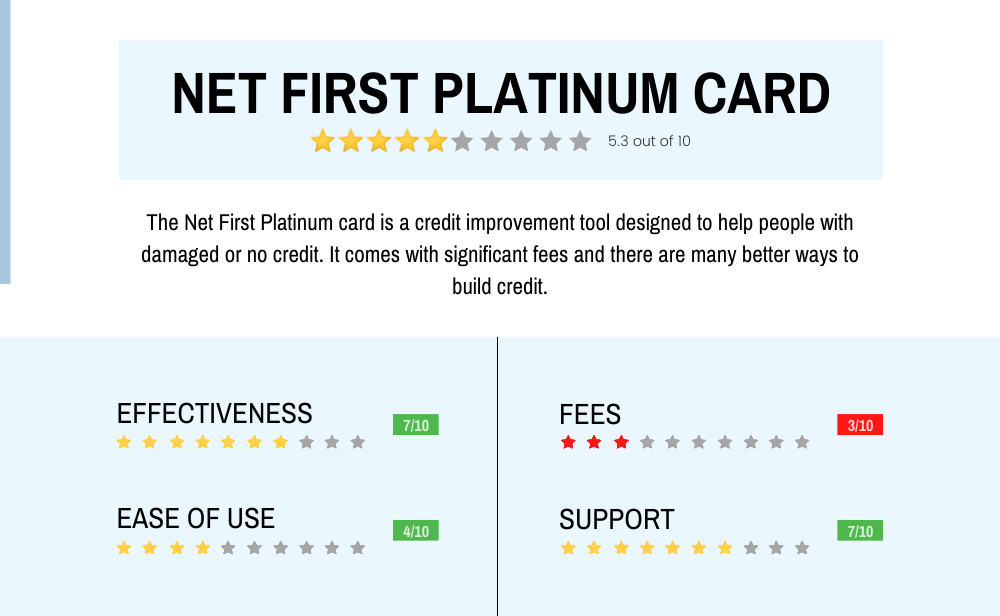

Net First Platinum Card Review

Introduction

If you’re looking for a low-interest credit card, read on. The Net First Platinum Card is one that you should consider. Seems too good to be true? Read this review and find out if that’s really the case.

There are thousands of credit cards and banking products for people in the USA. So which one should you choose? We have reviewed the Net First Platinum Card, looking at its interest rate, fees, credit bureau requirements, and rewards program.

What is Net First Platinum Credit Card?

A NetFirst Platinum is a merchandise card that you can use to make purchases only from Horizon Outlet. Horizon outlet sells various merchandise such as clothes, toys, cookware, etc. Thus, you can purchase a wide range of products using this card.

Interestingly, you can easily get a Net First Platinum card. Because, it doesn’t conduct a credit check on your credit report. In addition, you get a $750 credit line from this card. Thus, making it a lucrative option for people with bad credit. However, the card has high fees, and its use is restricted, making it a bad choice for most people.

Points that are noteworthy about the Net First Platinum card:

- Being a “merchandise card,” you can use it only at the Horizon Outlet.

- The card can buy everything, such as toys, clothes, equipment, and even books. You won’t discover many large brands in the selection.

- The card won’t conduct an inquiry into your credit history at the time of application. Therefore, errors from the past shouldn’t stop you from applying for it. The application does not ask if you’re employed or not.

- The Net First Platinum card offers a credit limit of $750 for anyone who accepts.

- The card will report information about your account to credit bureaus every month.

- There is a $5.00 fee to activate your credit card.

- Net First automatically enrolls you in a plan that costs $24.95 each month.

- The advantages of the $24.95/month plan aren’t worth the price. It is equivalent to 40 percent off prescriptions in certain drugstores and pharmacies, roadside assistance, and free legal consultations for 30 minutes.

- Even if you call Net First and say you do not want the benefits, they’ll cost you $6 per month to keep the card in use.

