AmOne Loans Reviews

Introduction

If you want a personal loan and want to contrast numerous offers to find the best rates, AmOne Loans are a terrific alternative.

AmOne has been in business since 2001 and specializes in locating the finest personal loan rates. They don’t charge a fee to connect you with their lender network. You do not pay; the lenders do.

AmOne is a reputable, free service that connects customers with local direct lenders. You complete a single application using our simple form, which is then used to connect you with direct lenders that accept your application and fund the loan.

AmOne Loans Overview

The AmOne lending procedure includes acquiring borrower information and connecting it with offers from lending partners. Then, the lender will check credit only after the consumer has chosen one of the offers.

One Finance, or simply “One,” is an online-only nonbank financial organization that receives FDIC protection for its clients’ deposits through a licensed partner bank.

They are not lenders, but they give a platform for customers with excellent or low credit to match with the lowest rates through various offers from different banks or lenders.

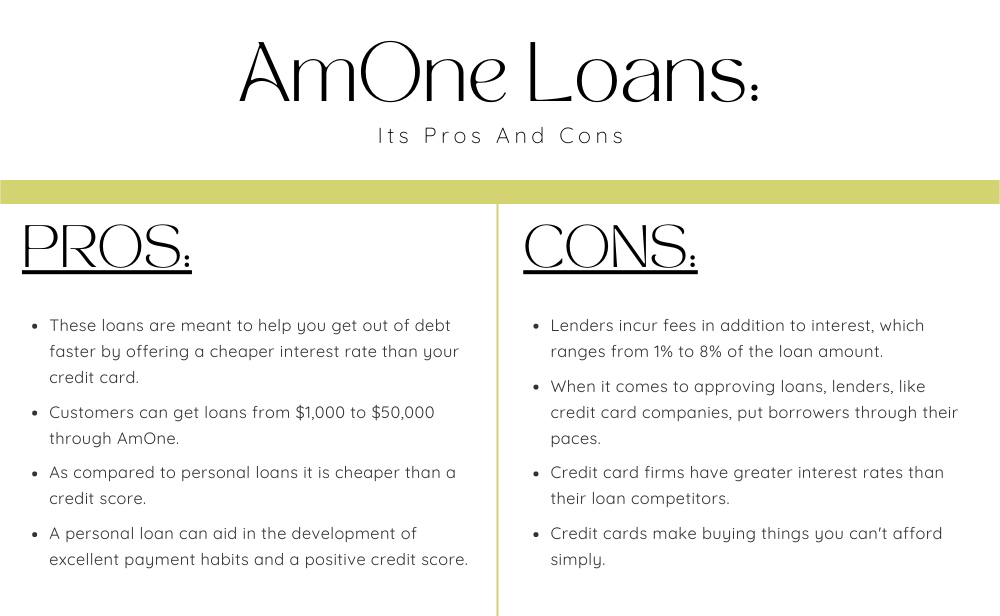

AmOne Loans: Its Pros And Cons

Each loan has its own advantages and downsides. Listed below are the advantages and downsides of AmOne Loans:

The pros of AmOne loans are given below:

- These loans are meant to help you get out of debt faster by offering a cheaper interest rate than your credit card. They don’t require any security.

- Customers can get loans from $1,000 to $50,000 through AmOne. However, the amount and interest rate is determined by the borrower’s credit score.

- As compared to personal loans, the AmOne loan is cheaper. But your credit score will determine the interest rate. When you have low debt, you will have a better credit score. Credit card interest rates are around 7% higher on average than personal loan interest rates.

- A personal loan can aid in developing excellent payment habits and a positive credit score. Repayment and budgeting are made easy by the set rate and payment. A personal loan might also build your credit score by substituting credit card debt. It is because paying off your credit card debt decreases your credit usage ratio, which accounts for 30% of your credit score.

- You must show yourself to be a responsible borrower who can repay your loans to borrow money. A credit card is one technique to establish credit.

- Issuers dangle cashback benefits, travel bonuses, and other advantages to getting you to sign up for a credit card. There is a catch: to obtain the incentives, you must spend money on the cards.

The cons of AmOne loans are given below:

- Lenders incur fees and interest, ranging from 1% to 8% of the loan amount.

- When it comes to approving loans, lenders, like credit card companies, put borrowers through their paces. The rate you pay may be greater for people with a poor credit score.

