How To Make Money Selling Tradelines? – Know All

People profit from the sale of their approved user tradelines. While you may not be able to earn $1,000 per hour, you may be able to generate a side income. There are various dangers associated with selling tradelines, such as the possibility of your account being closed down if you add too many authorized users. However, you might gain money by selling approved user credit card placements. Use the tradelines credit partners page to receive a price for selling your tradelines.

What Are Tradelines?

Credit accounts or debts displayed on your credit report are known as tradelines. Each account has its own tradeline. For example, if you have five credit cards, you have five tradelines. Tradelines are also granted for mortgages and other loans, although credit card tradelines are the most commonly purchased and traded.

A tradeline contains information on the debt or line of credit, as well as the kind of account, the lender’s name, the date the account was started, the monthly and current balance, payment history, and a partial account number, similar to the last four digits of your credit card.

Types of Tradelines

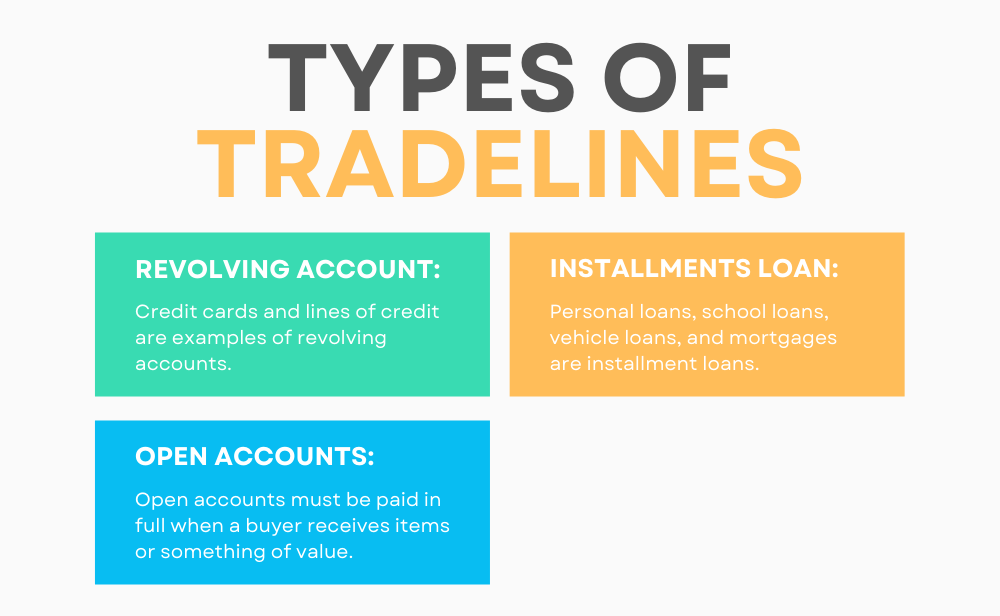

Each of your accounts is a separate credit tradeline. That is true for even if your payment is current or past due, the account is open or closed, whether the account is held solely in your name or jointly with someone else. However, not all tradelines are the same. They are classified into three types:

- Revolving Account

Credit cards and lines of credit are examples of revolving accounts. They’re called revolving credit cards since the amount, available credit, and payment due vary as you make purchases and payments.

- Installment Loans

Personal loans, school loans, vehicle loans, and mortgages are installment loans. These are accounts in which you borrow a set sum and return it over a set period. Mortgages, according to some analysts, are a different fourth category.

- Open Accounts

Open accounts must be paid in full when a buyer receives items or something of value. As a result, individuals are less likely to have these accounts than corporations.

The weight and components of credit tradelines differ from one category to the next. For example, missing a credit card payment would likely damage your credit score more than missing a mortgage or vehicle loan payment. And, unlike an auto loan tradeline, a credit card tradeline covers your credit limit and use.

Why Buy And Sell Tradelines?

A credit card tradeline with a strong payment history and minimal credit use will aid in the development of a high credit score. That is something that people desire. Because of this need, individuals are prepared to pay for the usage of a decent tradeline.

Authorized user status allows credit card tradelines to be shared. When you add an authorized user to your card, the tradeline will display on their credit record, along with your solid payment history. It is something that many parents use to help their children develop credit.

How to sell tradelines? You add a total stranger as an authorized user to your card when you sell a tradeline. That stranger benefits from the record you’ve established on the card, which can boost their credit score. They compensate you for this benefit.

How To Sell Tradelines?

A brokerage service is the most convenient way to sell tradelines. Selling tradelines entails charging a charge to add an authorized user to your credit card. The approved user will typically remain on your account for roughly two months, following which the broker will notify you when you may delete the user.

The amount you earn for selling tradelines is determined by your overall credit score, the age of the card, and the credit limit on the card. Some banks or credit card companies are also seen to have better reporting processes and will seek a higher premium.

How Much Do Tradelines Cost?