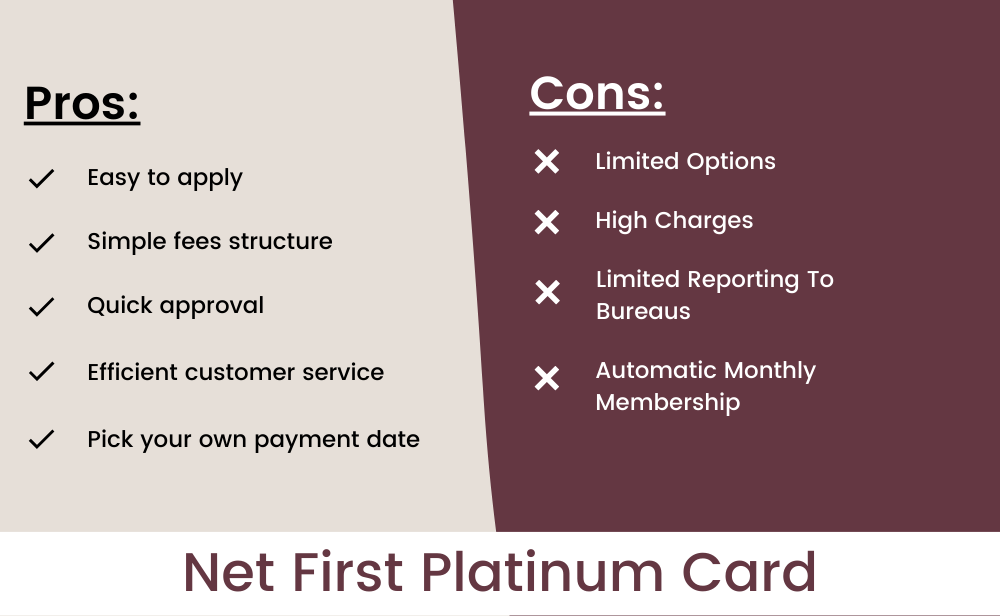

Net First Platinum Card – Pros And Cons

Pros

Easy to apply

It follows a simple online application process. Plus, there is very less waiting time.

No credit check: Your credit score is not taken into consideration when you apply for this card. So even if you have bad or no credit, you can still qualify for the Net First Platinum Card. Just submit your information online and meet the minimum requirements (see below).

No waiting period: After applying for the card online, there won’t be any waiting periods before receiving your new card! You’ll receive it within just a few days after approval. Therefore, start using it immediately with confidence that everything will work out smoothly from beginning to end without any problems. This also means no annual fees either, which makes this one of their most attractive benefits. It is because many other companies charge fees every year regardless of whether someone uses them or not.”

2. Simple fees structure

You will not be charged a processing fee or monthly account fee. There are no annual fees, and your transactions are free of charge. Additionally, you can take advantage of no ATM withdrawal fees at more than 400,000 ATMs in the U.S.

3. Quick approval

Net first platinum Card aims to provide consumers with quick access to credit for emergency purchases or bill payments that exceed the amount of money in their bank accounts.

The card can be used for any kind of purchase, not just emergencies, and it has no monthly fees.

4. Efficient customer service

Their customer service team is available at almost any time during the day by either phone or email. The team is very supportive and capable of resolving all the queries. They can help you with anything from activating your card to managing your account.

5. Pick your own payment date

You can pick a schedule for your payments that works best for you. For example, you can choose to pay weekly, bi-weekly, or monthly and select the day on which you would like to make those payments. And if your schedule changes at any point during the year, don’t worry; it’s easy to change your payment date with just one call. It’s also possible to ask for an extension if needed and make additional payments on top of what is required by the card issuer.

Cons

Limited Options:

The NetFirst Platinum card is not a typical credit card; rather, it is a line of credit. Thus, being its user, you can utilize this card only at Horizon Outlet Store.

High Charges:

The NetFirst Platinum card has a 0% APR and no annual fee, but it comes with other charges. Horizon automatically enrolls all of its customers in its $24.95 per month membership program. If you do not join the program, you will be charged a $6 monthly maintenance fee. In addition, you have other fees, such as all the shipping and handling made on the purchases in the Horizon Outlet Store and a $20 late payment fee if you don’t pay your bill on time.

Limited Reporting To Bureaus

Horizon Card Services says that it reports your credit card activity to some credit bureaus, but it does not specify which ones.

If you’re looking for a credit card that helps you build credit, consider one that reports to all three major credit bureaus. They are TransUnion, Experian, and Equifax.

Automatic Monthly Membership

Several online customer reviews give NetFirst, and Horizon Card low marks for the organization’s practice of automatically enrolling applicants in a membership program that costs $24.95 per month. In addition, many customer reviews claim they didn’t know that they were added to the plan when they applied for the NetFirst card.

It is difficult to know what benefits members get for their $24.95 per month fee because the terms and conditions of Horizon Card Services direct users to a site that requires them a password to log in.

Their monthly membership plan is legal assistance benefits, prescription discounts, privacy protection, and roadside assistance. However, they fail to explain exactly where users can claim these benefits.

Privacy Protection – Horizon Card Services offers unlimited internet access and lets you review your credit report once your account is activated.

Prescription Discounts – Members receive discounts on prescription drugs at pharmacies.

Legal Assistance Benefits – The members get a free call with an attorney or legal professional other than criminal law cases.

Roadside Assistance – Members can make up to three calls for towing or delivery of up to 15 miles or $50 worth of fuel per call every 30 days.

Does Net First Platinum Card Help In Building Your Credit Score?

This credit card can help you create credit and better your score. They say that they report the user’s activity to one credit bureau.

But Horizon’s terms and conditions mention that it doesn’t guarantee aid in building credit or guarantee any positive references to your credit report.

