Merchant Loan Advance Blursoft.com – Same Day Funding

Merchant Loan Advance Blursoft.com is a one-time payment given to a company or organization in return for future debit or credit cards worth an agreed-upon percentage. It is to note that a firm does not owe any money to the lender until it generates revenue.

Merchant Cash Advances can refer to either short-term business loans or the purchase of future credit card transactions. MCA is distinguished by modest payments made in short time periods or payments made on each business activity.

Generally retail firms frequently use by retail firms that cannot get bank loans. Merchant Cash Advances can also provide external capital to small firms that cannot afford to fund an innovation or growth project on their own.

What is Merchant Cash Advance?

A merchant cash advance is a sort of company finance that is ideal for small businesses that accept debit and credit card payments from clients. The creditor gives the firm the required funds, which it repays as a percentage of the card payments made by its consumers using a card terminal.

Merchant Cash Advance: a Flexible Business Funding Options For Businesses With Bad Credit

Repayments are often made as a proportion of sales, so they change with your firm’s revenues. That implies that you pay more back each month when things are going well, but you pay less when the firm is struggling. It’s a suitable solution for various small businesses because, like loans with a fixed amount of payments, it guarantees you that you can make payments if you encounter a snag.

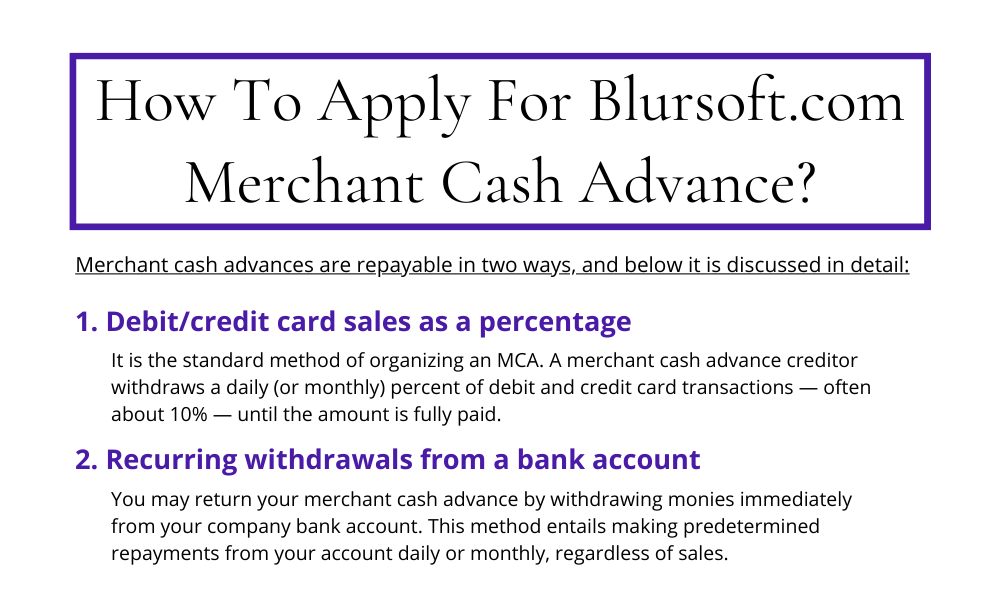

How To Apply For Merchant Loan Advance Blursoft.com?

Blursoft is developed to assist many company owners with negative credit and is prepared to stand by their side through difficult economic times. Their purpose is to assist company owners in obtaining the funds they require at the moment when they require them the most. Even if your credit score is important in the loan application process, it should not be the sole factor. We recognize that your credit score does not define you or your company. We provide a diverse range of business loans and cash advance options for people with bad credit, allowing every business owner to obtain a loan tailored to their specific needs. Any business owner can apply for a Blursoft business loan regardless of their credit score. Blursoft will ensure that you receive the necessary funding.

When a merchant cash advance provider authorizes a business for a predetermined amount, the owner has immediate access to cash. This sum is subsequently recovered through fees calculated as a proportion of future earnings.