In general, the greater the price, the higher the limit, and the older the tradeline (and vice versa).

For example, if you’re on a tight budget, you might buy a three-year-old tradeline with a $3,000 credit limit for around $275. If you want a lot of age and a big credit limit, $1,200 may buy you a tradeline with a $45,000 maximum and almost 10 years of age.

There are also instances when a tradeline has a lot of age but a meager credit limit or where a tradeline has a high limit but a lot of age (and everything in between). Therefore, it depends on other factors to determine how much tradelines cost.

Making Money Selling Tradelines

How Much Can You Make Selling Tradelines?

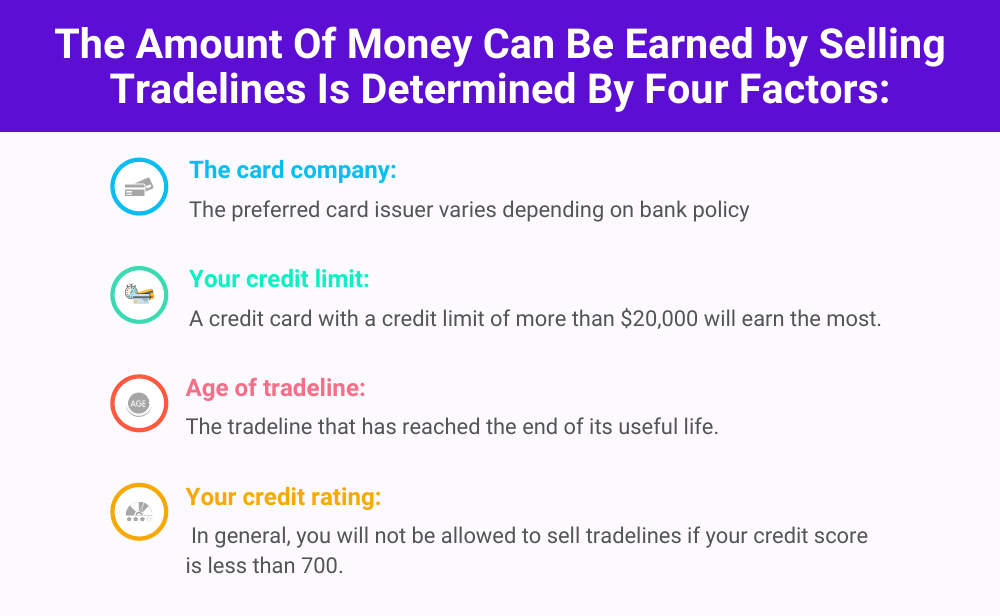

The amount of money you may make by selling tradelines is determined by four factors:

- The card company: The preferred card issuer varies depending on bank policy, but Barclays, Discover, Capital One, Chase Bank, Bank of America, or Elan are recommended.

- Your credit limit: A credit card with a credit limit of more than $20,000 will earn the most.

- Age of tradeline: The tradeline that has reached the end of its useful life. A card that is at least ten years old is incredible. Prices for those aged 18 and up will be the highest.

- Your credit rating: In general, you will not be allowed to sell tradelines if your credit score is less than 700. The price of every tradeline sold rises in direct proportion to your credit score

How Do I Get Paid from Tradelines?

You add a total stranger as an authorized user to your card when you sell a tradeline. That stranger benefits from the record you’ve established on the card, which can boost their credit score. They compensate you for this benefit.

Risks of Selling Tradelines

Selling tradelines entails some risk. The threats range from identity theft to linkages to criminal behavior. The following are the primary dangers associated with selling tradelines:

- Infringing on the terms of service of your credit card business.

If this occurs, they have the power to cancel your account, which would reduce your total credit lines and perhaps harm your credit score.

- Taking part in identity theft.

To legitimate a phony ID, someone might purchase a tradeline. While it may appear that you are assisting someone less fortunate in improving their credit score, you may actually be assisting in the theft of someone’s identity. There is no way to know who you are selling the tradeline to or why they are buying it.

- Purchases made without authorization.

As an authorized user, the tradeline buyer might request a card be mailed to their address and charge your card.

- Breach of data.

Selling tradelines raises your risk of data exposure or identity theft as you share your details with a stranger, which sometimes does not favor you and may cause you a loss.

- Deactivation of account.

If your credit card company notices that you have added a significant number of authorized users — often more than four to six — they may flag your account or close it entirely. As a result, you risk having your credit score decreased, especially if that was your oldest or biggest line of credit.

Conclusion

A credit tradeline is merely the appearance of an account you’ve created with a lender on your credit report. Each tradeline contains specific information about the account, such as payment history, both good and bad. These facts are used to determine your credit score and to assist lenders in determining how hazardous it is to lend you money. Tradelines remain on your credit record for a minimum of seven years. As a result, it’s critical to regularly go through your report to ensure that each tradeline is accurate before selling tradeline.