems banks simply do not utilize ChexSystems to check new accounts; they may, however, employ alternative consumer reporting services. Early Warning Services, for example, provides new account screening. EWS, albeit less well-known than ChexSystems, can prohibit you from registering a new account. Bank of America, BB&T, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo stake in EWS. These banks developed EWS primarily to prevent client fraud. Non-ChexSystems institutions may also screen consumers using a credit report.

Second chance banks may employ ChexSystems to evaluate new consumers and provide fresh start checking accounts. These banks offer “second chance” checking accounts, which allow customers to rebuild their financial past. When a bank or credit union gives a second chance checking account, they are ready to ignore a questionable ChexSystems record.

You may expect to pay a monthly checking fee with second chance checking accounts. Still, most offer users the option to upgrade to a standard checking account after 12 months of responsible account management.

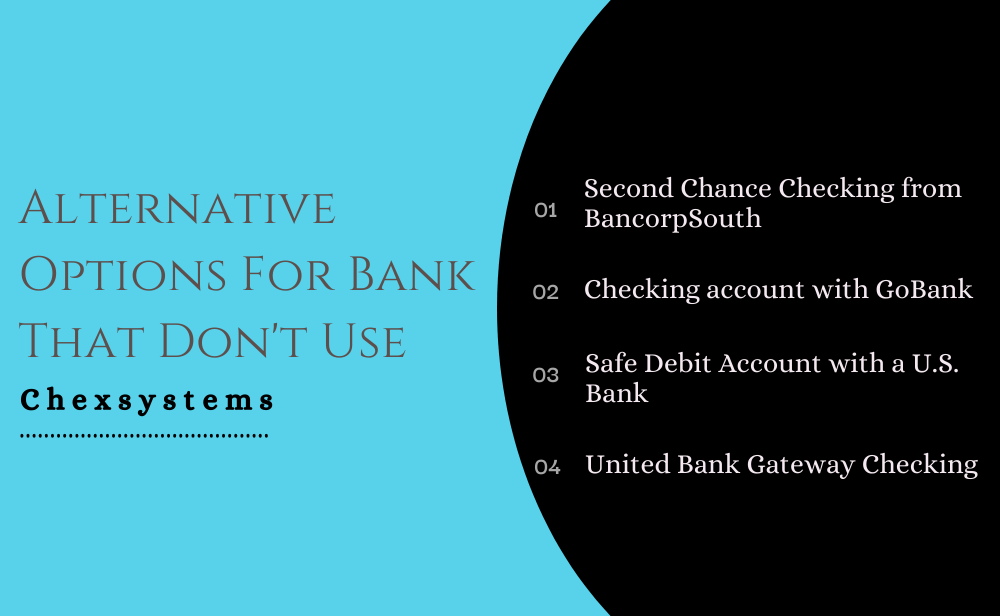

Alternative Options For Bank That Don’t Use Chexsystems

If you are turned down by a bank that does not use ChexSystems, there are various alternatives to regular checking accounts. Some alternatives to non-ChexSystems banks may offer restricted checking functions, such as no check-writing, but they are worth investigating. Here are some other options:

Banks that provide second chance checking accounts know that specific consumers may have a less-than-perfect financial history. Therefore, they are eager to assist their consumers in getting back on track. However, most second chance checking accounts charge a monthly fee, some require direct deposit, and offer fewer benefits than ordinary checking accounts.

Second Chance Checking from BancorpSouth

BancorpSouth’s second chance checking account has a $10 monthly cost. But after one year of exemplary account management, you can switch to a normal Bancorp checking account. A minimum deposit of $50 is required to start an account, and it comes with a Mastercard debit card.

Checking account with GoBank

GoBank’s checking account is easily accessible and openable online. With a $500 direct transfer, you may avoid the monthly service cost. GoBank offers a vast network of free ATMs, although cash deposits can cost up to $4.95.

Safe Debit Account with a U.S. Bank

The monthly charge for the U.S. Bank Safe Debit Account is $4.95. It has internet banking, mobile check deposits, and a Visa debit card. However, you will not be able to use paper checks with this account.

United Bank Gateway Checking

The United Bank Gateway Checking account has a $10 monthly maintenance cost. But after six months of prudent account management, you can upgrade to one of United Bank’s normal checking accounts. For $4.95 each month, you may access online banking and bill pay.

FAQs

Is It Possible To Dispute Chexsystems?

Consumers can challenge ChexSystems’ information, which is a good idea because a bad ChexSystems report might prevent you from using traditional banking for five years. ChexSystems is bound by the Fair Credit Reporting Act and is required to examine each dispute you file. When you file a complaint with ChexSystems, they have 30 days to investigate your complaint. If the reporting bank, financial institution, or credit union cannot verify the challenged item, the negative item must be removed from your ChexSystems Consumer Report.

How To Remove Inaccurate Items From Chexsystems?

If you identify mistakes, take the necessary procedures to be removed from ChexSystems. ChexSystems disputes are similar to credit disputes in that the same measures must be taken to erase unfavorable records. Here’s a basic overview of how to dispute ChexSystems. Then, follow the more extensive ChexSystems removal steps if “suspected fraud” has been highlighted.

1. Make a request for your ChexSystems report. Get your ChexSystems report online in seconds.

2. Go over your report again. Identify and refute any incorrect information.

3. Take the necessary steps to eliminate ChexSystems faults. Disputes with ChexSystems can be submitted online, via fax, or by mail. If you file a dispute through fax or mail. ChexSystems’ website has a Request for Investigation form.

4. Pay for the deletion of recorded indebtedness. Pay the bank that reported the debt in return for the debt removed from your ChexSystems report. If the debt is older, you may be able to negotiate a lower amount and settle for pennies on the dollar. If you cannot persuade the bank to agree to a total deletion, ensure that ChexSystems adjusts your record to pay.

Conclusion

Institutions like banks that donot use ChexSystems provide the same services as ChexSystems banks – you will have several options to meet your banking needs regardless of your banking history. Since 2010, we’ve kept an up-to-date, exhaustive list of banks that don’t utilize ChexSystems, bank accounts for bad credit, and second chance banking options.

There is no credit check. Banks allow persons who have had financial problems in the past to re-enter the banking system and enhance their overall credit record. Some financial operations necessitate a checking account; for example, you cannot apply for a home loan without demonstrating a banking history. Checking accounts for those with negative credit paves the way to a brighter financial future.