Best Guaranteed Auto Loans for Bad Credit

A transportation system is an indispensable part of daily life. When you have an independent vehicle, your work is done fast and efficiently. But when it comes down to purchasing a new car, the most trustworthy is the option of an auto loan. But what if you have a bad credit score and history? You will need some time to find a financing source that will not reject you even if you have a bad credit score.

Fortunately, a guaranteed auto loan comes to the rescue if you have a poor credit score. This article will tell you more about a guaranteed loan and which sites provide the best-guaranteed auto loans.

The 5 Best-Guaranteed Auto Loans

You will be relieved to hear that you can get an auto loan even if you have a bad credit score. You will be granted an auto loan because an auto loan is a secured loan. The car itself will act as collateral if you default on your loan. In addition, they would not take high rate interests and would not put strict loan restrictions because, in the auto loan industry, there is enormous competition. Let us know the five best-guaranteed auto loans:

Auto Credit Express

Auto Credit Express helps people with bad credit for a car loan by partnering with different dealers throughout the US. The company has been in this business since 1999. With Auto Credit Express, you will be connected if you have no credit history, bad credit, bankruptcy, or repossession. But remember, every good opportunity comes with a cost. This guaranteed auto loan is no exception. If you have bad credit, you will be charged a high-interest rate. In this case, the lender makes up for the risk of lending with bad credit. Auto Credit Express has the following features:

- Qualification Form: The Auto Credit Express qualification form will help you understand whether you are eligible for the loan. They will ask you to select the range of your credit score. Second, you must mention your income before the tax deduction and monthly recurring debt such as credit card payments, rent, and other loan payments. You will be approved in minutes after you submit the form. Then the next step will be followed by an application form.

- Online Application Form: In this form, you will need to provide basic information like name, zip code, and monthly income. After you have completed filling out the form, Auto Credit Express will look for the dealers in your area, and you will receive confirmation within some minutes. And the application is free of cost.

Lending Tree

Lending Tree offers you best installment loans for bad credit after you submit the application form. Each loan will provide you with a different interest rate, repayment amount, and loan amount. As Lending Tree is not the lender, it does not decide the loan amount or interest rate. It sets the lender for you and will step out when you have connected to the lender. LendingTree lenders charge interest rates as low as 1.99% on purchase and 1.49% on refinance. You get the opportunity to select the loan type, and you will receive personalized rates charged by the lenders. You can compare the interest rate and settle for the kind that does not charge you a lot. The features of a Lending Tree are:

- Different Repayment Periods: Lending Tree discloses all the information to their customers. The 36-month purchase is the first package with an A+BBB rating, and you can also fund it online. Therefore, you can use it free of cost. The interest rate for this is 2.49%.

- Quick Application Process: You can fill out the form within minutes to fill in your name, phone number, address, income, SSN, and Zip Code. After completing the form, you can get connected to the five lenders. Next, you can deal with your lender for the terms, interest rate, and loan amount. Once you finalize the offer after reading the terms and conditions carefully, Lending Tree will provide check-ins in less than 24 hours.

myAutoloan.com:

MyAutoloan.com has been in business since 2003 and offers financing options such as new and used auto loans, leasing, and refinancing. They feature “today’s lowest rate” that shows the lowest APR charged to a customer on the day. The customer’s credit score determines APR. myAutoloan.com has the following features:

- Online application for four loans: The four different personal loans have the same online application. Therefore, you do not fill in different forms for different information, and they do not charge a fee from the applicants. Furthermore, they allow you to reject a loan if you do not find it suitable.

- Multiple Services: You will find features like an interest rate estimator, payment calculator, and rate chart on their website to check the interest rate you will be charged for the loan. Even before you have connected to the lender, you can at least get some idea of the repayment amount. The only cons of this loan site are that you will have to provide many details.

