What is Credit Card Piggybacking and How it works?

Piggybacking credit occurs when someone adds you to their credit card account to create or enhance your credit score. Thus, you become an authorized user of their credit card account with this process. However, it’s crucial to remember that there are hazards to this approach. Hence, piggybacking isn’t a long-term answer for establishing or boosting your credit.

If someone with good credit registers you as an authorized user to their credit card account, their payment history is included in your credit report. So, if they’ve kept the credit card open for ten years, your credit report will show an active credit account for that period.

If the principal cardholder has a good payment history and maintains a modest account amount, Your credit ratings may improve. However, if the principal cardholder falls behind on payments, your credit scores may also suffer, potentially worsening your credit condition. Furthermore, becoming an authorized user does not assist you in learning and developing excellent habits for using and managing credit sensibly. The most fantastic strategy to establish credit and improve your credit scores is to open your own credit accounts, pay them all on time, and keep your credit usage ratio low.

What Does Piggybacking Credit Mean?

Credit piggybacking refers to being added to someone else’s credit accounts, typically credit cards, to improve your own credit score. The other person is effectively piggybacking you on their credit, which is how the word gained its name.

Piggyback credit may be a helpful strategy for assisting someone who has no credit or is attempting to repair credit to establish some good credit history.

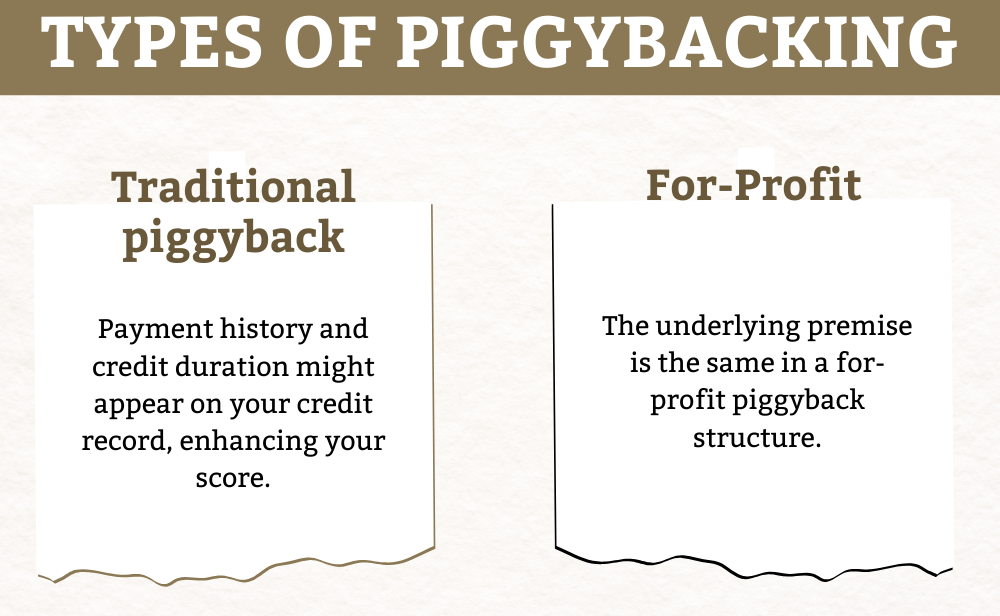

Types of Piggybacking

There are two basic ways to get piggyback credit, and both offer advantages and disadvantages. First, examine this summary to see which choice would be ideal for you.

Traditional Piggyback

Traditional piggyback credit involves someone—usually a friend or family member—adding you as an authorized user to their account. Payment history and credit duration might appear on your credit record, enhancing your score.

However, because some firms do not report on authorized users, you must check that the account you’re being added to reports to both your credit history and the account holder’s history.

For-Profit

The underlying premise is the same in a for-profit piggyback structure. However, rather than working with someone you know, you pay a fee to a firm that connects you with someone with strong credit. The apparent disadvantage of a for-profit arrangement is that it is costly. You’re also tying your financial future to a total stranger, which might be unsettling. On the other hand, you won’t have to worry about severing a personal relationship if things don’t work out.

How does piggybacking work?

To understand how and why piggybacking credit services works, you must first grasp the fundamentals of credit ratings. Your payment history, how much of your available credit you’re using (known as credit usage), the duration of your credit history, whether you’ve recently gotten new credit, and your credit mix all have an impact on your credit score. It’s essentially an assessment of how well you’ve handled your debt.

A few things happen when you become an authorized user. First, the account will appear on your credit report, but there will be a note for prospective lenders indicating that you are an approved user. Second, your overall credit limit increases, which may cut your credit usage ratio if you keep the balance on the card you’re piggybacking on low. Finally, it affects the duration of your credit history. Depending on how long the account has been active, you may choose to lengthen or shorten your credit history. Longer credit history is advantageous since it indicates that you have more expertise in managing credit. In addition, the cardholder’s (supposedly) strong track record of timely payments is included in your credit report.

Piggybacking is permitted because women encountered significant challenges decades ago in obtaining their own credit cards or establishing separate credit records when they used (and helped pay off) cards given to their husbands as to the principal cardholder.