- Credit card firms have greater interest rates than their loan competitors. The average credit card rate of interest is nearly 17%. On the other hand, the average personal loan rate is over only 10%.

- Credit cards make buying things you can’t afford simple. However, it is unsustainable to spend more than you make.

Eligibility Criteria to Qualify For AmOne Loans

You must fulfill the following AmOne loan requirements to be eligible for an AmOne personal loan:

- Be a permanent resident of the United States.

- Your age must not be less than 18 years.

- There is no credit score requirement.

Following are the information that you will require to complete the online form.

- The year you were born.

- What amount do you want to borrow?

- What do you intend to do with the funds?

Rates and Terms for AmOne Personal Loans

We wanted to show you the exact least and highest amount you may be offered because AmOne allows you to examine offers from numerous lenders. Various lenders will make various offers.

APR Range*: 2.99 percent – 35.99 percent Loan Amount Range: $1,000 – $50,000

Costs:

- Lenders charge different fees for origination, late payment, and NSF.

- Penalties for prepayment: none

- The time given to pay the loan amount is seven years.

- Direct Payments to Creditors: Depending on the lender.

Steps After AmOne Loan Review Approval

There are a few steps after loan approval given below. But, first, let’s look at the AmOne application procedure now that we know the loan criteria – we’ll go over the steps you’ll need to do to apply for a loan. To begin with, it is a straightforward procedure that users can perform online in a matter of minutes.

The following is how it works:

- Visit AmOne.com is their official website.

- In the right corner of the website, click the ‘Get started’ tab.

- Borrowers should answer questions like ‘Where would you wish to spend the money?’ and ‘How would you rate your credit?’

- Choose your loan amount as well as your work status.

- Verify your income that is taxable and, if applicable, include the name of the co-applicant.

- Give details about your present financial condition. They’ll ask you things like “how much credit card debt do you have?” and “have you filed for bankruptcy?”

- Give your phone number and email address.

- Enter your birth date and select the ‘Get my choices’ link.

- After completing the application procedure on its website, it will match you with many possible lenders so that you may compare your possibilities.

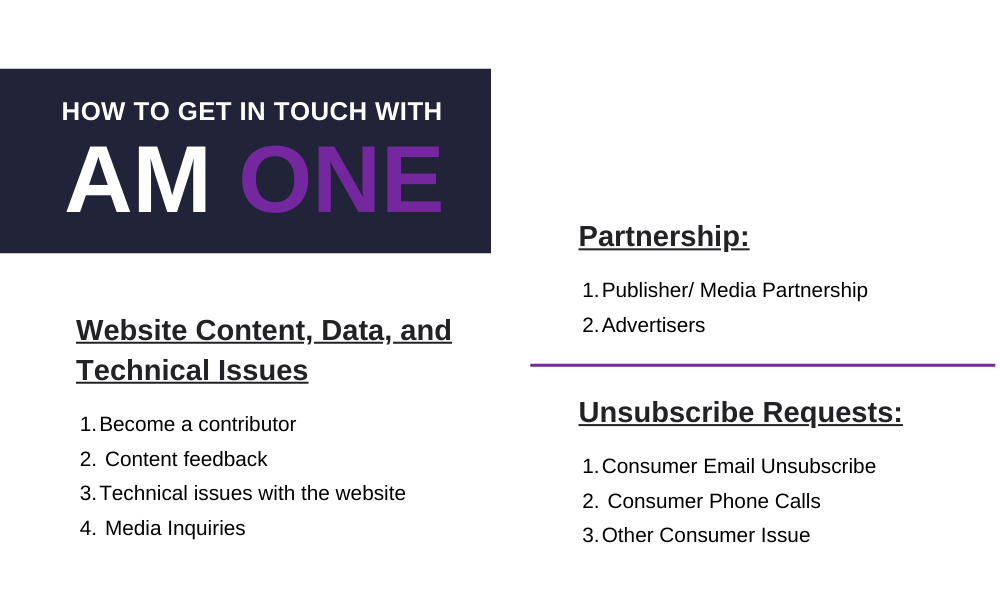

How To Get In Touch With AmOne

You can get in touch with AmOne by selecting one option from three of them. And the three options are as follows:

