Does Paying Off Collections Improve Credit Score?

Contrary to popular belief, paying off collections alone will not improve your credit score. In this blog, we have explained why is it so and shared helpful tips to potentially remove old debt from your credit report.

What Are Collection Accounts?

A collection account is an account that collects debts and that have been sold to a third-party debt collection agency by the original lender. It happens when you fail behind on your payments to the creditor and the lender then transfers the account to the debt collection agency. It generally takes you 180 days after you become a delinquent. They declare your account a loss and hand it over to the agency to charge off the loan.

After the account has been charged off, the original lender closes the account and sells it to the debt buyer. A debt buyer generally purchases a debt account and hires debt collection companies to collect the debt from the delinquents. Then you need to pay off collections directly to the collection agency instead of the original creditor. However, you will be notified using letters or calls about the debt before transferring it to the debt collection agency. But you would not be notified if they sell it to them.

Read the article to know the best way to remove collections from credit scores.

How does paying off collections affect your credit report?

FICO® ‘s and VantageScore’s credit scoring systems consider collection accounts. As a result, it can highly affect your credit report.

The collection falls under payment history:

As collections fall under payment history, it is the crucial factor to drive 35% of your credit score based on FICO® Score calculation. As a result, people with collections on their credit reports might have low credit scores. Therefore, paying off collections will affect your credit score positively.

Influence lender decisions:

If you have collection accounts on your credit report, it might affect the lender’s decisions. Many financial or mortgage lenders have policies that want you to pay off your debts before closing your mortgage loans.

Harassing Calls:

You might always be harassed by the debt collection agency if you do not pay off the debt you legitimately owe. You might receive calls or letters, or they might even sue you. Paying off collections will prevent you from getting sued, and you will have a chance to have a credit report showing you the collection account has a zero balance.

It is assumed that playing off collections might lead you to a higher credit score. But it is not always true. Even if you have paid your debt, it might not increase your credit score.

Benefits of paying off collections

You legitimately owe the debt collector agency what they are asking to pay. However, you might have consumed the products associated with the debt. Therefore, it might cause you pain to part with your hard-earned money. But considering paying off the collection will provide some benefits. Here are the five benefits of getting the collections agency off your back:

Paying Off Collection Will Stop Collection for Good:

You will have constant calls from the debt collection agency if you have outstanding debt on your credit report. You might stop the calls by a cease and desist letter to a debt collector. But the collection agencies often sell the collection accounts to other debt collection agencies, and you would be contacted as long as you do not take care of it. However, you can stop these by sending cease and desist letters to the new collection agencies trying to contact you. But it would be good if you took care of the debts.

It Will Help You To Get Approved for Credit Cards and Loans:

Your loans for a car or mortgage might get stuck or would not get approved if you do not clear the outstanding debt collection on your credit report. In addition, you would also have to leave opportunities for some of the jobs as some employers would not hire you for some jobs if you have debts on the credit reports. Furthermore, many landlords might reject your application for a lease.

But remember that paying off the debt might not assure that it will be removed from the credit report. However, you will have certain benefits, like you can get a loan for your home or car. It was the debt that was standing between you and the needed loan. But be sure to ask for verification of the debt before you pay it because collection agencies are known to place expired or fake debts on the customer’s credit reports when they shop for a home or car.

It Will Improve Your Credit Score:

You are fortunate if your collection is older as the effect of the collection on your credit score is less. After seven years, the collection accounts drop off the credit card, even if you do not pay them. But if your account is less than seven years old and you have enough time to approach the time limit of credit reporting, choosing to pay the debt might be a better option than not clearing off the debt.

Paying Off Collections Also Eliminate the Risk of Being Sued:

Many people might assume that debt collectors would not waste their money or time suing a small collection account. But this is not always the case. If you have an outstanding debt collection within the credit reporting limitation, there is a risk of you being sued. If they sue you, you might be taken to a court judgment, or a public record might tarnish your credit report for seven years. Even if you do not pay off your debt, the debt collector might get court permission to take away your wages.

You will be closer to Being Debt-free by paying off collections:

If you can afford to clear off your debt, you must pay off the debt collections because it can be better for your finances and credit in the long term. It might be painful to pay off the debt even after resisting for years, but paying off the debts might suit your finances and credit if you think for an extended period.