If you’re looking for a credit card that can help you improve your credit rating or establish credit, you’ll probably be happier with another card.

When choosing a credit card, it’s best to select one that will help you build a positive payment history by showing creditors that you can use credit responsibly.

Net First Platinum Reviews: Should You Go For It?

Does Net First Platinum Report Your Card To Credit Bureaus?

Horizon Card Services states that they report the user’s activity to at least one credit bureau, but they don’t state its name. So if building your credit score is important to you, another option might be a better choice.

How To Apply For Net First Platinum Card?

Step 1: Visit the website of Net First Platinum Card and create an account.

The first step in the process is to visit the website of Net First Platinum Card and create an account. It may be done by clicking on the link to apply for the card, after which you can fill out all your details. Once completed, you will receive an email from Net First Platinum Card with a temporary password to log into your account. In addition, there will be further instructions on how to complete your application and links to download documentation and forms.

Step 2: After creating the account, fill out the application form.

You need to provide the following information:

- Full name

- Current address

- Email address (you must use this email address as your login)

- Phone number (you can only apply for one card per phone number)

- Date of birth

- Social security number

- Income, including employment status and current monthly mortgage or rent payments (this should be based on your latest available pay stubs)

- Desired credit limit

Step 3: You will get the confirmation page after filling out the form.

You will get the confirmation page after filling out the form. The page will say, “Your application has been received,” it will have an application reference number and, dates and time of submission, a link to our privacy policy and terms & conditions.

Step 4: Right after you submit your application, you will see a message on your screen.

After submitting the application, a message will come up on the page. You will also receive a confirmation message in your email inbox, and you will be asked to verify your email address. Lastly, it will ask you to confirm your identity via phone call.

Step 5: You will receive your card within 7 to 10 business days.

- You’ll receive your card within 7 to 10 business days of approval, and you can use it as soon as you receive it.

- Log in to your account on the Net First Platinum website to check the status of your application.

How To Cancel Your Net First Platinum Credit Card?

As per NetFirst Platinum policy, you can request cancellations and refunds within 30 days of the billing date. It can be done by calling Member Services at 1-800-251-6144.

Please note that you are not eligible for a refund if you cancel your account after 30 days from your billing date. If you do not pay any remaining balance in full while canceling the account, your outstanding balances will continually accumulate interest. Be sure you pay any balances before or right after you cancel the card.

There are no fees associated with closing your account beyond any remaining balance.

Best Alternative Options For Net First Platinum Card

OpenSky Secured Visa

OpenSky has an 85% approval rate for its credit cards, which has remained steady for the past five years. After six months, the company also provides a credit line increase for on-time payments, which does not require an additional deposit. Unlike prepaid or debit cards, OpenSky reports monthly to all the main credit bureaus. In addition, nearly half of OpenSky card users making on-time payments increase their FICO score by 30+ points in the first three months. Your refundable deposit becomes your OpenSky Visa credit limit when you apply online using your mobile phone. You can select the available due date that matches your payment schedule when you pay online through OpenSky’s website or mobile app.

The Pros

Opensky offers low-risk, high-reward credit cards. You can choose a secured deposit from $200 to $3,000 for your card. That deposit is fully refundable if you close the account. Likewise, it is refundable in case you upgrade it to an unsecured card. In addition, Opensky reports to all three credit bureaus so you can establish or rebuild your credit history.

The Cons

The OpenSky Secured Visa has a yearly charge of $35 and a minimum security deposit of $200. Besides, this card does not let you upgrade to an unsecured card. In addition, with an 18.89% APR, it has a lower rate of interest than other secured cards.

Capital One Secured MasterCard

The Capital One Platinum Secured Credit Card is among the best credit cards for creating credit scores at a low cost. The card is excellent since it offers a $0 annual fee and a $200 starting credit limit in return for a refundable security deposit that can be as low as just $49. Or, the deposit requirement could be $99 or $200, depending on the specifics of your credit history and the present condition of your finances.

The Pros

It can be secured partially.

Low overall cost due to $0 annual fee.

Report to all three bureaus, thus improving your credit.

The cons

If you have seriously damaged credit, you may not get this card.

Deserve Pro Mastercard

This card has a competitive rewards rate, an excellent wire transfer service, no annual fee, no foreign transaction fee, and is a great cashback card for someone who spends on expenses rather than rewards.

Deserve Inc. is a credit card issuer that permits applicants to have a cosigner. If you find your credit is low, adding a cosigner improves the chances of approval. It offers a variety of benefits, such as identity theft protection, travel assistance, travel accident insurance, rental insurance, emergency support, extended warranty protection on purchases, and price protection. However, approval odds are low if your score is below 700.

The Pros

- Zero annual fees.

- Multiple card benefits.

- Report your credit activity to multiple bureaus.