The firms can repay the Merchant cash advances in two ways. Following are the ways:

1. Debit/credit card sales as a percentage

It is the standard method of organizing an MCA. A merchant cash advance creditor withdraws a daily (or monthly) percent of debit and credit card transactions — often about 10% — until they fully pay the amount.

Unlike other types of company loans, merchant cash advances do not have standard payback terms. It is due to the fact that the payback schedule is based on sales. Repayment lengths might range from three to eighteen months. The quicker you refund the loan, the greater your credit card sales will be.

2. Recurring withdrawals from a bank account

You may return your merchant cash advance by withdrawing monies immediately from your company bank account. This method entails making predetermined repayments from your account daily or monthly, regardless of sales. The set payback amount is based on a monthly revenue forecast.

The repayment structure by Blursoft.com permits the borrowers to calculate exactly the duration it will take them to pay off the amount. The calculation is based on the fund borrowed by the borrower. Therefore, this loan is best suits to firms that do not rely primarily on debit and credit card sales.

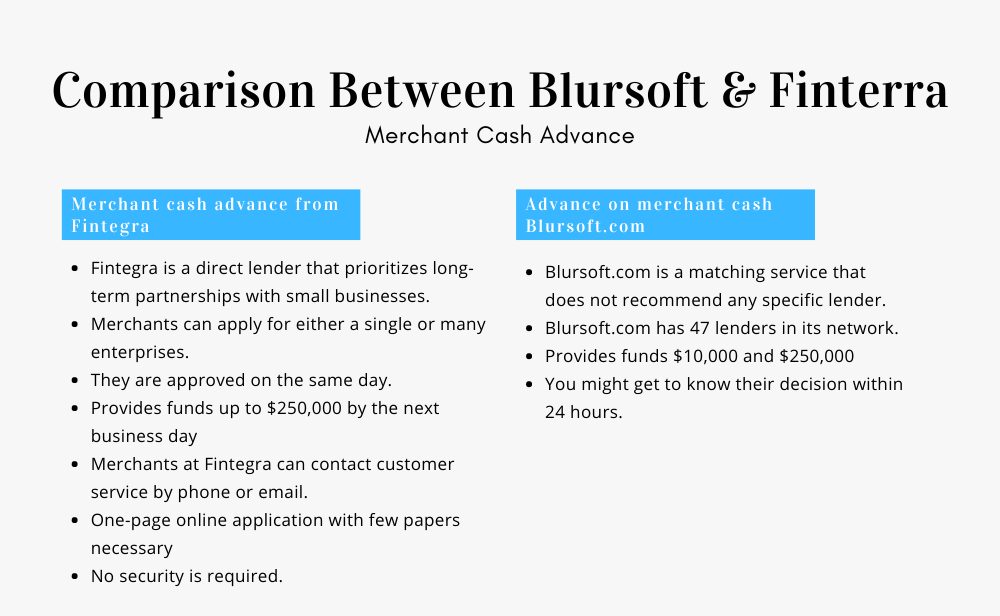

Comparison Between Blursoft and Finterra Merchant Cash Advance

Merchant cash advance from Fintegra

- Fintegra is a direct lender that prioritizes long-term partnerships with small businesses.

- Merchants can apply for either a single or many enterprises.

- Fintegra approves the loan on the same day.

- Provides funds up to $250,000 by the next business day

- Merchants at Fintegra can contact customer service by phone or email.

- One-page online application with few papers necessary

- You to do not require to pay any security.

Advance on merchant cash Blursoft.com

- Blursoft.com is a matching service that does not recommend any specific lender.

- Blursoft.com has 47 lenders in its network.

- Provides funds $10,000 and $250,000

- You might get to know their decision within 24 hours.

