First Savings Credit Card Reviews

Introduction

It is the safest Credit card because it reports to all three main credit agencies and does not need a security deposit. The First Savings Credit Card is an excellent option to improve your credit score. However, applying for this card is a bit more difficult because you require an invitation. But, the increased fees may put you off using this credit card.

What is a First Savings Credit Card?

In reality, the First Savings MasterCard is designed for clients with poor credit. It is essentially an unsecured credit card with a credit limit that you may obtain even if you have a poor credit score. However, remember that it can only be acquired after receiving an invitation from the credit card company.

The credit card provided by First Savings Bank is known as the First Savings Credit Card. It’s a MasterCard, and it’s accepted at almost every store in the country, making it a convenient card for everyday transactions.

Overview Of The First Savings Credit Card

The First Savings credit card offers six offers to consumers. Your credit score and income or other factors determine the offer you receive.

First Savings Credit Card is a card that can only be received by an offer, and you cannot apply it yourself. Instead, they will offer it via an invitation in your mail. Therefore it isn’t easy to get in-depth details about its terms and conditions. But you may find information about the credit card offers on their official website.

Check out the annual fees and interest rates for each of the different offers:

| Offers | APR | Annual Fee |

| Offer 1 | 16.40% | None |

| Offer 2 | 29.9% | $39 |

| Offer 3 | 29.9% | $75 |

| Offer 4 | 29.9% | $75 |

| Offer 5 | 29.9% | $49 |

| Offer 6 | 29.9% | $75 |

First Savings does not specify the criteria consumers need to qualify for the favorable terms. But it can be assumed that the people with low credit scores are required to pay an annual fee along with 29.9%, the higher rate for the credit card.

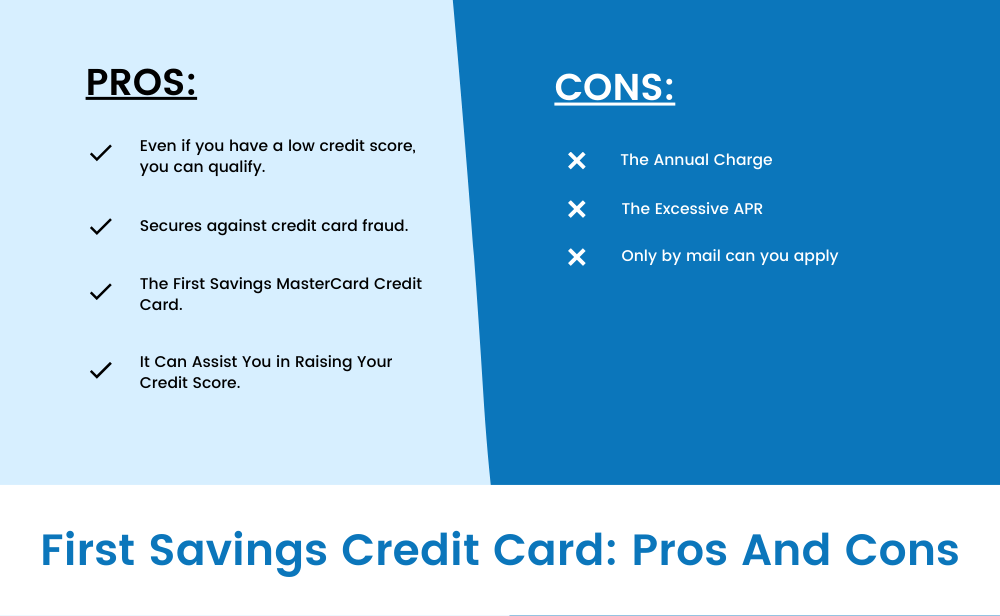

First Savings Credit Card: Pros And Cons

Every card has its own advantages and disadvantages, and First Savings Credit Card is no exception. Listed are the advantages and downsides of the First Savings Credit Card:

PROS

- Even if you have a low credit score, you can qualify

Qualifying even with a low credit score is one of the card’s finest attributes. This card can help you boost your credit score because it accepts applicants with lower credit scores in the first place.

- Secures against credit card fraud

There’s no need to worry about anyone stealing the credit card details and stacking up debt on the account. First Savings provides fraud protection and compensation if you can’t find your card or it is stolen.

