Does Applying For A Credit Card Hurt Your Credit?

How does applying for a credit card hurt your credit?

If your are worried whether applying of a new credit card really hurt your credit score or not, you will find the complete truth here.

Once you apply for a credit card, you will have an inquiry known as a hard inquiry. Credit inquiries can be defined as asking for information from credit card reports. There are two types of inquiries based on credit reports- soft and hard inquiries. When you apply for a credit card, you will have a hard inquiry, but you trigger a soft inquiry when you request your credit report. Besides, receiving a pre-approved credit offer can also be regarded as a soft inquiry. Soft inquiries do not hurt your credit because you are not requesting additional credit.

Hard inquiries get triggered Hard inquiries get triggered when you apply for new or additional credit. Your credit report might be affected in the process. Thus, if you are wondering, does applying for a credit card hurt your credit score? The answer is definitely yes. In addition, it might also result in a dip in your score, and it will be for two months on average because the credit card issuers are unsure of your want of more credit cards. Again they have no clear answer if you can manage the additional credit.

Does getting a credit card hurt your credit?

When you apply for an additional credit card, the issuer checks your credit information called ‘hard pull’ or ‘hard inquiry.’ Even if you are not approved for the credit, your credit score will drop. Getting a credit card might result in a bigger drop if you use the new credit.

Don’t do these 5 things before applying for a credit card

Lie About Income: Now the question is does a background check hurt your credit? Well, lying on a credit application is considered fraud, and it can get you penalized for 30 years in prison. Card issues check your ability to repay the credit by checking your income.

Apply for multiple credit cards: Do not apply for many credit loans to see who might approve a card. According to FICO, a new card makes 10% of the score, and applying for a credit card will trigger a hard inquiry to check if you are creditworthy. In addition, if you apply for many credit cards, issuers might consider it risky behavior.

Canceling other cards: Does a secured credit card hurt your credit? It may if you choose to close your credit card account that is no longer in use, you might end up affecting your credit score negatively.A small activity is always welcomed rather than canceling the cards. On the other hand, do not close multiple cards at once. Close the newer one so that you do not erase the long credit history.

Do not cosign a loan for a financially reckless person: When you cosign for someone, you take responsibility for their credit decisions, be it good or bad. For example, if the other person is late for payment by 90 days, your credit will generate late reports, which will hurt your score.

Fail to check Credit Reports for Errors: Mistakes can hurt your credit. Therefore, it is crucial to review the credit card reports if you find any, or it might start hurting the credit score.

The best time to apply for a credit card

Does applying for a credit card hurt your credit? Yes, it does. As we already know that it generates a hard inquiry. Therefore, before applying for a credit card, determine why you want a credit card. But you should also consider how you will use your card, and this question might help you choose the best card that fits your needs. Consider the listed points before you apply for your card:

Your Credit is in Good Shape:

Credit cards are available for all credit levels. However, people with excellent credit scores are reserved for the best offers. The most crucial point to remember is that one should not go for a top-tier credit card until the credit card score is in the range of good or excellent scores. You have a hard credit inquiry every time you apply for a credit card. However, only one hard inquiry cannot affect the credit score, but your credit score can be hurt if you have multiple inquiries.

Major credit card issuers might increase the odds of approval if you can keep your credit score above 670. Some credit cards are designed based on people’s poor or fair credit scores. Therefore, your card can get approved without a perfect credit score. But good credit does not always guarantee your credit can be approved.

When You Turn 18

It is best to start soon to build credit. The length of a credit card history determines a 15 % FICO credit score. You can create your credit if you can manage it responsibly. Besides, it can get you approved for larger loans in the future and at a lower cost. But getting approved for a credit card at such a young age can be more challenging because youngsters might not have a stable source of income to pay the bills regularly.

You Plan to Make a Larger Purchase

When you plan on making a large purchase, a credit card with the right perks can help you save on interest or reduce the cost. Some rewards offer sign-up bonuses to attract customers. They might provide you with hundreds of dollars. It enables you to meet the spending requirements, but you can apply the bonus to the balance for cards offering statement credits or cashback as a reward. However, you need to ensure that the sign-up bonus is not taxable. It might be rare but not impossible. But remember, you must have a strong credit history and score to qualify for these rewards.

When There is a Great Welcome Bonus

Credit cards offer exclusive offers and welcome bonuses that can allow you to enhance your rewards after opening an account. The rewards maximization depends on how many specific spending requirements you have met.

Remember, do not open a credit card only for the welcome bonus. Instead, consider checking on other perks, rewards, and fees to ensure the card is worth your fit or if you can afford the spending requirements.

When You are Pre-Qualified for a Card

Some credit card issuers provide pre-qualifying forms. It is the best time to take your chances to qualify for a credit card. Shop for the best offers by filling out a pre-qualifying form. In addition, filling out the pre-qualifying form does not hurt your credit. You might sometimes see that these forms target welcome offers, giving you a chance to earn more rewards. However, it does not guarantee your application will be approved because they take many factors into account, such as employment status, monthly housing payment, etc.