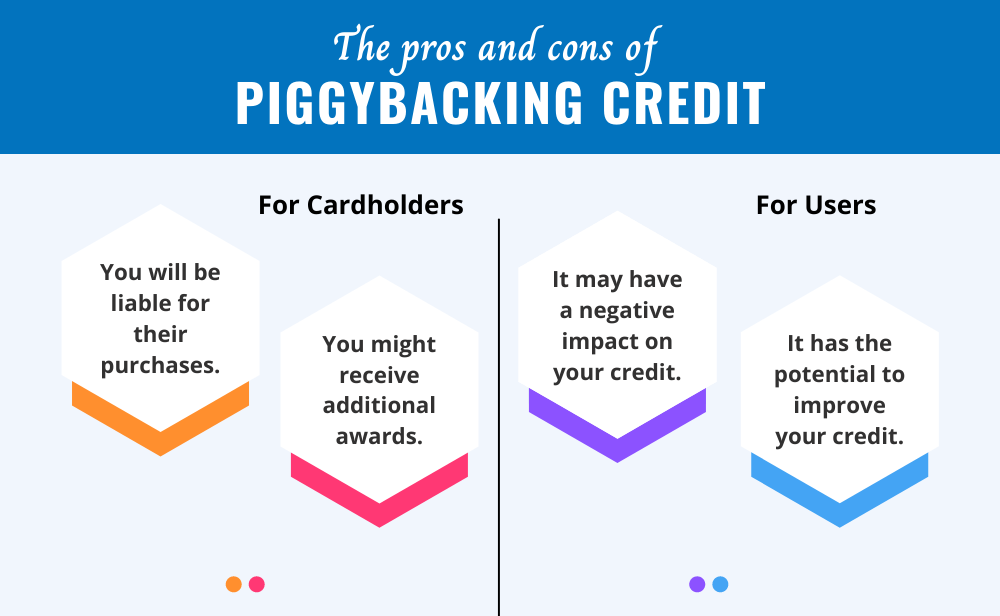

The pros and cons of piggybacking credit

For Cardholders:

You will be liable for their purchases.

The most important thing to remember as a cardholder thinking about adding someone else as an authorized user is that you will be held responsible for any transactions they make. After all, the “approved” in authorized user means: you’re permitting them to use your card to make purchases. As a result, you’ll want to be sure that the person you’re trying to add — whether a family member or a friend — is trustworthy.

You might receive additional awards.

On the other hand, any purchases made by your authorized user will most likely be qualified for the benefits granted by your card. This might help you unlock even more prizes in other circumstances because some cards have features that need a specific number of points.

For Users:

It may have a negative impact on your credit.

Potential Authorized users should be aware of their primary cardholder’s financial habits. Similarly, cardholders should know and trust the person they wish to add as an authorized user. For instance, if a cardholder makes late payments, it will appear on your credit report. Eventually, impacting your credit score negatively. In the same way, if the card in issue is frequently maxed out, it may increase your credit use. Thus, again harming your credit ratings.

It has the potential to improve your credit.

There are some possible credit score benefits to being an authorized user. For instance, suppose that your partner adds you as an authorized user to their credit card account when you get married. First, if your partner has been using credit cards for a long time (say 10 or 11 years), their credit history will boost your credit score. Secondly, it will help reduce total credit usage as you both can utilize their cards for various purchases.

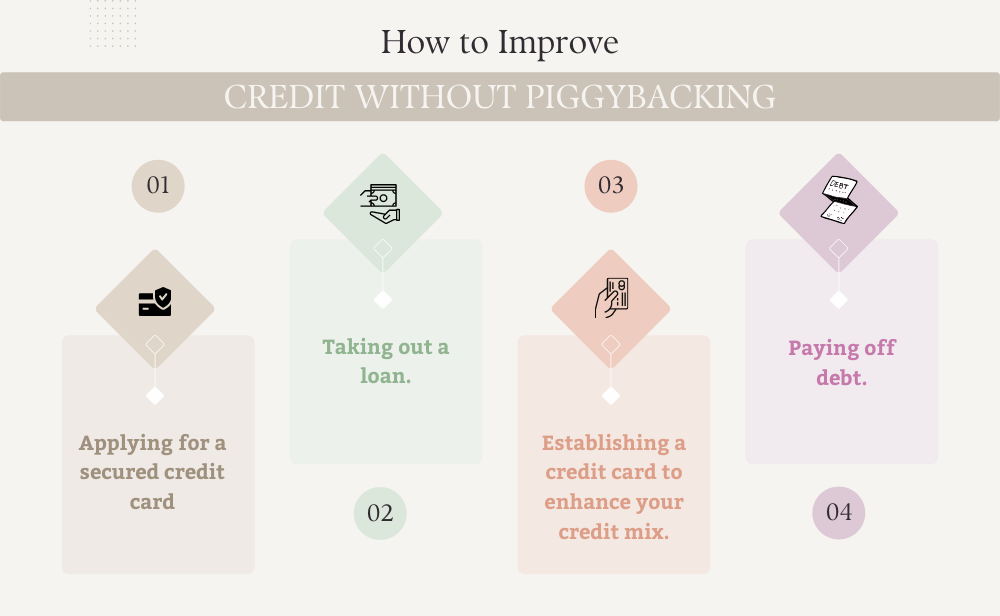

How to Improve Credit Without Piggybacking?

Whether you choose to use piggyback credit or not, there are plenty of other methods to establish a good credit history. Always make all payments on time, as this is one of the most important aspects of calculating your credit score.

If you suspect you won’t be able to pay your payments, contact your creditor as soon as possible. This will help you to find assistance programs to maintain your account in good standing while you sort things out. Other possibilities include:

- Applying for a secured credit card.

- Taking out a loan.

- Establishing a credit card to enhance your credit mix.

- Paying off debt,

All these processes may help you develop credit and increase your credit score.

Conclusion

Piggybacking or not piggybacking? Piggybacking is a smart credit-boosting strategy for people with poor credit or a low credit score. It’s also suitable for folks who don’t believe they can develop their own credit using a credit card.

This method will not help someone who already has good credit. Because they were modest credit risks, to begin with, the interest rates they may obtain will not be considerably higher. If you’re thinking of piggybacking, you should first try to improve your score in other methods.