- Acceptance:

This credit card is accepted in the majority of locations. Acceptance in practical every site is included because it is a MasterCard.

- It Can Assist You in Raising Your Credit Score

Because this card does not require a high credit score to open, you should use it properly to raise your score. You may do this by paying off the entire amount on-time monthly. It’s not a quick fix, but smart credit card usage should help your score grow over time.

CONS

- The Annual Charge

For four of the five offers sent out, the card does have an annual charge. It is $39.00 per year or more. It may not be a big deal if you believe you receive value from the card and can improve your credit score by using it every now and then. However, it might not be best if you don’t use it frequently.

- The Excessive APR

This card’s standard APR may reach 29.9 percent, which is quite high. Because this is a starter credit card, the APR is lower than on some others. However, if you pay it off on a regular basis and do not have debt every month, you are free from worrying about paying this exorbitant interest rate.

- It can be applied only by mail.

Everyone is not eligible to apply for a First Savings Credit Card. To be qualified, you must first get an offer in the mail, after which you can apply online.

Who Can Apply For This Credit Card?

After you have received the invitation for the application, assess the reasons why considering the First Savings card is a good option.

A credit card helps to build your credit score as well as your credit history. In addition, you can make small purchases each month and clear the debt by paying it off. This way, you can make the card work for your benefit.

First Savings reports your activities to the credit bureaus. Therefore, paying all the debts in time can boost your credit score. Besides, you should know that 35% of your credit score is generated only because of your payment history.

Secondly, the First Savings Mastercard can be an excellent choice if you do not prefer secured credit. But for a secured card, you need to pay a security deposit to protect the card. However, if you have a bad credit score and do not qualify for First Savings Credit with no annual fee, opening a secured card might be an excellent choice, and then transitioning to an unsecured card after your credit score improves.

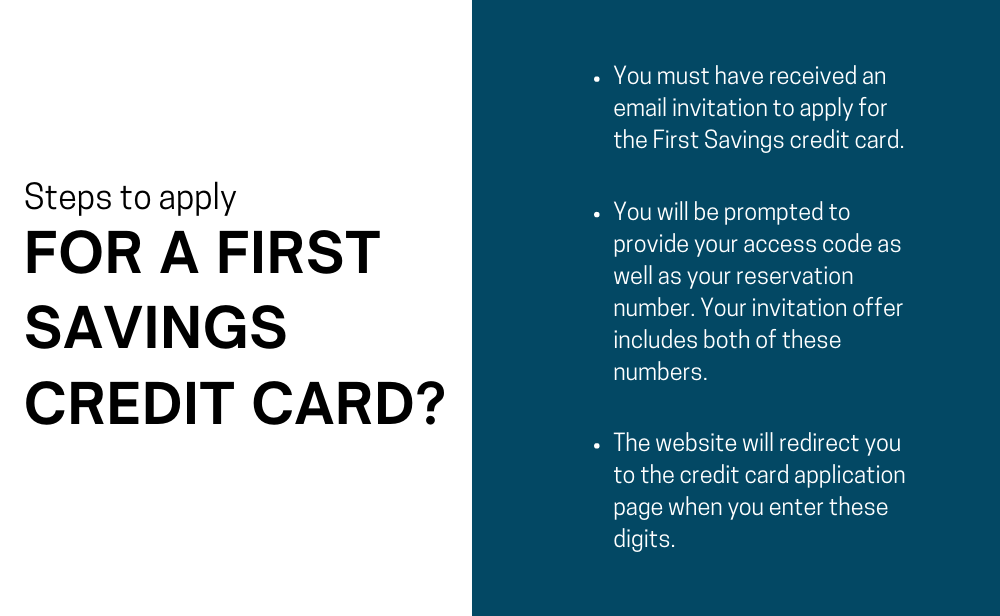

Steps To Apply For A First Savings Credit Card:

Applying for the First Savings Credit Card is easy. You can follow the steps listed below after getting an offer:

- You must receive an email invitation to apply for the First Savings credit card. After you are invited with an email, visit the First Savings website, and click on a button that reads “Accept Online.”