CarLoans.com

CarLoans.com provides best short term loans for bad credit. It will not charge you with interest, but the dealer will. CarLoans.com sets its APR range as between 0% and 25%. This rate also depends on the credit history, vehicle type, and geographic location. In addition, it has the following features:

- Strong privacy policy: They have a strong privacy policy to ensure the customer’s information is safe. In addition, they provide the reasons as to why they collect the specific information, what they do with the information, and who can access the customer’s information. They also mention that if you disagree with their policy, you might not be able to avail of their services.

- Easy Loan Process: No matter your credit score, you will get a loan from the company. They ask for information like name, address, monthly payment, etc. After completing the application, you will be directed to the lender. However, the cons of this company are that many customers cannot apply for the loan because of the eligibility criteria.

DriveTime

DriveTime has 136 dealership locations for people looking for auto loans for bad credit. Since its inception, they have helped over four million customers. It has the following features:

- Quick Approval: You can complete the form within minutes and with just two steps. Firstly they ask you to fill in your name, valid number, and zip code. The second step consists of address, email, gross monthly income, SSN, and date of birth. Before submitting the form, you have to agree to their terms and conditions.

- Advice Center: Through their advice center, you can learn about balancing credit, house financing, getting a bad credit auto loan, and more. However, you need the eligibility criteria to get approved for their services.

What is Guaranteed Auto Financing?

Some lenders make an effort to provide guaranteed auto financing to consumers with enough income even though they have no credit or have a bad score. These lenders specialize in approving loans that other lenders would not agree to for applicants with bad credit.

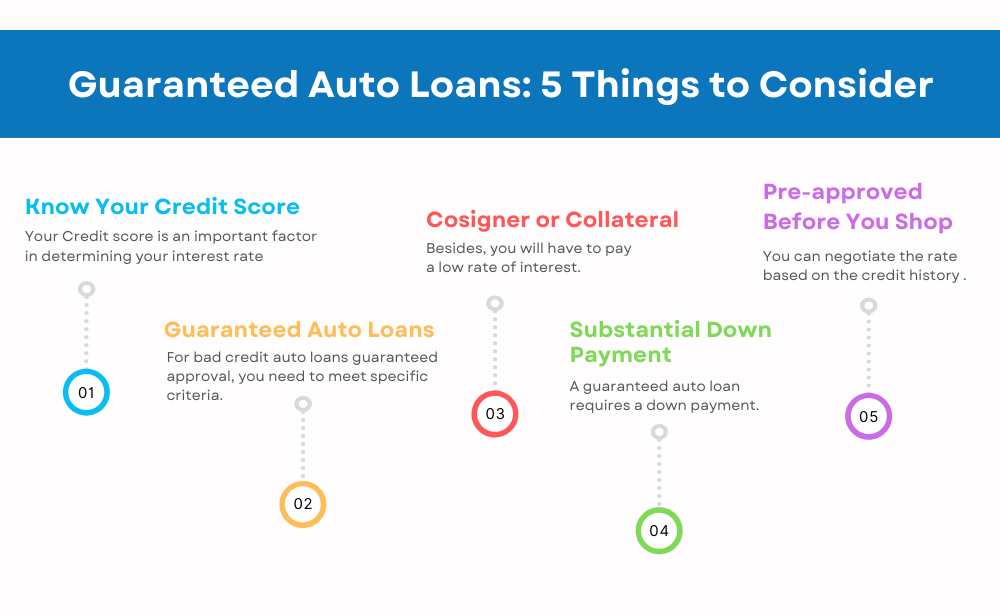

Guaranteed Auto Loans: 5 Things to Consider

Know Your Credit Score

Your Credit score is an important factor in determining your interest rate, the loan amount, and monthly payment. However, different lenders have different criteria to measure the credit score. In addition, your score will vary depending on the company you are applying for financing the auto loan.

Requirement for the Guaranteed Auto Loans

For bad credit auto loans guaranteed approval, you need to meet specific criteria. But they would not check my credit score. The requirements depend on the dealership. Following are the least requirements for a guaranteed auto loan:

- Proof of the current income like a recent paycheck stub

- Employment history at least the past three years.

- Proof of residence like a recent utility bill.