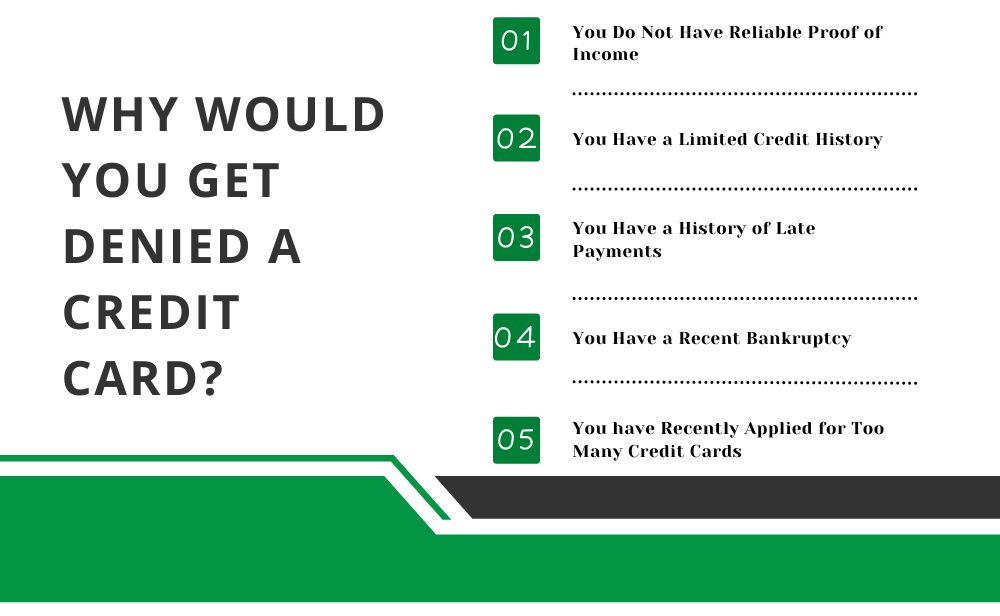

Why would you get denied a credit card?

It can be a demoralizing experience having be denied a credit card application. There are several reasons the issuers can deny your credit card applications. Knowing the specific reasons can help you understand the situation of the denied application. In addition, it can help you take the proper steps to make your credit card application approved the next time you apply. Finally, it might make the applicants more careful while applying for credit cards if the creditors provided an action notice why the application was denied. Listed are why the creditors may have turned down your credit card application.

You Do Not Have Reliable Proof of Income

Your credit card application may be denied if you do not have reliable proof of your income. Credit card companies want to ensure that you can clear the changes you make with your card. Therefore, you must be able to prove your income with proofs like tax returns or pay stubs, or else you may not get approved for a credit card.

It may be helpful to take help from a cosigner if you find yourself in this situation. The credit card company will take the cosigner’s income credentials and your income credentials to proceed further. Remember that it is good to calculate your income before thinking of charging more than you can afford.

You Have a Limited Credit History

Getting your credit card application approved can be challenging if you are new to credit. It might make you think about how you can build credit without getting and using credit card accounts. But it shows that the card issuer does not have enough information about you or how you manage your credit card bills. Without a credit history, they cannot determine if you can be a good customer.

You can consider applying for the ones designed to help people build credit. Or you may choose to go to a card issuer that takes income and expenses as alternative credit data to evaluate your credit applications.

You Have a History of Late Payments

An essential factor in your credit card score is your payment history. If you miss your payment by 30 days or more, it might damage your credit card score. In addition, it can also get difficult for you to get approved for specific credit cards.

To ensure you are approved for credit cards, you need to pay your credit card payment regularly. Besides, you may access cards for fair credits as you work to rebuild your credit score.

You Have a Recent Bankruptcy

Since payment history is the most important factor determining your fit for the credit card, bankruptcy indicates that you have not paid off the debts you had agreed on. Therefore, getting your credit card application approved might be challenging if you have an ongoing bankruptcy. However, getting a positive credit history may take some time to qualify for other specific cards, even if you have been discharged from your bankruptcy.

However, a secured credit card is available if you still have bankruptcy on your credit card report. But it is to remember that you may have to pay high fees and interest or a security deposit.

You have Recently Applied for Too Many Credit Cards

Some credit card issuers will not approve your application if you have applied for too many other credit cards. If this situation occurs, you need to wait for other inquiries to drop off your credit record.

It stands as the most common reason to get your new credit card application denied that you have applied for. Therefore, you need to research the ones that can be a good fit for you. Take time to explore your options and apply for a credit card worth your fit.

Conclusion

It is crucial for credit card applicants to know if they are applicable to apply for a credit card. In addition, they must also know the best time to open a credit besides having good knowledge about the factor that matters to balance the credit card scores. Having a better idea of what hurts the credit score or how you can reduce the risk of hurting the credit might help you in the long run.