- You will need to fill in your access code as well as your reservation number. Your invitation offer includes both of these numbers. The website also includes a visual to assist you in finding these numbers on the invite message.

- The website will redirect you to the page where you have your application after you enter these digits. Fill out the form with details required to put, such as monthly income and job status.

Steps To Login To The First Savings Credit Card

You get free access to the website as a cardmember, where you can;

- View your account details

- Manage your account information

- Configure email and text notifications

- Control automatic payments

Simply click on the orange icon on their website to register as a new user and log in using your username and password.

Ways To Pay For The First Savings Credit Card Bill

You may make a payment utilizing the First Savings Credit Card online site or their automated phone system for free.

There will be a $3.95 processing charge if you pay with a customer care agent. The phone number for its customer care is 888-469-0291.

How To Use This Card Responsibly

If you apply for the First Savings Credit Card, you can utilize the limited credit amounts to improve your credit score. Because the restrictions are minor, you could think about utilizing it to purchase one or two of your budget categories. For example, let’s say you need food and gas for your automobile.

It will be easier to develop healthy habits and check how frequently you use the card if you use it for a limited number of activities on a regular basis. It will also make it easier to pay off the debt each month, which is an important component of using this card responsibly.

Alternatives To The First Savings Credit Card

Following are the alternatives to the First Savings Credit Card:

Citi Secured Mastercard

Another First Savings Credit Card option is the Citi Secured Mastercard, which needs $200 as a security deposit. Fortunately, this credit card has no annual charge. Besides, you also have a $2,500 credit limit. It is considered to be pricey.

The Citi Secured Mastercard offers a lower APR of 22.49 percent than the First Savings credit card. Therefore, even though you have a bad credit score, you may be eligible for the card. Furthermore, you can freely access your credit score to monitor your creditworthiness.

But, if you are willing to receive cashback benefits, opting for a Discover It Secured card is a better option.

Discover It Secured Credit Card

The Discover It Secured Card is an excellent alternative.

Because it is a secured card, you must pay a deposit of $200, a security deposit. In addition, the Discover It credit card includes a reward program, allowing the users to earn a 2% cashback on dining and gas purchases.

You will also receive 1% cashback on any other purchases. Besides, Discover It does not take a yearly fee, and the APR is 22.99 percent, which is far lower than the 29.99 percent that First Savings may charge.

Capital One Secured Mastercard

Most credit cards might be difficult to qualify for if you presently have no credit history or a terrible background from a turbulent past. As a result, the Capital One Platinum Secured Credit Card is a wonderful alternative for demonstrating to lenders that you are responsible with credit and beginning to develop your score in a reduced risk setting.

The card has no annual charge and can help you develop credit over time while automatically qualifying you for a greater credit line in as little as six months. In addition, you can increase your credit limit by depositing extra money before your account starts.

FAQs

What Credit Score Is Required To Qualify For a First Savings Credit Card?

You may receive this credit card even if you have bad credit. However, it implies that you could apply for the card only if you have been sent an invitation offer.

What Is The Duration Of Approval For The Card?

Typically, the approval procedure is short and only takes a few days. In rare cases, it is completed instantly. However, in certain cases, it might also take more than a week.

How To Get A Credit Line Increase With The First Savings Credit Card?

According to some reviewers, the credit limit increases after paying on-time bills for six months.

Can I Get A First Savings Credit Card Cash Advance?

Getting a First Savings Credit Cash Advance entirely depends on your creditworthiness. However, the cardmember needs to pay 2% of the cash advance and 29.9% APR on the balance of the account.

The First Savings Credit Card contact states that the users who receive a 16.40% with no annual fee will need to pay a 4% advance along with a 25.40% APR on balance carried on the account.

How To Cancel A First Savings Credit Card?

To cancel First Savings MasterCard, you must contact the company’s customer service.

We propose dialing 888-469-0291 for this reason.

Conclusion

Although the First Savings credit card is a fantastic alternative for credit development and credit restoration, the annual fees and APR would be more appealing if they were lower. Furthermore, an invitation email is necessary for the application, which may be a barrier for some.

However, if you receive the invitation and are willing to pay the yearly fees, the First Savings credit card review might quickly help you get back on track.