- Zero foreign transaction fee.

- Provide travel assistance and travel accident insurance.

- Offer protection from identity theft.

- You get an extended warranty as well as price protection on purchases.

The Cons

- A good credit score is a must.

- There is no sign-up bonus.

Easy Ways To Build Your Credit Score

Start small and build slowly.

It’s an excellent idea to start small and build slowly. This can be as simple as applying for a small loan (for example, a car loan), or it could mean applying for several small credit cards at once. Once you have established some positive credit history, you can then use this history to apply for larger loans and better rewards programs.

An excellent way to create your credit is by making regular payments on time and paying off your debt in full each month. Your goal should always be to keep the amount of debt you carry at or below 30% of your total available limit on each card so that you don’t incur interest charges that will eat away at your available credit line (and thus reduce its value).

Make on-time payments every time.

You can include the crucial habit by making timely payments to build your credit score. Paying more than the minimum is also a good idea — it shows that you’re capable of paying more than what’s required.

Late payments are expensive and can stay on your record for up to seven years after they happen, so it’s not worth taking the risk of missing a payment just to save $5 or $10 in interest charges. If you find yourself unable to pay off all of your debt at once, put together a plan for paying off different debts over different periods so that no one late fee sticks around longer than necessary. You’ll have better luck getting approved for loans if your current accounts have low utilization rates (the amount owed divided by total credit limit).

Keep your credit utilization low.

The second and third items on this list are related to the first. Credit utilization is the number of dollars you have on your credit card divided by your total credit limit. The higher your credit utilization, the lower your score will be because it indicates that you’re using many available funds for purchases.

You want to keep this percentage as low as possible — ideally at 30% or less, but preferably even lower than that, depending on which expert you ask. Having multiple accounts with high balances can also negatively affect your score, and having one account with a high balance (your overall debt-to-credit ratio).

Get a secured credit card.

If you have no credit history, a secured credit card can help you establish a positive payment history.

Secured cards are designed for people with no or little credit history. They’re intended to provide an alternative option who might not qualify for other credit cards. To get one of these cards, you put down a security deposit that functions like collateral (it can be taken away if you don’t pay your bill). Your deposit is then used as part of your overall available credit limit when making purchases on the card. So if your balance is $500 and your deposit is $300, then only $200 will be available in your account at any given time. You’ll need to pay off all monthly charges; otherwise, the issuer will take back the amount owed plus interest from your security deposit during their next billing cycle.

Pay off your debt instead of moving it around.

If you have credit card debt and are looking to pay it off, you should first figure out the interest rate on each of your cards. You should pay off the card with the highest interest rate at first. It is because that’s where you’re losing the most money. Then, once you have paid off the card, move on to paying off the next highest interest rate card and so on until you have cleared all of your balances.

It’s also important to understand how balance transfers work when consolidating debts: your credit score needs to be high enough for them to work well for you. If it isn’t high enough yet, or if there aren’t multiple cards with higher interest rates than what you currently have (since this will help lower overall payments), then consider applying for a small personal loan instead; these typically have much lower APRs than traditional bank loans and can still help consolidate debts while improving your credit score at the same time!

Fix errors on your credit report.

You can see your credit reports for mistakes. If you see anything that’s not correct, dispute it. It may take time to remove the error from your report, so keep checking until they fix it.

Some companies sell credit-building products with high up-front fees—and if you fail to meet their terms, they’ll charge you more money or even cancel your contract (while keeping what they’ve already charged).

The best way to build credit is by staying on top of your bills and payments every month, which will help improve scores over time because lenders like to see a history of responsible behavior in those records.

Check your credit score for free at least once a year.

A credit score is a score that represents your complete financial health. For example, it can determine whether you’re eligible for a loan, what interest rate you’ll pay, and whether you’ll have access to other financial products like insurance or cell phone service plans.

Credit scores are calculated by the data from the three main credit reporting bureaus. You can get free access to your credit reports from the bureaus but only once a year.

Use different credit accounts (and don’t close any if you can avoid it).

The most important thing to understand about building a credit score is that there are many different types of credit accounts, and you want to have a mix of all those types.

The first type is an installment loan. These are mortgages, student loans, and auto loans. The second type is revolving debt: credit cards and home equity lines of credit (HELOCs). Finally, installment accounts such as personal loans or retail store cards are the third type. Each of these account types helps your score in different ways.

You also want to keep all your accounts open if you can avoid closing them. And remember how much you owe on each account so it doesn’t impact your utilization rate unnecessarily high for any given month during which one payment might be late or missed completely.

Conclusion

While there’s no denying that the net first platinum card presents a lot of financial perks, such as access to airport lounges and travel credits, it’s by no means the best credit card on the market. In fact, if you’re looking for a rewards credit card that offers more cashback and flexibility, you’ll likely consider other alternative options.