- Partnership

- Publisher/ Media Partnership

- Advertisers

- Website Content, Data, and Technical Issues

- Become a contributor

- Content feedback

- Technical issues with the website

- Media Inquiries

- Unsubscribe Requests

- Consumer Email Unsubscribe

- Consumer Phone Calls

- Other Consumer Issue

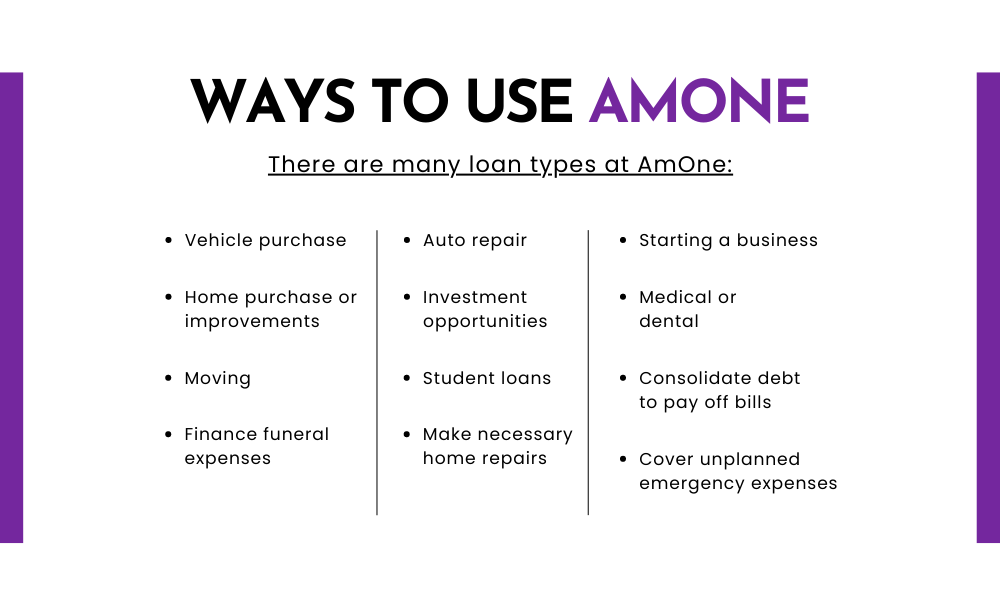

Ways To Use AmOne

To improve your credit score, you must first spend money. There are different loan types at AmOne:

- Vehicle purchase.

- Auto repair.

- Investment opportunities.

- Moving.

- Student loans.

- Starting a business.

- Consolidate debt to pay off bills.

- Cover unplanned emergency expenses.

- Home repairs.

- Finance funeral expenses.

- Make a large purchase.

- Home purchase or improvements.

- Medical or dental.

How Do AmOne Loans Work?

AmOne is a user-friendly system that takes only 30 seconds or less to find the best rates. AmOne operates by sending your information to a network of lenders who could be a good fit for you. The lenders then provide the offer according to your credit history, score, and capability to repay.

FAQs Related To AmOne Loans

Is AmOne Legit Loan Company?

AmOne is a reputable, free service that connects customers with local direct lenders. You complete a single application using our simple form, which they use to connect you with direct lenders that accept your application and fund the loan.

What Is The Cost Of AmOne Personal Loans?

The APR is calculated at the time of application and ranges from 7.04 percent to 35.89 percent. The origination charge varies between 3% and 6% of the loan amount. Borrowers with great credit might get the lowest APR.

Does AmOne Do A Hard Pull Of Credit?

Your credit score will not get affected if you use the AmOne platform to match with financial institutions and learn about your loan alternatives. AmOne will merely check the information you supplied and perform a soft pull to connect borrowers in the United States with distinct lenders.

Customer Feedback

- Customers compliment AmOne’s customer support representatives for their politeness and ability to address difficulties.

- Customers like the truth that AmOne offers loan to people with bad credit or no credit.

- Overall, we feel confident recommending AmOne for any future funding you may require after reviewing hours of AmOne reviews.

Conclusion

AmOne has been in business since 2001 and specializes in locating the finest personal loan rates. AmOne loans are meant to help you get out of debt faster by offering a cheaper interest rate than your credit card. But, they do not allow any type of security.

Customers can get loans from $1,000 to $50,000 through AmOne, with the amount and interest rate determined by the borrower’s credit score. We hope the information provided in the AmOne loan review has been helpful.