Advantages of Merchant Loan Advance Blursoft.com

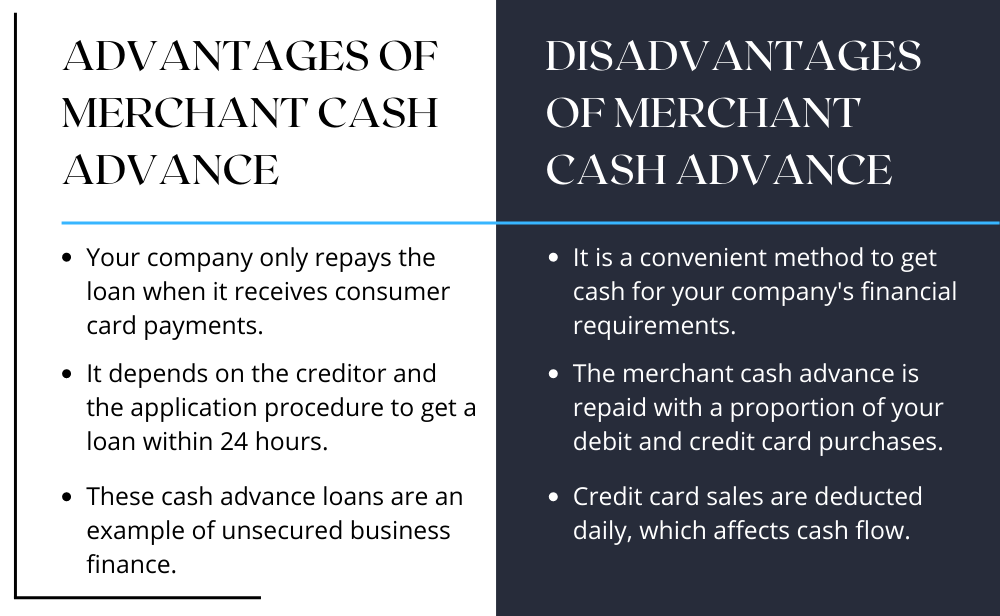

Merchant loan advance Blursoft.com have a number of advantages, including:

- Flexibility – Your company only repays the loan when it receives consumer card payments, which means they connect the repayments to sales, allowing you to better manage cash flow.

- Access – It depends on the creditor and the application procedure to get a loan within 24 hours.

- Unsecured- These cash advance loans are an example of unsecured business finance. Because there is no requirement of collateral, it is less risky than traditional financing.

- Application procedure – While traditional lenders may need a business plan when applying for a conventional loan, merchant cash advance lenders do not.

- Credit Score- The lender does not consider credit scores because they obtain money having visibility into your sales.

Disadvantages of Merchant Cash Advance

It has various disadvantages, as discussed below:

- A merchant loan advance Blursoft.com is a convenient method to get cash for your company’s financial requirements, but it may also be a costly kind of business finance.

- The lender uses your sales to calculate your repayment. You need to repay the merchant cash advance with a proportion of your debit and credit card purchases.

- Cash flow has been reduced. Credit card sales are deducted daily, which affects cash flow.

- It lacks regulation. The market is unregulated because merchant cash advance loans are prevented from considering business loans.

Small Business Funding Blursoft.com – What does it include?

Quick funding

It is to make sure the firm does not run out of funding. It might be the difference between success and failure for those just starting. With the assistance of a small business solution, you will feel in charge of the process, and the money will be adequate. Therefore, it can be the best solution for a small business in both the short and long run.

Continual Cash Flow

The most important factor will be consistent cash flow. You will be able to sign up with a reputable service provider, such as Blursoft, knowing that your money will be there when you need it. Many businesses worry about their everyday expenditures, but that is not the case here.

The cash flow will always be present, and it will be simple to handle throughout the year.

Legal and safe

It is critical to select a dedicated provider to keep things safe. That includes adhering to the region’s set laws for small company lending. In addition, you would definitely want to keep everything simple while ensuring that they are done correctly.

Who is eligible to apply for a merchant cash advance?

If your company accepts payments using a card terminal, you can apply for a merchant cash advance. Because the lender has visibility into what the firm produces on a monthly basis, they may reach an agreement on a business loan size and payback plan more quickly than other short-term financing options. That makes it a good choice for organizations lacking significant assets or wanting rapid cash for unforeseen costs.

Conclusion

Small company finance is crucial for obtaining a reputable option that meets your needs. Each circumstance will be unique, which is where our service comes into play. You will be able to select how they handle the financing and when you have access to the monies. You will feel safer as a business if you have this reliability in place. In addition, it enables you to conduct transactions without worrying about running out of available money.