- A down payment

- Two or more personal references

A Cosigner or Collateral

If you have someone with a good credit score and willing to sign your loan, it can significantly benefit you to get your loan approved. Besides, you will have to pay a low rate of interest. If you do not have anyone as a cosigner, you can lower your interest rate by offering extra collateral for the loan.

If you do not pay the loan, they will have the right to take away the thing you kept as collateral. However, if you have collateral attached to your loan, your loan will become a secured loan.

A substantial Down Payment

A guaranteed auto loan requires a down payment. It depends on the price of the car you wish to buy. If you pay a large amount as a downpayment, your monthly payment for the loan will be reduced. If you cannot afford to pay for the down payment, you can trade your old car. Some dealerships count the value of the trade-in car as the down payment.

Get Pre-approved Before You Shop

If you have your guaranteed auto financing pre-approved, you can focus on the vehicle choice without worrying about the monthly payment. In addition, you can organize your financing. Even if you have bad credit, you have control over the loan rate and the monthly payment amount. You can negotiate the rate based on the credit history by having a relationship with the bank. This can have a positive impact on the loan terms.

Requirements for Bad Credit Auto Financing

Will to Pay a Higher Interest Rate:

You will be a riskier borrower than the other borrowers. Therefore, you will have to pay a higher interest rate than the customer with a higher credit score. For instance, if the average interest for the customer with a prime credit score is 2.47%, it will be 6.07% for non prime borrowers, while for deep subprime borrowers, it will be 12.53%.

Find Dealers that Specializes in Buyers with Bad Credit

Look for dealers specializing in buyers with bad credit if the traditional dealership cannot approve your loan. But, they charge very high interest because they are considered a risky borrowing due to their bad credit score.

Apply for a Loan With a Cosigner

If you want to apply for a car and have a credit score in the subprime range, you might need to apply for an auto loan with a cosigner. A cosigner may be someone from the family who has an excellent credit score. The cosigner helps to reduce the lender’s risk by sharing the responsibility. You will be approved for a loan with a low-interest rate with a cosigner. However, if you do not pay the loan, your co-signer is liable to pay the loan.

Assess Your Income and Debt

The lenders weigh your capability to repay your loan utilizing your income against your monthly expenses. They check to know if you can make new car payments every month and your existing debt obligations. All the information will help the lender determine your interest, additional fees, and down payment required to secure the loan. If they see you as a riskier borrower, you need to pay more loan fees. Therefore, check your monthly debt against your monthly income to get a better idea of how much you can afford to pay per month.

Prove Personal Stability

The lenders also check on how long you have lived at your current address and how you have been with your current employer. Knowing it helps them know how secure you are, where you live, and how secure your job is. The stability in your employment and your residency are the two important factors to measure how risky a borrower you are. They might ask you to show the address proof and recent paycheck stubs.

FAQs

What is Bad Credit?

When a person fails to pay bills on time through their credit card, they have a low credit score. This low credit score after a specific range is called bad credit. People or companies with a low credit history are considered riskier than the other borrowers. This applies to all types of loans, whether secured or unsecured.

What is An Acceptable Credit Score for A Car Loan?

When you apply for a car loan, your lenders look at your income and credit score, deciding to approve your car loan. Customers are divided into different categories based on their loans:

- 781 to 850 are considered Super Prime

- 661 to 780 are considered Prime.

- 601 to 660 are considered as Non-Prime.

- 501 to 600 are considered ad Subprime.

- 300 to 500 are considered Deep Subprime.

Lenders generally look for customers within the prime range or better. Therefore, you will require a credit score of 661 or higher to get approved for an auto loan.

Conclusion

Guaranteed Auto loans help people purchase cars even if they have bad credit and cannot get a loan from the traditional car loan lenders. Dealerships finance the guaranteed auto loans. They do not check your credit history but check your income and employment to qualify for your auto loan. However, if you are eligible for the loan with the requirements, they charge a high-interest rate and fees. Besides, they do not build your credit. Therefore, if a guaranteed auto loan is your last option, consider carefully going through the terms and conditions to get the best terms.