How will collections accounts affect your credit?

An account ended in the collection account has already done the damage. But the damage depends on the credit score range. For instance, if you have 500s in one and 700s in the other, a collection account will severely damage the credit score of 700s instead of the 500s.

The newer models of scoring credit might either ignore the paid collection accounts or might weigh them lightly. So, for example, if you have unpaid medical invoices, that would not be treated more harshly than other bills. However, most lenders still use the older credit reporting model, where they weigh everything heavily, and that can impact your credit.

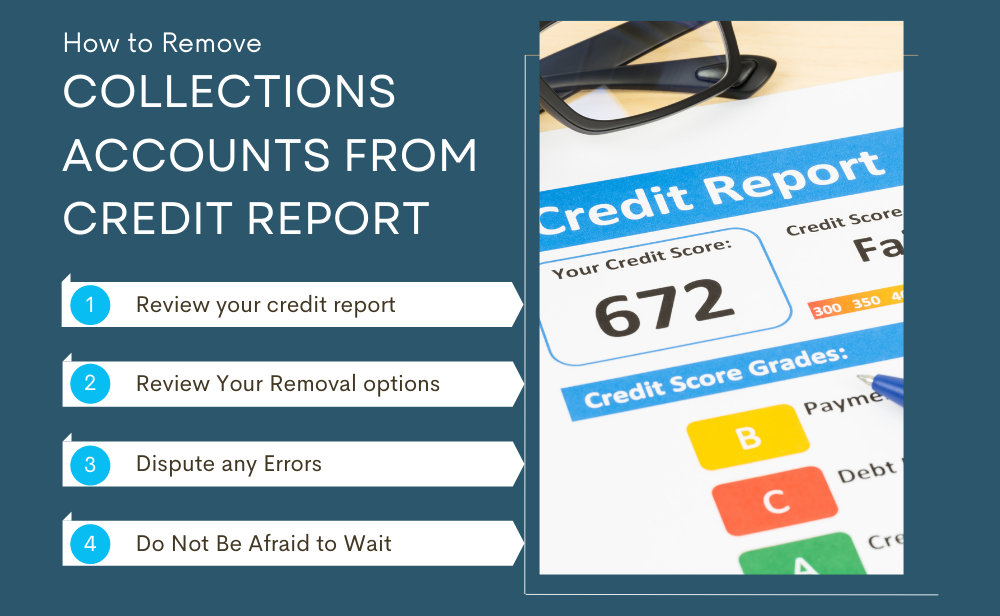

How to Remove Collections Accounts from Credit Report?

Remember that Collection Accounts are not easy to remove from the Credit Report. Even if you have paid off the debts, they will not disappear automatically. If you wish to remove the item entirely, you must negotiate with the collection agency and ask for a goodwill removal. You can follow the following steps to clear your credit profile:

Review your credit report:

It is important to note that each credit bureau holds slightly different information about you. So before you opt for anything else, take out all the credit reports from the different agencies. The credit holders can get a free copy of the credit report per bureau every year. If you want to challenge the credit reports, you will have to create disputes with each agency. Therefore make sure to review all the details to ensure their accuracy. Make sure to note the following: if you know the lenders if all the details filled in the credit report are familiar to you, if the report shows accurate details, if you feel behind the payments, check when it has happened. Then, with all the accurate information, proceed to follow the next move.

Review Your Removal options:

You can follow the two strategies to remove the collection accounts from the credit reports: ask for goodwill deletions and challenge inaccurate items.

Ask for goodwill Deletions:

You may ask the original creditor or the debt collection agency to remove it as an act of goodwill if you have an excellent credit history. Besides, if you have not cleared off your loan, pay it off first.

If you have cleared all your dues, you can ask them to delete them from your credit report. The removal might be against their rules, but goodwill deletions might not be. Therefore it never hurts to ask them to delete through goodwill deletions. If you are looking for a goodwill deletion method, you can find online goodwill letter templates. Communicate with your lender through online goodwill letter templates.

Challenge Inaccurate Items:

Credit bureaus or the collection agency are not allowed to report inaccurate details on your credit report. If you find any item being inaccurate, you have the right to challenge them about the accuracy of the details. The credit bureaus will have 30 to 45 days to investigate, confirm and make the necessary changes to your file after they receive your challenge.

Furthermore, if you find the debt on your credit report isn’t yours, it is advised not to pay it. Instead, write a dispute letter to the credit bureaus requesting them to remove it. If the crest bureaus keep debt over seven years on your credit report, you can challenge them and request them to remove it. It can be possible only if you have proof of the start of your delinquency.

Dispute any Errors:

Even if your debt is paid or unpaid, you can check your credit report for any errors. If you find any mistakes on the credit report, you can dispute them. For example, they might have put in the wrong amounts, wrong dates, wrong names, and more. If you find any items to be incorrect, you can dispute them.

Do Not Be Afraid to Wait:

Your collection should fall off the credit report after seven years. After seven years, the effect on the credit score will be lessened, and after the collection account disappears, you might have a chance to improve your credit score.

Debt Collection Rights and Law

The lenders have the right to take their money, and the debt collector, who is involved, is trying to reclaim what legally you owe to them.

Debt Collection Process

There are three phases to the collection process:

- The creditor’s internal collector deals with you for the first six months of your delinquency. If you can settle your debt in the first phase, you can create a positive relationship with your creditor.

- If they assume that you will not pay off the debt within six months, they will assign a third-party agency to reclaim the money. It is still the lender’s money. If the collection agency successfully reclaims the collection, it will be given commissions from the original creditor.

- The creditor sells it to the debt buyer in the third phase, often for pennies in dollars. In this phase, the original creditor is no longer involved. The debt buyer will try to recoup to turn a profit on their purchase.

Recently, the creditors are turning over to the debt collection laws because communication from the lawyer increases the chance of repayment from the debtor.

Initial Contact for Debt Collectors

They should follow specific rules, or they violate the Fair Debt Collection Practices Act (FDCPA). The rules are:

- They should give their collection agency’s name and address, identifying themselves as a debt collection agency.

- They should tell you the lender’s name, the amount of money you own, and how you can verify the debtor can dispute the debt.

- If the collection agency does not provide the verification information, they must send a written notice within the initial first five days of communication.

Therefore, it is advisable to ask the collection as many questions during the first communication. But remember to avoid admitting you owe the debt.

Debt Collection Laws

The collectors are restricted in the methods they can employ to collect the debts by the Fair Debt Collection Practices Act. The law was passed in 1977 as an amendment to the Consumer Credit Protection Act of 1968:

The FDCPA:

- Prohibits the debt collection agency from discussing the debt with employers, neighbors, family, or friends.

- Limits the times of calls from the collector.

- Prohibits threatening or insulting.

- Provides solutions to the consumers who wish to stop the collection agency from contacting them.

- Requires the collector to verify the debts and collection procedures if it is not verified.

The original creditors are not covered in the act, but all the third-party bill collectors are. Most US collection agencies belong to the ACA International, which is the world’s largest non-profit trade group representing service providers. It requires abiding by the laws and regulations and treating consumers with respect, and communicating with them with honesty and integrity.

Will paying off collections improve my Credit?

New credit scoring models generally ignore collections if you have a zero balance. The recent version of FICO® ‘s 9 and the two new versions of the VantageScore® ignore collections with zero balance.

Your FICO® 9 and VantageScore 3.0 and 4.0 scores may improve after you pay the collection, and when it is reflected on your credit report, you have a zero balance.

But the older models of scoring do not ignore the paid collections. Therefore, if the older models generate a score, you will not have an improved score. For example, mortgage lenders use the older medals of scoring, and even if you have paid the collections, you might not have a higher credit score. But you can, however, see how it impacts your credit score.

FAQs

How Long Do Collections Accounts Normally Stay on Your Report?

The Collection Accounts usually remain for seven years on the credit scores. Again 180 days from the day your account first became past due.

How much will your credit score increase after paying off collections?

It is naturally assumed that the credit score will increase after paying off the collections. But it is not always true. The answer to whether paying a collection debt will increase the credit score is: “It depends.”

Conclusion

As we have already discussed above, paying off collections has various benefits. Even if you do not take care of the debts, they will fall off after seven years. But your debt collectors might take legal actions against you that you might even have to lose your wages. Besides, paying off collections might also result in a good credit score. After consuming the things associated with the debt, you might sometimes need to purchase with credit again. And if you do not take care of your present debts, you might lose the chance to reissue your credit.